Surety Bonds vs. Insurance

July 30, 2021

A common misconception among insurance agents is that surety bonds are just another insurance product, no different from standard, more traditional lines. However, any agent who has actually worked to obtain a surety bond knows that this is far from the truth. While surety bonds are technically considered insurance, their unique purpose, underwriting requirements, and claims process sets them in a category of their own. Surety bonds are a unique beast and not something most insurance agents deal with regularly. In order to help insurance agents better understand the intricacies of suretyship, better serve their surety customers, and continue building their book of business, we’re analyzing and reporting on the four key differences between surety bonds and insurance.

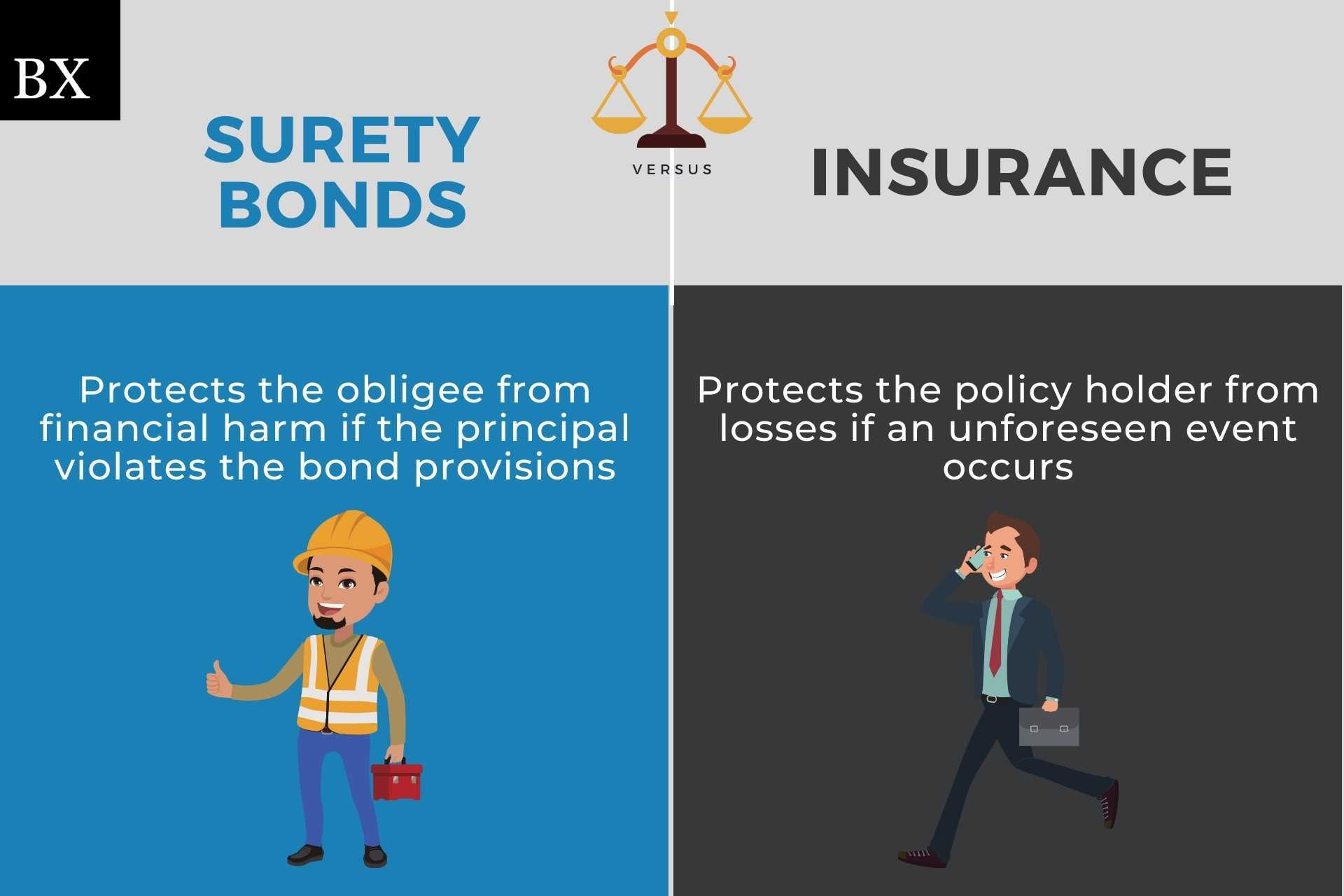

Purpose

The biggest difference between surety bonds and insurance is their intended purpose. Surety bonds protect the obligee (person/entity requiring the bond) from financial harm if the principal (bondholder) acts unethically. Surety bonds are generally (but not always) required by a government agency as a prerequisite to obtaining a business license or permit, and provide a means for the obligee to recover any losses resulting from the principal’s failure to comply with licensing or permit regulations. This is a stark contrast to other insurance products, who protect the policy owner from losses resulting from unforeseen events occuring. Simply put, surety bonds protect the obligee from financial harm if the principal acts unethically, while insurance protects the policyholder from losses resulting from accidents.

Underwriting

Both surety bond and insurance underwriters are tasked with determining the level of risk that issuing a specific bond/policy will result in a payout. The key difference, however, are the factors being examined. The underwriting requirements for traditional insurance products will examine the level of risk that an accident will occur, tasking underwriters with determining how the policy holder contributes to that risk. Take auto insurance for example, since this coverage protects against property damage to the insured’s vehicle, underwriters will examine factors such as the insured’s driving record, history of accidents, and type of vehicle being covered.

On the other hand, surety bond underwriters not only need to examine the level of risk of a claim being made against a bond, but also the principal’s ability to repay them were a claim to occur. To determine the level of risk the surety company will assume should they issue the bond, underwriters will examine the principal’s credit history, years of experience, and in some cases business financial statements.

Claims

Claims made against surety bonds are generally avoidable and will only occur if the principal violates the provisions set forth in the bond form. Each surety bond will have its own specific provisions outlining what actions warrant a valid claim, and these provisions are generally codified in statutes written by a legislative authority. If your customer adheres to all of the provisions contained in their bond form, which will typically bar any acts of fraud, deceit or non-performance, then they should never have any valid claims made against their bond. For other lines of insurance, claims are not always avoidable, and are most often made after an accident or unforseen event occurs.

Indemnification

The requirement to repay the surety company, known as indemnification, often trips up insurance agents. Why should my customer need to repay the surety company for bond claims if they already pay a premium? Unlike insurance, the bonded principal is required to repay the surety company for all claims and claims handling expenses. For example, if a claim is made against an auto dealer’s surety bond as a result of the dealer’s failure to transfer a vehicle title, the dealer will need to repay the surety company the full amount paid to the claimant, as well as any claims adjusting and legal expenses. Think of surety bonds as an extension of credit that the surety company lends to your customer. If the surety company is forced to pay out a claim against a bond, then your customer must repay them for the credit used.

Surety bonds can seem complex at first glance, but once agents begin familiarizing themselves with these products then the process of explaining bonding requirements to customers becomes much smoother. Have any additional questions that have not been answered in this article? Contact BondExchange today and let us help you with all your surety bond needs.

How Can an Insurance Agent Obtain a Surety Bond?

BondExchange makes obtaining a surety bond easy. Simply login to your account and use our keyword search to find your bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone (800) 438-1162, email or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.