Why Do Surety Companies Examine Credit?

July 14, 2021

Surety bonds have a unique set of underwriting requirements not present in other lines of insurance, and arguably the most important aspect of surety underwriting is examining the principal’s (your customer’s) credit history. Surety bonds are a niche product, and chances are your agency specializes in more traditional insurance lines such as home, auto, or commercial insurance coverages, none of which have underwriting as contingent on personal credit requirements as surety bonds. In this article, we break down why surety companies review credit history, providing insurance agents a comprehensive overview of this distinct underwriting requirement.

What is a Credit Score?

A credit score is a quantitative analysis of an individual’s creditworthiness. Credit scores are represented in numbers, and scores can range from anywhere between 300 to 850. Individuals with high credit scores are able to qualify for larger loans and secure low interest rates. Whereas individuals with low credit scores oftentimes struggle to obtain loans and get locked in at high interest rates. Lenders will examine an individual’s credit score to determine the likelihood that they will repay their debts on time.

How is a Credit Score Determined?

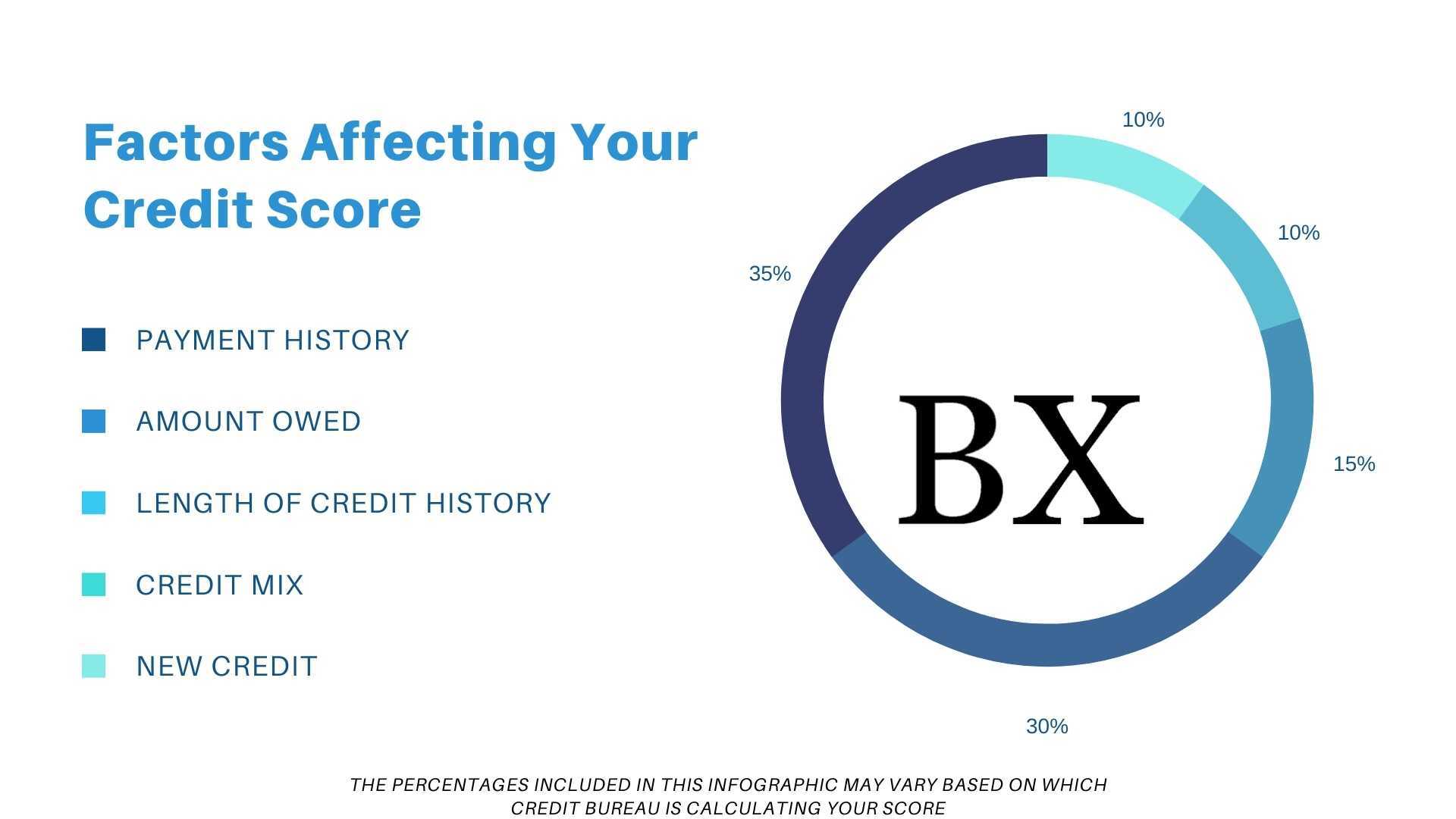

Credit scores are determined by examining an individual’s credit history, which generally consists of the following factors:

- History of making on-time payments

- Oldest line of credit

- Percentage of total credit used

- Recent inquiries regarding the individual’s credit score

- Number of credit accounts and how recently they were opened

- Total credit available

Who Determines Credit Ratings?

There isn’t one single entity that determines credit scores, and credit scores will vary based on the entity providing it. The three major credit bureaus are Equifax, Experian, and TransUnion. These three entities are the standard bearers for credit accuracy in the US, and most lenders will obtain your credit score from one of these three firms when evaluating your creditworthiness. The reason your credit score may vary among the three major credit bureaus is due to the fact that not all lenders and credit unions report the same information to all bureaus.

Why Do Surety Companies Examine Credit?

Surety companies examine the principal’s credit history, compare the report against underwriting criteria, and utilize this information to assess a premium rate in line with the risk they are assuming should they issue the bond. When applying for auto insurance, consumers will have to disclose all accidents they have been involved in as well as any traffic citations. This might seem intrusive, but it serves the purpose of determining the level of a risk that the carrier will need to pay out a claim. But unlike auto insurance coverage (and virtually all other insurance products), surety bond principals are required to repay the surety company for any valid claims made against their bond, as well as all claims handling expenses. This aspect, known as indemnification, is what sets surety bonds apart from other lines of insurance. Surety companies not only need to assess the likelihood of a claim occuring, but also the principal’s ability to repay them were a claim to occur. The method surety companies utilize most frequently to determine a principal’s ability to repay them is by conducting a personal credit check.

When Do Surety Companies Examine Credit?

Surety companies require credit checks be conducted for most surety bonds. Some carriers have classified lower risk bonds as “Instant Issue”, meaning they will not pull credit on the applicant to determine their eligibility. Bonds with historically low losses are deemed less risky by surety companies and smaller bond limits (think $10,000 or lower) will typically fall into this “Instant Issue” category.

Does Credit Impact Surety Bond Eligibility?

Your customer’s credit score will determine their eligibility for surety bond coverage. If your customer has a low credit score, they may be declined coverage by some surety companies. Each surety company has their own underwriting criteria and risk appetites that can accommodate varying credit scenarios. If your customer has been rejected for surety bond coverage, give us a call at (800) 438-1162 and we will work with you to place their bond.

Does Credit Impact Surety Bond Pricing?

Yes, your customer’s credit score is the primary factor in determining the premium rate they will pay on their bond. Principals with a high credit score will typically pay less for their bond, and principals with a low credit score will pay more. Most surety bonds have a tiered pricing structure, meaning that different credit score ranges will result in varying premium rates. To illustrate this point, we have included the pricing information on a $50,000 North Carolina Auto Dealer Bond.

$50,000 North Carolina Auto Dealer Bond Cost

| Credit Score | Bond Cost (1 year) |

|---|---|

| 635+ | $250 |

| 625 – 634 | $750 |

| 600 – 624 | $1,000 |

| 550 – 599 | $2,500 |

| 500 – 549 | $3,500 |

While your customer’s credit score is the primary factor in determining their premium rate, it is not the only factor. Surety companies will also examine your customer’s years of business experience, and in some cases their business financial statements, when determining their premium rate and bond eligibility.

Do Surety Credit Checks Impact Your Customer’s Credit Score?

No, credit checks conducted by surety companies are “soft hits”, meaning they will not affect your customer’s credit score.

Do Missed Bond Payments Impact Your Customer’s Credit Score?

Missed surety bond payments will generally not impact your customer’s credit score. However, there are a few specific circumstances where missed payments could negatively impact your customer’s credit. Once your customer’s premium rate is determined, the full premium amount must be paid prior to the bond being issued. Some companies, BondExchange included, offer financing options for principals who prefer to split up their payments, rather than pay the full amount of premium owed upfront. Most payment plan agreements give the surety company the option of reporting any missed payments if they so choose to. Additionally, for bonds that cannot be cancelled (think contract and probate bonds), surety companies can place principals in collections for unpaid premiums. This usually occurs in one of the following situations:

- Contract bonds that have overruns, meaning that the final contract price is greater than the agreed upon contract. Premium is due for any increases.

- Probate bond renewals. Probate bonds can last for many years until the estate assets have been disbursed (administrator/executor bonds), minor is of adult age (conservator/guardian),or incompetent person passes away (conservator/guardian). If the principal does not pay the renewals they made be sent to collections

To summarize, surety companies do have the ability to report unpaid financed premium balances, unpaid premium balances on non-cancellable bonds, and unpaid claims expenses to credit reporting bureaus. That said, most surety companies and brokers alike prefer to work with their clients to ensure payments are collected accordingly.

How Can An Insurance Agent Obtain a Surety Bond?

BondExchange makes obtaining a Surety Bond easy. Simply login to your account and use our keyword search to find your bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone (800) 438-1162, email or chat from 7:30 AM to 7:00 PM EST to assist you.