Supply Bonds: A Comprehensive Guide For Insurance Agents

July 12, 2021

This guide provides information for insurance agents to help their customers obtain Supply Bonds

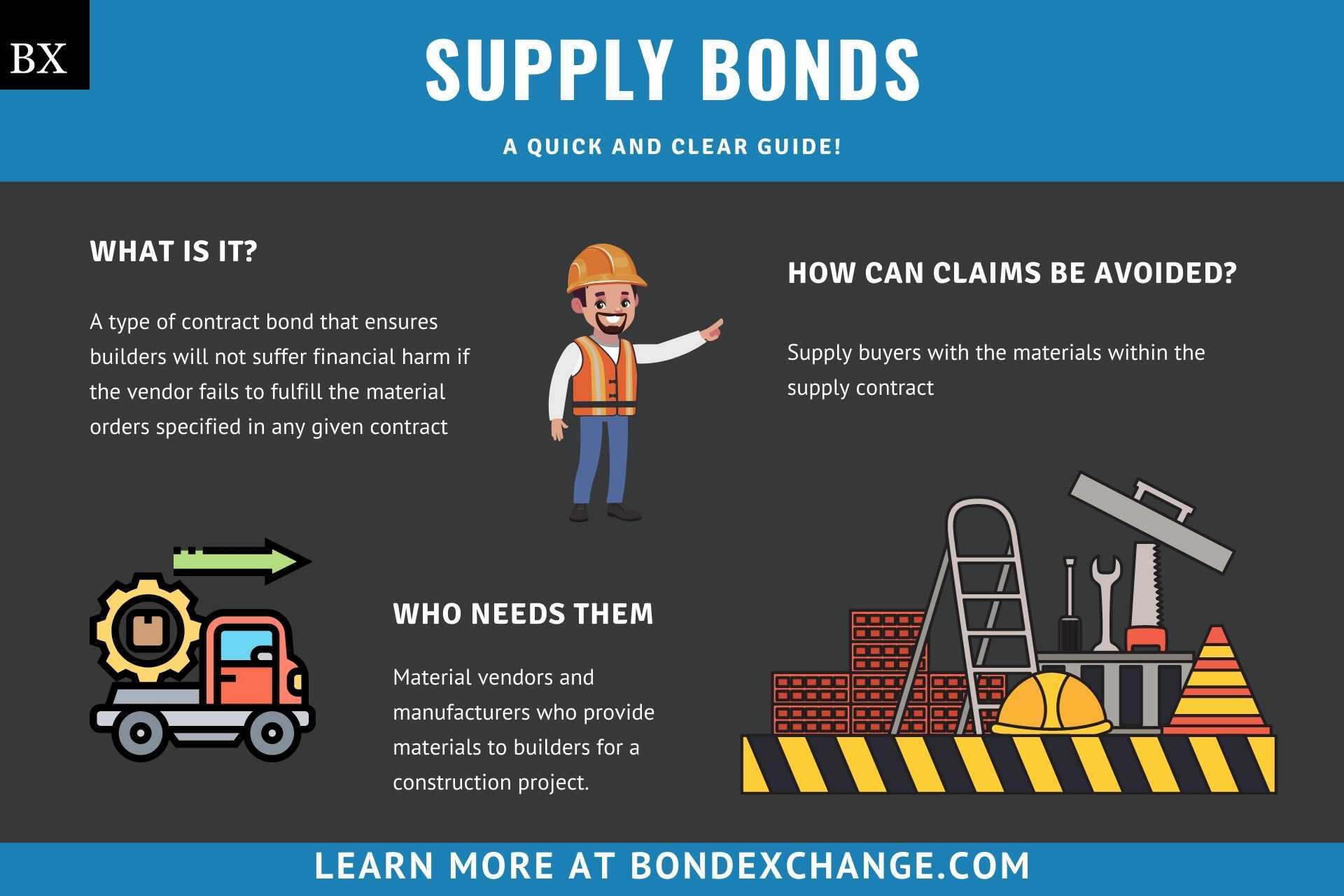

What is a Supply Bond?

Supply bonds are surety bonds that material vendors must purchase when providing materials to builders for a construction project. Supply bonds are a type of contract bond that ensures builders will not suffer financial harm if the vendor fails to fulfill the material orders specified in any given contract. For example, if a builder placed an order for windows and the vendor was unable to fulfill the order, then the supply bond would reimburse the builder for any loss they would suffer from the failure of the supplier to furnish the windows. Supply bonds are commonly confused with performance and payment bonds; however, unlike performance and payment bonds, supply bonds do not guarantee completion of a project or payment to employees/subcontractors. Rather, supply bonds ensure builders either receive materials ordered or are reimbursed for materials not received.

Supply bonds are typically required for private jobs (not government funded), and are most often needed for custom or design/build projects where the products aren’t off the shelf (windows for a high-end apartment complex, customized equipment or machinery, etc.).

Unlike most insurance products, supply bonds protect a third party (buyers) for acts that are violations of an established contract. When the surety company suffers a loss due to the supplier’s failure to supply the materials or products, the supplier must repay to the surety company any losses and sometimes court costs and other fees.

Who Needs A Supply Bond?

Vendors or manufacturers who supply builders with materials needed for the completion of a construction project may need to purchase a supply bond. The bond requirement will be outlined in the supply contract, and are generally only required for custom or design/build projects. If the supply contract does not state that vendors must be bonded, then a supply bond is not required. Supply bonds are most often required for privately funded construction projects, and the vendor must purchase a separate bond for each supply contract. This means that material vendors cannot purchase just one supply bond that covers all existing contracts.

Who Requires Supply Bonds?

The obligee (the individual or entity requiring the bond) for supply bonds will be the project owner. The obligee for a supply bond will most often be a non-government entity. However, the Miller Act requires contractors to purchase performance and payment bonds on federally funded projects over $100,000. While the act doesn’t explicitly mandate supply bonds, some of these contracts will require them anyway to protect public funds being used. Many states have enacted “Little Miller Acts” that mirror the federal requirements on a state level.

What are the Underwriting Requirements for Supply Bonds?

When determining a vendor’s eligibility for a supply bond, surety companies will examine the following factors:

- Credit History: Arguably the most important underwriting factor as a vendor’s credit history is indicative of the likelihood the vendor will repay the surety company if a valid claim is made against their bond

- Financial Stability: Vendors who are financially stable are deemed less risky by surety underwriters as strong financial statements indicate their ability to repay the surety company for all claims and claims handling expenses. To determine a vendor’s financial stability, surety companies will oftentimes require the vendor’s business financial statements

- Experience: Vendors with multiple years of business experience are more likely to be approved for a supply bond

How Much Does a Supply Bond Cost?

Supply bonds will typically cost between 1% to 3% of the bond amount. The limit on a supply bond will vary from contract to contract, but will most often mirror the total cost of materials being purchased. Most larger projects are rated using a sliding scale. Below is an example of the premium cost for a $1 million bond:

$1 million Supply Bond Cost

| Bond Amount | Premium Rate | Bond Cost |

|---|---|---|

| First $100,000 | 2.5% | $2,500 |

| Next $400,000 | 1.5% | $6,000 |

| Next $500,000 | 1% | $5,000 |

Total Cost: $13,500

Sometimes the total material costs will exceed what has been specified in the contract, resulting in an overrun. Because the premium is based on the bond amount, the surety company will charge an additional premium for the cost difference between the material costs outlined in the contract and the final project cost. By contrast, projects completed for an amount lower than the initial cost estimate will incur an underrun and the surety company will refund the difference in premium between the initial estimated cost and the final project cost.

How Do Material Vendors File Their Bond?

Surety bond companies will provide the material vendor with a completed surety bond to be presented to the obligee (project owner). Surety companies should include the following information on most supply bond forms:

- Legal name and address of the material vendor buying the bond

- Surety company’s name and address

- Bond amount

- Signatures of the surety representative

- Date the bond is effective and issued

- Corporate seal of the surety company

- Power of Attorney

Do Supply Bonds Need to Be Renewed?

No, supply bonds do not need to be renewed as they will expire after the completion of the construction project. This means that vendors are only required to make a one time premium payment on a supply bond. However, vendors will need to purchase a separate supply bond for each contract that requires it.

What Can Material Vendors Do to Avoid Claims Against Their Supply Bond?

To avoid claims against their bond, material vendors must ensure they supply the builders with the materials within the supply contract. For example, a material vendor who only provides five custom windows on an order for six must refund the builder for the window that was paid for but not received.

How Does Inflation Impact Supply Bonds?

Inflation has the potential to lead to claims being made against your customer’s supply bond. If the price of raw materials (lumber, steel, copper, etc) increases after the supply contract has been signed, then your customer may not be able to procure the agreed upon materials with the funds they received from the buyer, opening themselves up to bond claims. To protect themselves in scenarios such as these, vendors should insist that an escalation clause is added to the supply contract. An escalation clause guarantees a change in the agreed upon buying price of the materials requested if an external factor, such as inflation, causes the price of materials to increase. The inclusion of an escalation clause in a supply contract grants suppliers some protection when costs of certain materials have rapidly increased due to reasons outside of their control. This clause would also benefit the buyers by avoiding delayed delivery from performance claims and defaults. An escalation clause can be implemented by tying the baseline price to a published cost index for those materials that are subject to a price fluctuation.

How Can an Insurance Agent Obtain a Supply Bond?

BondExchange makes obtaining a surety bond easy. Simply login to your account and use our keyword search to find your bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone (800) 438-1162, email or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

What Other Insurance Products Can Agents Offer Material Vendors?

Most reputable material vendors will purchase liability insurance to protect themselves from losses in the event any materials are damaged during the shipping process. Bonds are our only business at BondExchange, so we do not issue any other forms of insurance, but our agents often utilize brokers on these lines. A list of brokers in the supply bond space can be found here.

Why Should Agents Offer Supply Bonds?

Supply bonds not only provide significant commission opportunities for agents, but can also help to create sticky client relationships. Agents that can tackle the complex surety bond requirement for material vendors often become trusted advisors to their clients, leading to increased retention and cross-selling opportunities.

As with other types of contract bonds, the initial underwriting requirements for supply bonds can be fairly intrusive and comprehensive for material vendors. However, once a surety line is established, the process going forward is pretty painless. Oftentimes vendors are apprehensive about disclosing their business financial statements during the underwriting process, and are highly unlikely to switch agents after providing this information. Construction contracts also often require other insurance products like general liability and workers compensation, opening up an easy cross-selling opportunity.