Insurance Agent’s Guide to Surety Bond Claims

November 19th, 2020

As the first point of contact, insurance agents play a vital role in the claims process. Understanding the basics can improve communication with clients and lead to higher satisfaction and retention. Surety bonds have some unique characteristics that make the claims process different from most insurance products.

In this article, we discuss those key differences and provide insurance agents with all the information they need to help their customers when a claim is made on their bond.

What Makes Surety Bond Claims Different From Other Insurance Claims?

To lay some foundation, let’s examine some key differences between surety bonds and other insurance to understand why surety bond claims are different.

Who’s Covered

Unlike insurance products, surety bonds do not protect the insured (“principal”). Surety bonds act as a financial guarantee that the obligee (usually a government agency) will be reimbursed for financial harm if the principal fails to comply with license law.

So even though your customer (the insured) pays for the bond premium, the coverage benefits a 3rd party.

What’s Covered

Insurance is obtained to avoid suffering a financial loss in case an accidental event occurs. On the other hand, surety bonds are designed to protect the public from illegal or unethical behavior that is prohibited by law.

Claim Responsibility

In a typical claims situation, the insurance company is solely responsible for payment of a claim, usually with your client as the beneficiary. In the event of a claim, the insured may experience an increase to their premium rates or even cancellation of future coverage, but they are not responsible for paying back the insurance company for the loss.

Conversely, surety bond companies require insureds to sign an indemnity agreement which contractually binds the insured to repay the surety company for any losses related to the bond.

This key concept transforms the way surety bond claims are handled.

What Happens When a Surety Claim is Received?

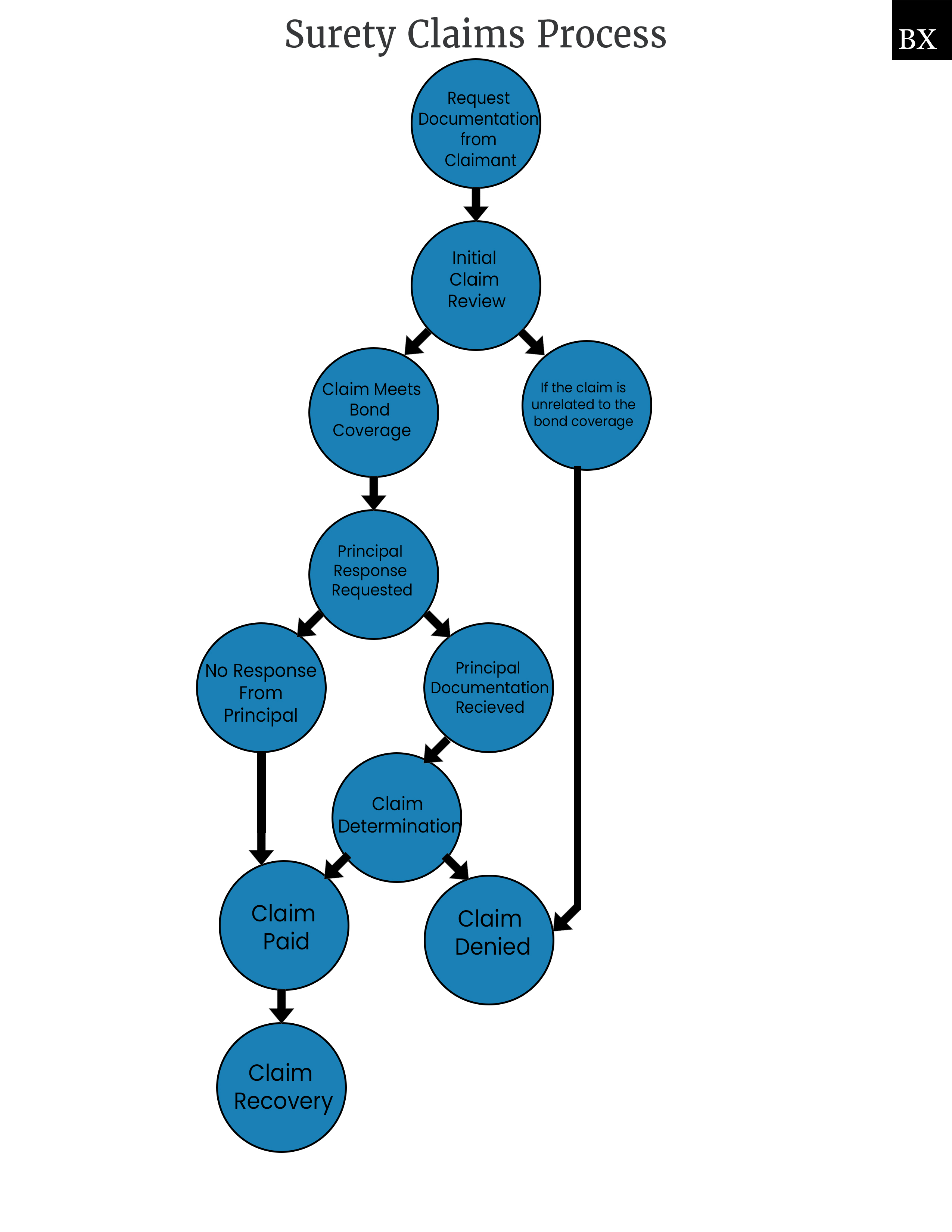

When a surety bond claim is received, surety companies will take the following steps to handle the claim:

Step 1: Request Documentation from Claimant

Surety companies typically require some form of written communication from the claimant explaining the situation and any supporting documentation showing proof of the loss.

Step 2: Initial Claim Review

Upon receipt of the documentation from the claimant, the surety company will review the bond form and all applicable statutes to determine if the grievance is covered by the bond. If the claim is unrelated to the bond coverage, the claim will be denied.

Step 3: Principal Response and Documentation

For claims that may be valid, the surety company will reach out to the bond principal for a written response and any documentation. This step provides the bond principal with an opportunity to mount a defense against the claim.

As an agent, you should urge your client to provide timely responses and documentation to the claims handler.

Step 4: Claim Determination

After receiving documentation from all parties and reviewing all applicable statutes, the surety company will determine if the claim is valid.

In some cases, claims may be disputed and subject to arbitration or court proceedings to determine validity.

Step 5: Claim Payment

If a claim is deemed valid and the principal has not settled the claim independently with the claimant, the surety company will make payment. The claim payment will not exceed the amount of the bond.

Step 6: Claim Recovery

When a surety company has made a claim payment, they will seek repayment from the bond principal for all losses, often including attorney’s and claims handling fees. The bond principal is required to repay these amounts and the surety company may take legal action to recover any losses.

How Should Insurance Agents Advise Bond Principals When a Claim is Received?

As discussed, your insured (bond principal) is ultimately responsible for claims against their bond. As an agent, you should advise your clients to do the following when a claim is received:

Respond Quickly to the Surety

While the surety company is your client’s advocate, they are legally bound to pay valid claims in a timely fashion. If your client fails to respond to a surety’s request for information, they may have no choice but to pay a claim, even if the bond principal has a reasonable defense.

Attempt to Resolve the Claim

Surety companies prefer that your client resolve any claims with the claimant before the surety gets involved. This is also in your client’s best interest as they may be required to reimburse the surety company for attorney’s fees and claims handling fees.

Reimburse the Surety Company

If a claim is paid by the surety company, bond principals should repay the surety company to avoid legal claims against the business, and even claims against personal assets. Oftentimes, failure to repay a surety company will result in the bond principal going out of business.

How Can Companies Avoid Surety Bond Claims?

As mentioned above, surety bonds are financial protection against losses to the obligee. If the principal acts unethically or violates licensing law, a claim may be triggered.

In general, to avoid claims, businesses should do the following:

- Follow all applicable license laws and regulations

- Pay all vendors, suppliers and employees

- Keep records of all transactions according to state or local laws

- Pay license fees and taxes in full and on time

This covers the basics, but businesses should carefully review all license laws, regulations, and contracts to be sure they are following the rules.

Need a surety expert? Give us a call at (800) 438-1162.