December 16th, 2020

Surety Bond Basics: Underwriting Guide

As an insurance agent, you’re most likely familiar with the underwriting requirements for insurance products. The insurance company estimates the likelihood that an unexpected event will occur, and charges the insured a premium rate based on that assessment. Surety bond underwriting incorporates these principles, but unique to surety bonds, a concept known as indemnification adds a wrinkle to the underwriting process. In this article, we detail the surety bond underwriting process so agents know what to expect when quoting bonds.

What Is Indemnification?

While surety bonds are technically insurance products, the bond principal (insured) must sign an indemnity agreement that legally requires them to reimburse the surety company for losses. This requirement to repay the insurance company fundamentally changes the underwriting process. Underwriters will examine not only the underlying risk of the insured’s business activities, but also their ability to repay losses. For the latter, most insurance companies will review the owner’s personal credit, and in some cases, business and personal financial statements.

What are the Underwriting Guidelines for Surety Bonds?

The underwriting process will determine the premium rate the principal will pay on their bond. Claims made against a surety bond are completely avoidable, and can only be made if the bonded principal breaks the agreement set forth in the bond. This causes underwriters to focus on two factors when evaluating a principal’s associated risk: 1.) The likelihood the principal may break the promise set forth in the bond, and 2.) The principal’s ability to repay the surety company should a valid claim be made against the bond.

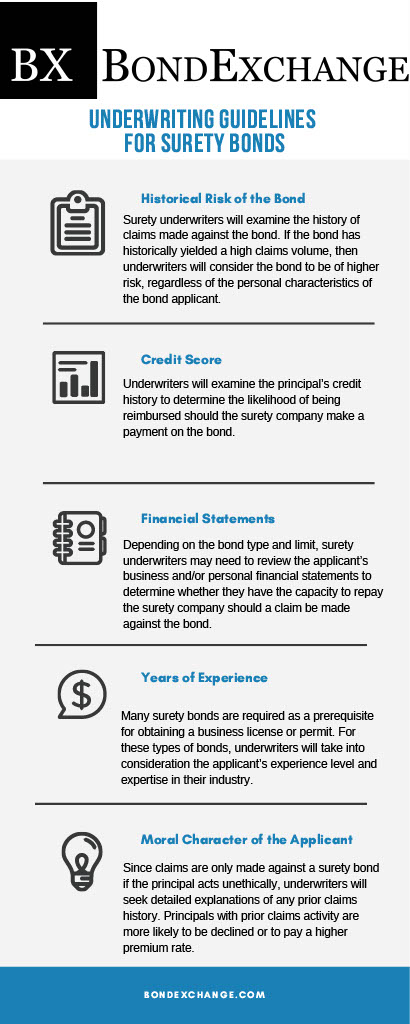

Underwriters will examine the following factors when determining the premium rate the principal will pay on their bond.

Historical Risk of the Bond

Surety underwriters will examine the history of claims made against the bond. If the bond has historically yielded a high claims volume, then underwriters will consider the bond to be of higher risk, regardless of the personal characteristics of the bond applicant.

Credit Score

Surety companies are essentially extending the principal a line of credit when issuing them a surety bond. If a claim is made against the bond, the indemnity agreement requires the principal to repay the surety company for its total loss. Underwriters will examine the principal’s credit history to determine the likelihood of being reimbursed should the surety company make a payment on the bond. Unlike when applying for a mortgage or credit card, the credit check is a “soft hit”, meaning that pulling the report will not affect the applicant’s credit.

Financial Statements

Depending on the bond type and limit, surety underwriters may need to review the applicant’s business and/or personal financial statements to determine whether they have the capacity to repay the surety company should a claim be made against the bond.

Years of Experience

Many surety bonds are required as a prerequisite for obtaining a business license or permit. For these types of bonds, underwriters will take into consideration the applicant’s experience level and expertise in their industry.

Moral Character of the Applicant

Since claims are only made against a surety bond if the principal acts unethically, underwriters will seek detailed explanations of any prior claims history. Principals with prior claims activity are more likely to be declined or to pay a higher premium rate.

These five underwriting criteria are consistent for most surety bond types. However, certain types of surety bonds will have additional underwriting requirements specific to the nature of the bond. For example, underwriters will examine additional factors like contract language for Bid, Performance, and Payment bonds to determine eligibility. Contact BondExchange for help determining the underwriting requirements for your customer’s specific bond.

Are all Surety Bonds Underwritten?

No, some surety bonds are considered low risk enough that they are issued freely and at a flat premium rate. For example: Notary Bonds are not subject to underwriting guidelines and all notaries will receive the same premium rate without having to undergo a credit check.

How Do Underwriters Determine the Bond’s Premium Rate?

Underwriters will determine the premium rate the principal will pay based on the principal’s associated risk. Principals who are deemed low risk can pay as low as 0.5% of the bond amount in premium each year. Whereas principals who are deemed high risk can pay as much as 10% of the bond amount each year. This can add up to a difference of hundreds or even thousands of dollars paid each year. As mentioned above, underwriters do not have personal discretion in determining premium rates and must adhere to the company rate filings to avoid regulatory scrutiny.

How Can an Insurance Agent Obtain a Surety Bond?

BondExchange makes obtaining a Surety Bond easy. Simply login to your account and use our keyword search to find your bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone (800) 438-1162, email or chat from 7:30 AM to 7:00 PM EST to assist you.