Insurance Agent’s Guide to Surety: What is a Surety Bond?

In the world of insurance, most of the time you’re processing insurance policies for clients in a fairly well-established pattern. Make sure your customer’s business license is current, confirm their credit standing, and then find the risk profile for their line of work to make sure that they’re within a reasonable risk profile, etc. However, every so often you’ll get a request for a surety bond, which although similar in principle, is a slightly different thing with its own approach. We created BondExchange to make the paperwork as easy as possible so you can quote your customer’s surety bond needs almost immediately.

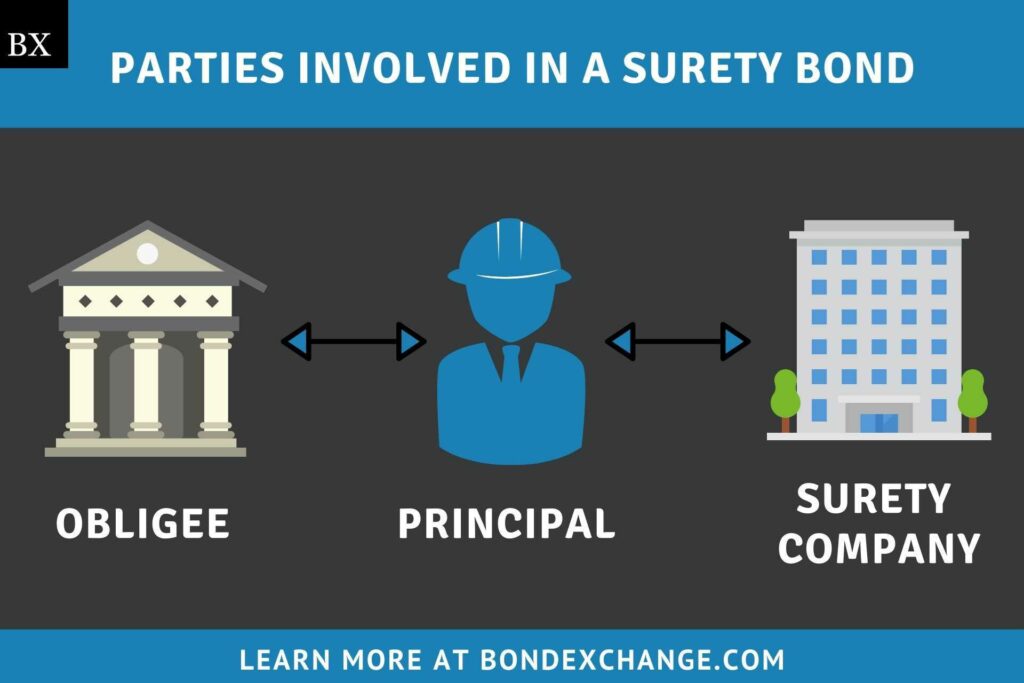

But for reference, here’s what a surety bond is and what it does:

A surety bond is a contract between three parties – the Principal (your customer, generally a business entity), the Surety Company, and the Obligee (the entity requiring the bond, typically a state or local government). The surety bond guarantees that the Principal will act in accordance with the terms established by the bond, usually a set of statutes or ordinances required for business licensing or performance of contract terms

Unlike most insurance products, the principal is required to indemnify the surety company against all losses. In other words, the surety company will pay the obligee up to the bond amount for valid claims; however, the principal must reimburse the surety company for all losses, typically including attorney fees and other claims handling expenses.

There are many different types of surety bonds with most bonds falling into one of the following categories:

- License and Permit

- Financial Guarantee

- Miscellaneous

- Public Official

- Contract

- Court

- Fidelity

How Can an Insurance Agent Obtain Surety Bonds?

BondExchange makes obtaining surety bonds easy. Simply login to your account and use our keyword search to find your bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone (800) 438-1162, email or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.