Surety Bonds vs. Letters of Credit: The Ultimate Guide

October 22nd, 2020

Federal, state, and local governments require many businesses to obtain a license to ensure that they engage in ethical business practices. To protect the public should the business fail to do so, businesses are often asked to post a form of “financial security” that can easily be tapped to reimburse the public for financial harm.

Most government agencies will allow two forms of security – a surety bond or letter of credit (“LOC”). In this article we will explain why surety bonds are oftentimes the better choice and how insurance agents can obtain these bonds for their customers

How are Surety Bonds and Letters of Credit Similar?

Surety bonds and letters of credit both act as a promissory note guaranteeing payment to a third party. When used as security for a license, they also serve the same purpose – to protect the public from financial harm if the business violates licensing law.

Further, both serve as an agreement between three different parties, as outlined below:

- Surety Bond

- Surety Company

- Principal (business owner)

- Obligee (government agency)

- Letter of Credit

- Bank

- Bank Customer (same as principal)

- Beneficiary (same as obligee)

How are They Different?

There are some key differences between surety bonds and letters of credit that should be considered by your clients as described below:

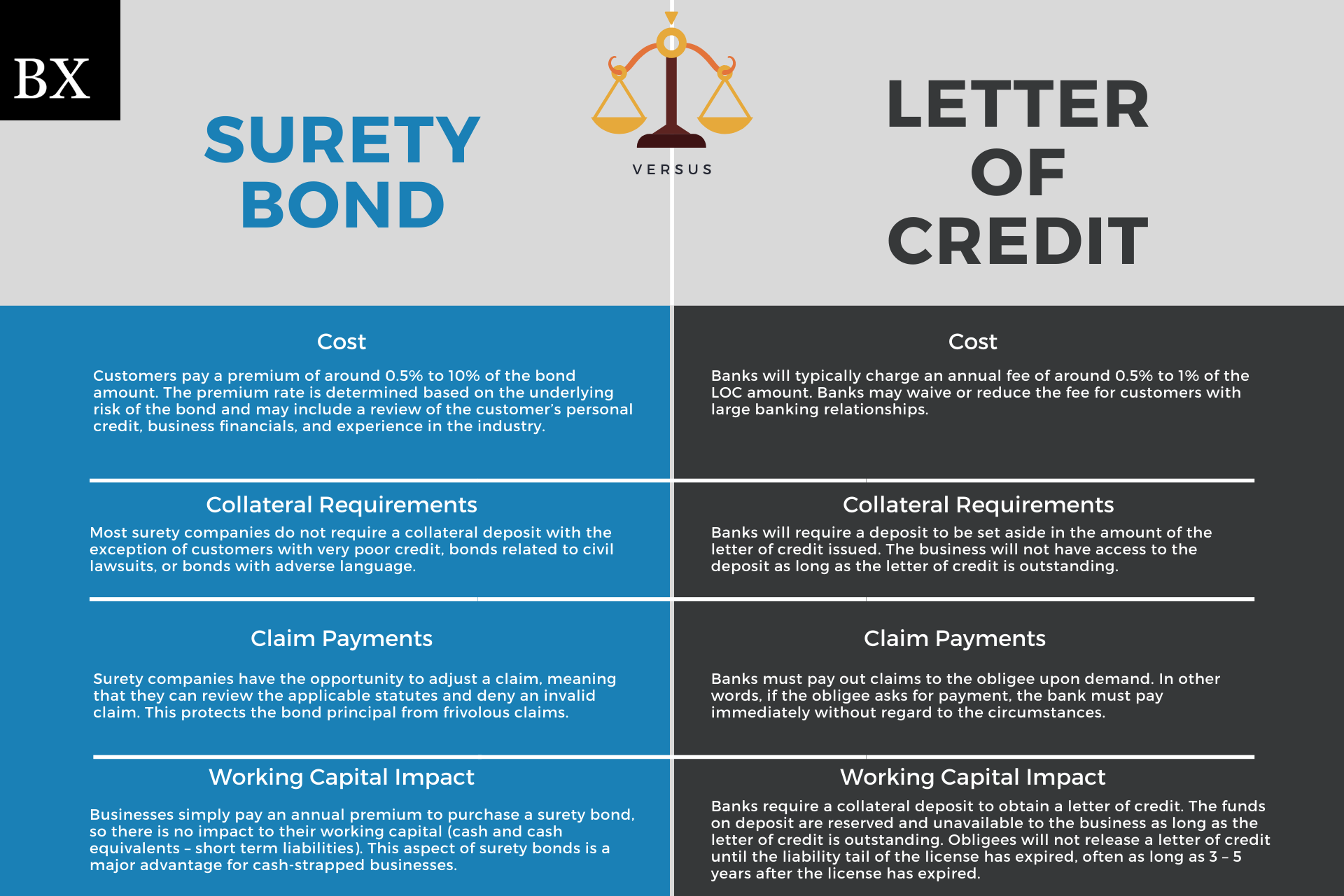

Collateral Requirements

- Letter of Credit – Banks will require a deposit to be set aside in the amount of the letter of credit issued. The business will not have access to the deposit as long as the letter of credit is outstanding.

- Surety Bond – Most surety companies do not require a collateral deposit with the exception of customers with very poor credit, bonds related to civil lawsuits, or bonds with adverse language.

Cost

- Letter of Credit – Banks will typically charge an annual fee of around 0.5% to 1% of the LOC amount. Banks may waive or reduce the fee for customers with large banking relationships.

- Surety Bond – Customers pay a premium of around 0.5% to 10% of the bond amount. The premium rate is determined based on the underlying risk of the bond and may include a review of the customer’s personal credit, business financials, and experience in the industry.

Claim Payments

- Letters of Credit – Banks must pay out claims to the obligee upon demand. In other words, if the obligee asks for payment, the bank must pay immediately without regard to the circumstances.

- Surety Bonds – Surety companies have the opportunity to adjust a claim, meaning that they can review the applicable statutes and deny an invalid claim. This protects the bond principal from frivolous claims.

Working Capital Impact

- Letter of Credit – As previously discussed, banks require a collateral deposit to obtain a letter of credit. The funds on deposit are reserved and unavailable to the business as long as the letter of credit is outstanding. Obligees will not release a letter of credit until the liability tail of the license has expired, often as long as 3 – 5 years after the license has expired.

- Surety Bond – Businesses simply pay an annual premium to purchase a surety bond, so there is no impact to their working capital (cash and cash equivalents – short term liabilities). This aspect of surety bonds is a major advantage for cash-strapped businesses.

When Should Your Customer Purchase a Surety Bond?

For most businesses, surety bonds are the better option. Most importantly, surety bonds do not diminish businesses working capital. As they say, “cash is king” and surety bonds only require a minimal cash outlay (premium payment) to meet the licensing requirement.

Surety bond companies also help to protect your customer’s cash by fighting frivolous claims from consumers. Alternatively, banks have less leverage to fight claims as the obligee may demand payment from the bank.

Another advantage to surety bonds is that the premium paid for the bond provides coverage commensurate with the bond term and any tail liability. For example, a claimant might make a claim on a bond two years after the activity that caused the claim. As long as the statutes allow for this claims tail, the surety company will be responsible to pay the claim. For this reason, most obligees will require a letter of credit or cash deposit to be on file for the full liability tail, which means your customer’s cash can be tied up for years after the business is no longer active or the LOC is replaced by a surety bond.

When Might a Letter of Credit be the Better Option?

Letters of credit may be a better option for businesses that are highly liquid and can afford to set aside the cash deposit.

In addition, surety companies typically charge a minimum premium amount of $100, so for smaller bond amounts ($1,000 or less), the rate charged is very high relative to the bond amount. In this scenario, we recommend the customer post a letter of credit or a cash deposit with the obligee.

How can Insurance Agents Obtain a Surety Bond?

BondExchange makes obtaining a surety bond easy. Simply login to your account and use our keyword search to find the “auto dealer” bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone (800) 438-1162, email or chat from 7:30 AM to 7:00 PM EST to assist you.