Texas Auto Dealer Bond: A Comprehensive Guide For Insurance Agents

September 8th, 2020

Effective September 1, 2021 the limit on the Texas Auto Dealer Bond has been increased to $50,000 (the limit was previously $25,000). The Texas legislature authored the bond increase in Texas House Bill 3533 to grant consumers additional protection against temporary tag abuse. This page has been updated to reflect the bond increase.

At a Glance:

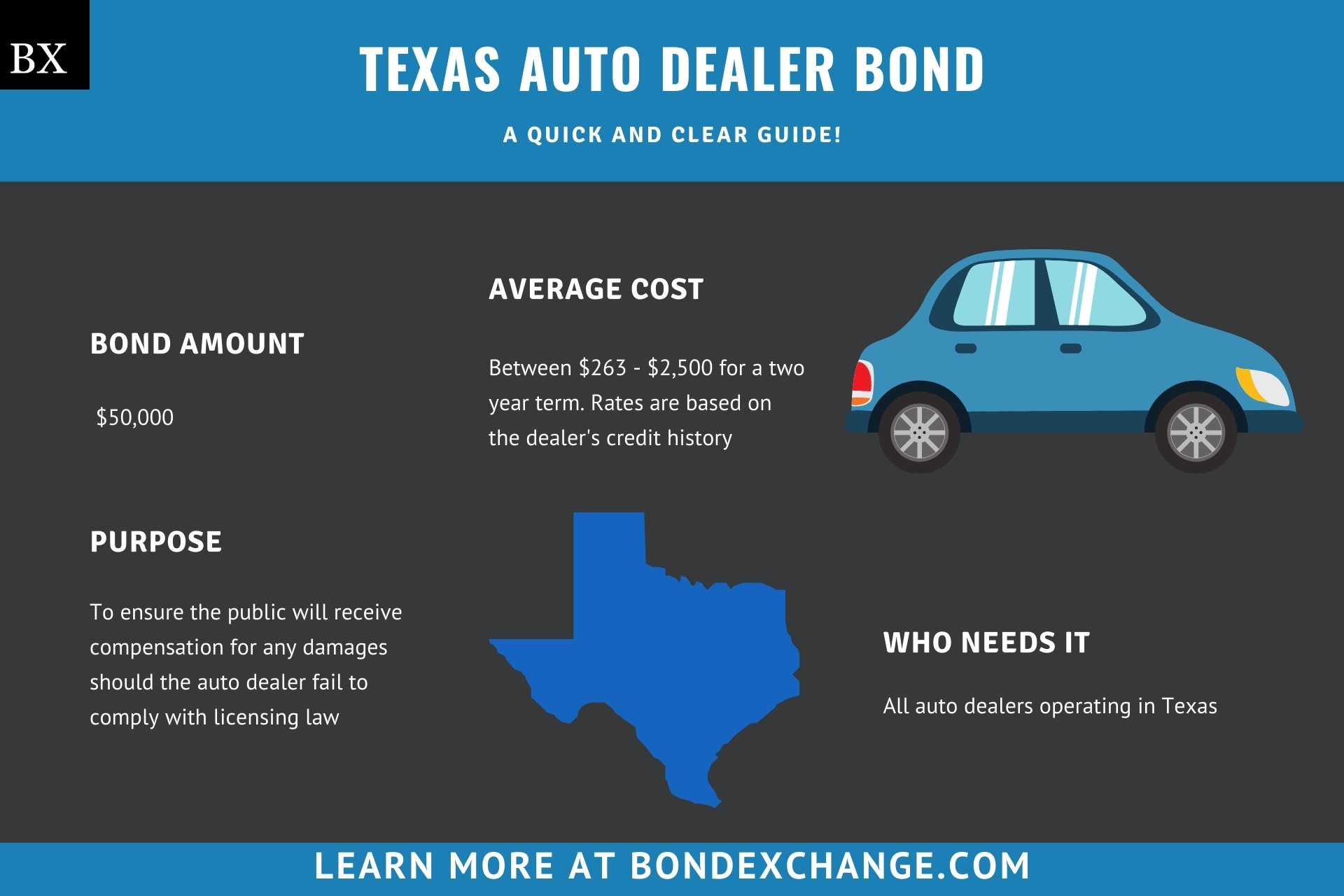

- Average Cost: Between $263 to $2,500 for a two year term, rates are based on business owner’s credit

- Bond Amount: $50,000

- Who Needs It: All dealers who seek to buy, sell, or exchange motor vehicles either directly or indirectly

- Purpose: To ensure the public will receive compensation for any damages should the auto dealer fail to comply with dealer licensing law

- Who Regulates Dealers in Texas: The Texas Department of Transportation, Motor Vehicle Division

Background

Texas House Bill 3533 requires all auto dealers operating in the state to obtain a license with the Motor Vehicle Division. The Texas legislature enacted the licensing laws and regulations to ensure that auto dealers engage in ethical business practices. In order to provide financial security for the enforcement of the licensing law, auto dealers must purchase and maintain a $50,000 surety bond to be eligible for licensure.

In 2019, Texas House Bill 1667 updated existing statutes removing the Salvage license requirement if the salvage dealer also holds a GDN license for the same location.

What is the Purpose of the Texas Auto Dealer Bond?

Texas requires dealers to purchase the Motor Vehicle Dealer Bond as part of the application process for licensure. The bond protects all purchasers, sellers, financing agencies, and government agencies from monetary loss stemming from any fraud or fraudulent representation, failure to comply with licensing law, and failure to pay required taxes and fees. In short, the bond is a type of insurance that protects the public if the dealer breaks the laws pertaining to motor vehicle dealers.

How Can an Insurance Agent Obtain a Texas Auto Dealer Bond for their Customer?

BondExchange makes obtaining a Texas Auto Dealer Bond easy. Simply login to your account and use our keyword search to find the “auto dealer” bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone, email or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

Is a Credit Check Required for the Texas Auto Dealer Bond?

Surety companies will run a credit check on the auto dealer to determine eligibility and pricing for the Texas Auto Dealer bond. Dealers with excellent credit and work experience can expect to receive the best rates. Dealers with poor credit may be declined by some surety companies or pay higher rates. The credit check is a “soft hit”, meaning that the credit check will not affect the dealer’s credit.

How Much Does the Texas Auto Dealer Bond Cost?

The Texas Auto Dealer Bond can cost anywhere between $263 to $2,500 for a two year term. Insurance companies determine the rate based on a number of factors including your customer’s credit score and experience. The chart below offers a quick reference for the approximate bond cost on the $50,000 bond requirement.

$50,000 Auto Dealer Bond Cost

| Credit Score | Bond Cost (2 year term) |

|---|---|

| 750+ | $263 |

| 680 – 749 | $380 |

| 660 – 679 | $625 |

| 625 – 659 | $875 |

| 600 – 624 | $1,250 |

| 580 – 599 | $1,500 |

| 550 – 579 | $1,750 |

| 525 – 549 | $2,000 |

| 500 – 524 | $2,500 |

*The credit score ranges do not include other factors that may result in a change to the annual premium offered to your customers, including but not limited to, years of experience and underlying credit factors contained within the business owner’s credit report.

How Does Texas Define “Motor Vehicle Dealer”?

Texas House Bill 3533 defines a dealer as “a person who regularly and actively buys, sells, or exchanges vehicles at an established or permanent location”. There are several exceptions to this definition, including:

- Any person selling 5 or fewer vehicles in the same year. Vehicles must be listed in the seller’s name to remain exempt

- Seller is a government agency

- A person selling a vehicle they acquired for personal or business use to a non-retail buyer

- A person who is selling their vehicle in a forced sale

- An insurance company selling a vehicle acquired through an insurance claim

- A person who is acting under a court order as a receiver, trustee, administrator, executor, guardian, or other appointed person

- The vehicle being sold is at least 25 years old (antique vehicles)

- The seller is a collector who is selling a special interest vehicle that is at least 12 years old

How Do Auto Dealers Apply for a License in Texas?

The process for applying for a motor vehicle dealer license in Texas is pretty complex and each license type has its own specific set of requirements. Below are the general guidelines, but dealers should refer to the Texas Vehicle Dealer Manual for details on the process.

License Period – The dealer license period is valid for two years from the date of issuance, and must be renewed prior to the expiration date for dealers to continue operations.

Step 1 – Determine the License Type

Texas requires dealers to obtain specific licenses corresponding to the nature in which the dealer’s business operates. Keep in mind that dealers will need to acquire a license for each type of business they wish to operate. Below are the license classifications for Texas dealers:

-

- Converter – Significantly modifies an already assembled vehicle

- Franchise – Sells new vehicles

- Independent (GDN) – Buys, sells, or exchanges used vehicles. Must obtain a GDN for each type of vehicle sold (car, motorcycle, trailer ect.)

- In-Transit – Transport vehicles from the manufacturer or any other point of origin

- Leasing – Operates as a leasing agent or leasing company. Does not apply to franchise dealers leasing vehicles they are permitted to sell

- Manufacturer – Creates or assembles new vehicles

- Distributor – Dispense or sell new vehicles to franchise dealers or enters into agreements with franchise dealers on behalf of manufacturers

- Salvage Dealer – Buys, sells, or repairs more than five salvage vehicles a year. Note, if the salvage dealer’s location is also licensed as an Independent (GDN), the salvage dealer license is not needed.

Step 2 – Obtain GDN Number(s)

All licensed dealers are required to obtain at least one general distinguishing number (GDN) issued by the Department of Transportation. In the scenarios below, additional GDNs will be needed:

-

- Franchise dealers with multiple locations

- Independent dealers with locations in different cities

- Dealers who sell more than one type of vehicle classified below (one GDN for each type)

- Independent Motor Vehicle – Used cars, trucks, motor homes, and neighborhood vehicles

- Independent Motorcycle – Used motorcycles, motor scooters or ATVs

- Travel Trailer – Used travel trailers

- Trailer/Semiltrailer – New or used utility trailers and/or semitrailers

- Wholesale Dealers – Sell or exchange vehicles only with other licensed dealers

- Independent Mobility Motor Vehicles – New vehicles designed and equipped to transport a person with a disability

Step 3 – Purchase a Surety Bond

Auto dealers must purchase and maintain a $50,000 surety bond

Step 4 – Pass Dealer Education Program (GDN Only)

Dealers seeking to buy, sell, or exchange used vehicles will need to complete a one time dealer education program to be eligible for licensure. For FAQs regarding the dealer education program, click here. A list of approved instructors can be found here.

Step 5 – Complete the Application

Texas requires all dealer license applications to be submitted online through their eLICENSING system. All required licensing forms can be found here. The only people who are authorized to submit an application are the license applicant, license holder, or an authorized representative.

Step 6 – Establish a Location

Dealers are required to have an established place of business that meets the minimum requirements outlined in chapter 3.8 of the Texas Vehicle Dealer Manual

Step 7 – Erect Signs

Retail dealers are required to display a permanent sign at each location that displays their business name. The sign must be noticeable and contain letters that are at least 6 inches in height. Wholesale dealers located in an office building with other businesses may mount a permanent sign located next to their entrance with letters at least 2 inches in height.

Step 8 – Establish Phone Listings

Dealers must have a phone number listed under the same name under which they conduct business

Step 9 – Obtain EIN

All dealers must obtain an employer identification number from the Internal Revenue Service

Step 10 – Pay Fees

Dealers must pay the $700 application fee for each license application and $90 for each dealer plate.

How Does a Texas Auto Dealer Renew Their License?

The Texas Motor Vehicle Dealer License is valid for two years and dealers must renew the license before the expiration date. The license is required to begin on the first day of the month, is issued for a two year term, and expires on the last day of the expiration month (i.e. 10/1/2020 – 9/30/2022). To renew their license, dealers must submit their renewal application online through Texas’s eLICENSING system. All relevant forms and instructions are listed in the renewal application. The renewal fee is $400 for applicants who start the renewal process before the expiration date. Dealers renewing late are assessed an additional fee of $200 for each 30 day period after the license expires. After 90 days, the applicant must apply for a new license.

How Does the Dealer File Their Bond With the Texas Department of Transportation?

Motor Vehicle Dealers must file their completed and signed bond with the Texas Department Transportation, Motor Vehicle Division online through Texas’s eLICENSING system. The bond form must include the following items:

- Signatures of both the dealer owner/principal and the bonding company

- Bond term concurrent with the license term of two years

- Business name matching the dealer license application

- Physical address of the dealership

- Power of attorney from the bond company

What Can Dealers Do to Avoid Claims Against the Texas Auto Dealer Bond?

To pursue a claim on the Texas Vehicle Dealer Bond, the claimant must prove financial harm in a court of law due to the dealer’s failure to comply with licensing regulations. Attorney fees may be included in the bond claim if the principal is found liable, but the total claim cannot exceed the bond amount of $50,000. To avoid claims against the bond, dealers should:

- Ensure that all bank drafts are paid in a timely manner

- Pay sellers for vehicles obtained in accordance with the terms of sale

- Ensure that titles are transferred between owners

- Adhere to all regulations regarding temporary tags

What Other Insurance Products Can Agents Offer Dealers in Texas?

While Texas does not require liability insurance for motor vehicle dealers, most reputable dealer firms should seek garage liability insurance. Bonds are our only business at BondExchange, so we do not issue any form of liability insurance; however, we recommend agents utilize brokers for this specific line of business. A list of brokers in this space can be found here.

How Can Insurance Agents Prospect for Texas Auto Dealer Customers?

Texas conveniently provides a public database to search for active motor vehicle dealers in the state. The database can be accessed on the DMV site here. For a complete list of dealers in Texas, agents can download the DMV provided spreadsheet here. Contact BondExchange for additional marketing resources Agents can also leverage our print-mail relationships for discounted mailing services.

What Other States Require Auto Dealer Bonds?

All 50 states and the District of Columbia require auto dealers to obtain an Auto Dealer Bond as a prerequisite for licensure. Insurance agents should utilize our Main MVD Page for a detailed analysis of the Auto Dealer Bond requirements nationwide.