Why Surety Bond Form Language Matters

October 28, 2021

For most insurance products, the quoting and issuing processes are pretty straightforward. You obtain a quote, your customer pays a premium, and everyone’s happy. Your customer may need to present a regulatory agency with proof of insurance, but there generally isn’t an additional step after they purchase their coverage. However, when it comes to surety bonds, your customers do need to perform an additional action after obtaining coverage; filing their bond with the obligee. To file their bonds, your customers need to complete a bond form, and then submit it to the entity requiring them to be bonded. Bond forms can be confusing and oftentimes trip up even the most seasoned industry veterans. In this week’s blog article, we provide insurance agents with everything they need to know about bond forms, helping them better assist their surety bond customers.

Why it Matters

Before we dive into the nitty-gritty of what constitutes a bond form, it’s important to understand why this information matters in the first place. Bond forms affect the underwriting criteria for bonds, and the language contained within them can be the difference between your customer paying $100 or $1,000 in premium. Surety companies pay close attention to how bond forms are written, and agents who know what to look for in these forms will be more effective in accurately advising their customers.

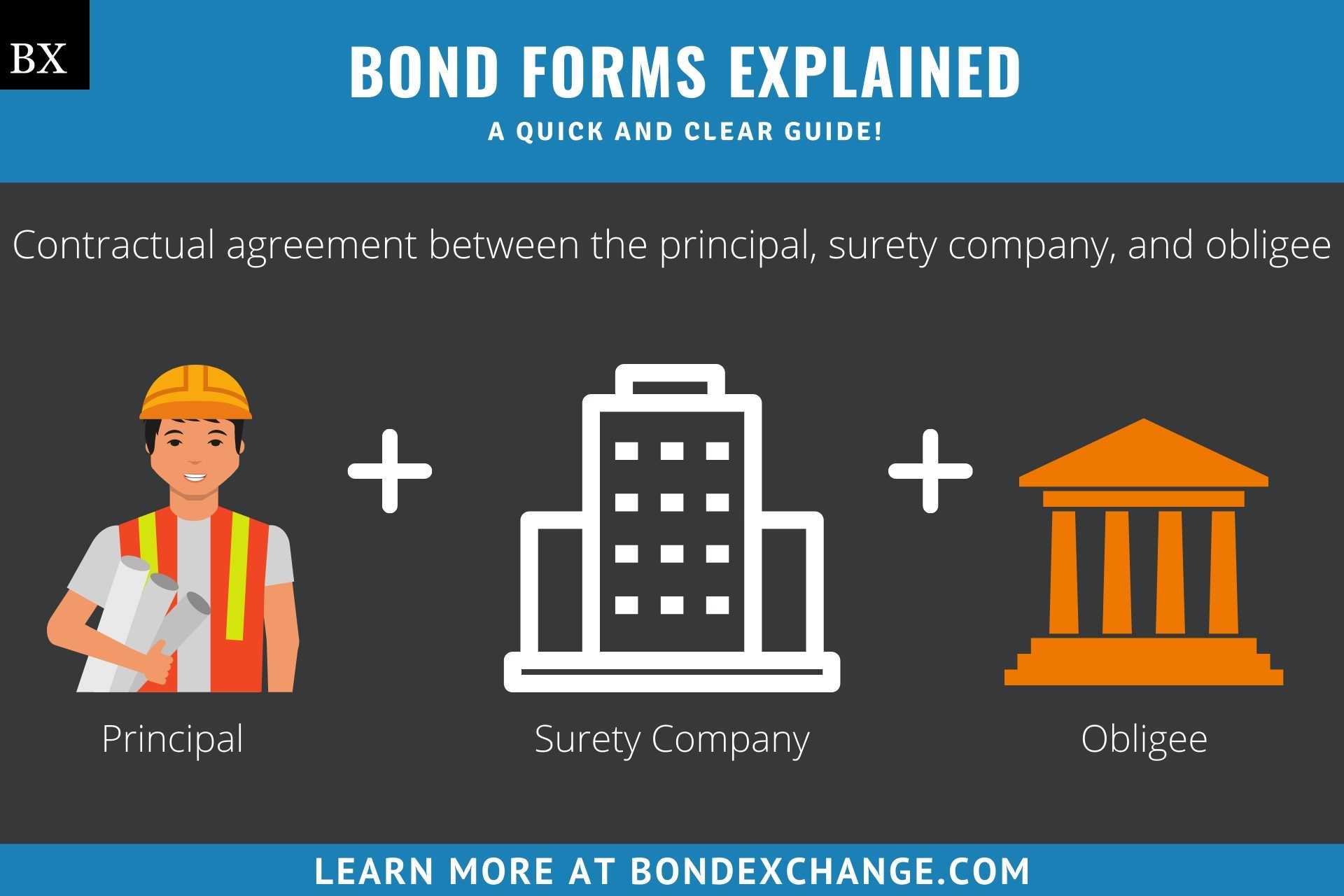

What is a Bond Form?

A bond form is a contractual agreement between the principal (your customer), the surety company, and the obligee. For surety bonds, the obligee sets the bonding requirement, and then the principal purchases the bond from the surety company. Bond forms are legally binding documents that outline the obligations of all three parties. Bond forms are written and issued by the obligee, who will most often be a government agency. Principals will need to file their completed bond forms with the obligee. The obligations contained within a bond form are as follows:

Principal

Agrees to adhere to the provisions contained within the form (not to violate licensing law, promptly pay all funds owed, etc.)

Surety Company

Assumes liability for violations committed by the principal and guarantees payment to the obligee for any valid bond claims

Obligee

Surety bonds protect the obligee, and therefore bond forms typically don’t contain specific obligations for obligees. However, obligees require surety bonds so the principal can perform a specific action, such as obtaining a business license or beginning work on a construction project.

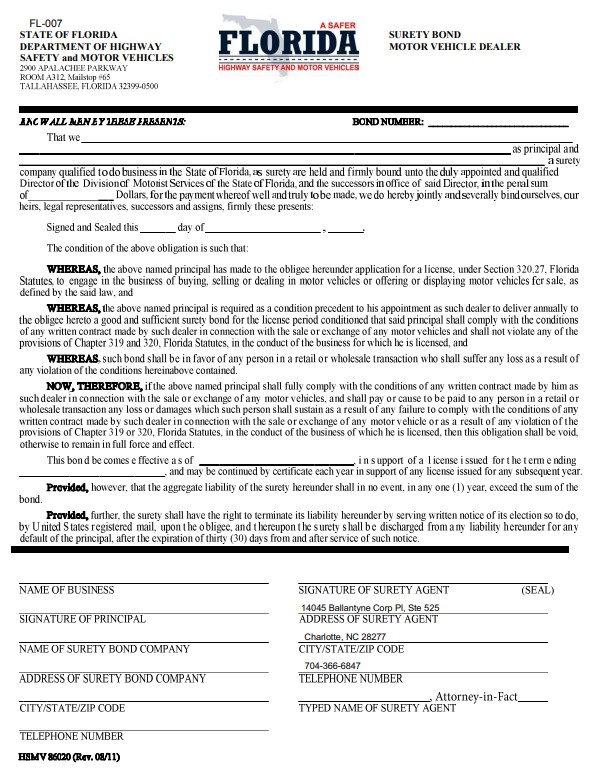

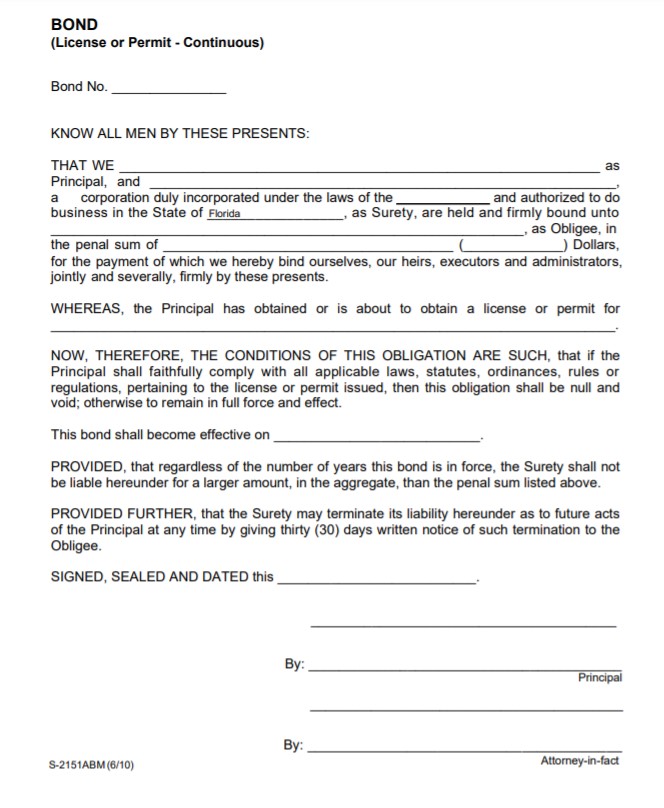

What is in a Bond Form?

As mentioned above, bond forms are legally binding contracts that lay out the obligations for the principal, surety company, and obligee. Most bond forms will contain the following items:

1. Binding Clause

Typically starts with the words “KNOW ALL MEN BY THESE PRESENTS,” and then the names of the three parties (surety, principal, and obligee). Binding clauses state the principal and surety company’s obligation to the obligee, and in most cases specify the bond amount.

2. Condition Clause

Typically starts with “THE CONDITION OF THIS OBLIGATION IS SUCH THAT” and then states the type of business license the principal is applying for. The condition clause identifies the underlying agreement that the bond guarantees and will sometimes reference a statute or regulation.

3. Now, Therefore Clause

States that the principal must comply with the terms of the bond, and if they do so, the bond will expire at the end of the contract. Alternatively, if the principal fails to adhere to the bond provisions, the bond will remain in full force and effect. Essentially what this section is saying is that if the principal doesn’t have valid claims made against their bond, then the bond will expire at the end of its term.

4. Provided, However Clause

Some surety bonds will include this clause to implement additional provisions that identify:

-

- How the bond can be canceled (specific expiration date or cancelation clause)

- If the bond can be continued by a continuation certificate

- Explicitly states the surety company’s liability

5. Signed and Sealed Dates

Indicates the date that the principal and surety company sign the bond, as well as the date the surety company seals it. All surety bonds will require signatures from both the principal and surety company, and some bonds will also require witness signatures for each party.

Are all Bond Forms the Same?

No, and while obligees will oftentimes use templated language when crafting these forms, they will typically have language unique to the specific bond requirement. Additionally, some surety bonds contain “onerous conditions”, or conditions that put strenuous burdens on the principal or surety company, and therefore increase the underwriting requirements for the bond. Examples of onerous conditions are:

Lack of Aggregate Liability Clause

An aggregate liability clause limits the surety company’s total liability to the bond amount, regardless of how many valid claims are made. To put it simply, bonds with an aggregate liability clause limit the surety company’s maximum liability to the bond amount, while bonds that don’t contain this clause hold the surety company liable up to the full bond amount for each individual claim made.

Lack of Cancellation Clause

A cancellation clause explicitly states the number of days notice the surety company must provide the obligee when cancellation occurs. Bonds without this clause prohibit surety companies from canceling the bond, and it must remain in effect until the bond’s term expires.

Forfeiture Clause

This clause allows the obligee to demand the surety company pay the full bond amount, regardless of the actual size of the loss. Needless to say, surety companies do not like this condition, and will heavily underwrite bonds that contain them.

Adverse Selection

When obligees require bonds for principals solely because they are inherently risky, then they are engaging in adverse selection. For example, Florida only requires construction contractors with a credit score below 660 to purchase a bond prior to obtaining a license. Contractors who have a credit score of 660 or higher are exempt from the bonding requirement. Surety companies rely heavily on principal credit scores during the underwriting process, and since Florida is only requiring the bond from contractors with lower credit, the surety company will view the bond as high risk.

Demand Clause

This clause limits the amount of time a surety company has to respond to a bond claim. Demand clauses hinder the surety company’s ability to conduct a thorough investigation on the alleged violation and oftentimes prevent them from coming to an accurate conclusion that is in the best interests of all parties involved.

Discovery Period/Tail

Obligees will generally establish a time period for which they are able to make claims against a bond once it is canceled. The longer this period is, the riskier the bond will be to the surety company.

Stacking/Cumulative Liability

Occurs when a bond has a definitive expiration date and a new bond must be filed for each subsequent term. This causes the surety company’s liability to “stack” each bond term. For example, Maryland requires home improvement contractors to file a $20,000 bond every two years. Because a new bond is filed each term, the surety company’s total liability increases by $20,000 every two years. After ten years, the surety company’s total liability will be $200,000 on a $20,000 bond requirement.

Per Occurrence Limits

Refers to bond penalties that are applied on a per-occurrence basis. For example, if a $10,000 per occurrence bond received ten claims of $5,000 each, then the surety company would be on the hook for a total of $50,000.

Extensive Warranty Provisions

Involves the bond extending the surety companies liability to cover any warranties the principal is required to honor. For example, the city of Redmond, Washington requires surety companies to be liable if a side sewage contractor fails to restore public land to its prior state after completing a construction project. The restoration periods may extend for long periods of time, therefore increasing the surety company’s exposure.

Liability in Excess of Bond Penalty

Increases the surety company’s liability, past the bond amount, to cover additional items such as court costs and attorney’s fees.

What if the Obligee Doesn’t Provide a Bond Form?

If the obligee doesn’t provide your customer with a bond form, then a generic form, written by the surety company, must be used. Since the surety company writes these forms, they will generally contain language more suited to the surety company.

Do Insurance Agents Need to Fill out the Bond Form?

No, as the surety company will usually provide your customers with a completed bond form. In most cases, all your customers will need to do is sign the form. However, your customer will need to provide the surety company with the following information:

- Their name and address

- Type of license being applied for (if applicable)

How Can Your Customers File Their Bonds?

Most surety bonds must be mailed, along with the power of attorney, to the obligee. However, some surety bonds can be filed electronically through a licensing portal or via email. Contact BondExchange for help determining how your customer’s bond must be filed.

How Can an Insurance Agent Obtain a Surety Bond?

BondExchange makes obtaining a surety bond easy. Simply log in to your account and use our keyword search to find their bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone at (800) 438-1162, email, or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.