Oil and Gas Bonds: A Comprehensive Guide For Insurance Agents

July 21, 2021

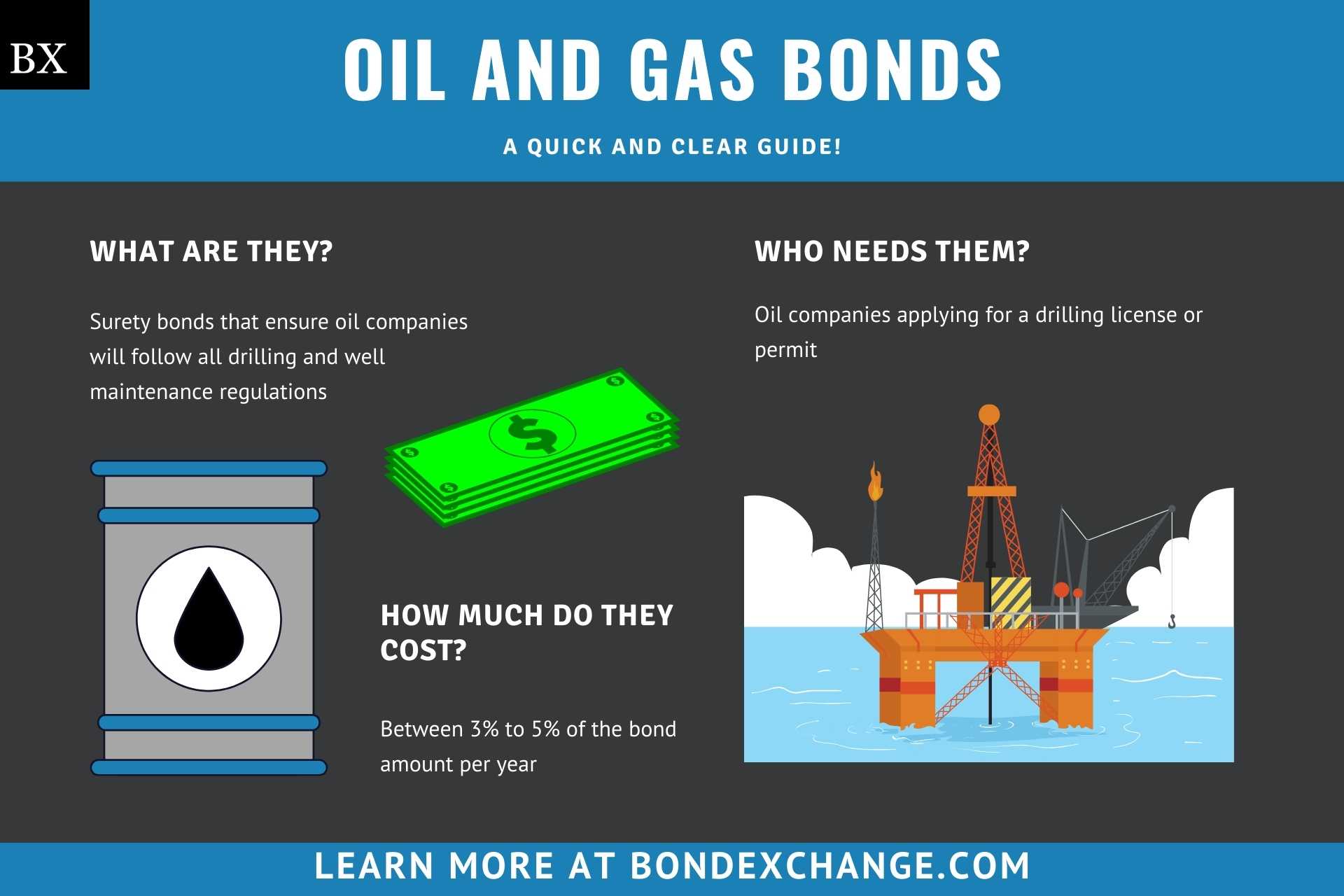

This guide provides information for insurance agents to help their customers obtain Oil and Gas Bonds

What are Oil and Gas Bonds?

Oil and gas bonds are surety bonds that oil companies must purchase when applying for a drilling license or permit. Oil and gas bonds ensure that oil companies will follow all drilling regulations, and provide a financial guarantee that the oil company will perform the following actions:

- Comply with all relevant regulations when drilling, deepening, or re-drilling wells

- Properly dispose of all waste/pollutants

- Maintain the well and promptly conduct any necessary repairs

- Plug all retired wells and return the land to its original state

For example, if an oil company failed to adequately clean up a well and return the surrounding landscape to its original condition, then an oil and gas bond provides the funds needed to cover the cleanup costs. Oil and gas bonds provide the public with an efficient means of recovering the costs of returning land used for drilling to its original state. In the event of a bankruptcy or insolvency, it would be nearly impossible to hold companies responsible for ensuring the drilling site is returned to its previous condition without oil and gas bonds.

Oil and gas bonds are similar to reclamation bonds, which also ensure that companies who alter public lands will return the land to its original state. However, unlike reclamation bonds, oil and gas bonds are specific to the oil and gas industry and cover additional liabilities, such as well maintenance, not present in reclamation bond forms.

Unlike most insurance products, oil and gas bonds protect a third party (the general public) for acts that are violations of the law. When the surety company suffers a loss due to the oil company’s failure to properly maintain and clean up a well, the oil company must repay to the surety company any losses and sometimes court costs and other fees, a concept known as indemnification.

Who Needs An Oil and Gas Bond?

Oil companies who are applying for a drilling license or permit will need to purchase an oil and gas bond as a prerequisite to conducting drilling operations. Additionally, contractors involved in the drilling, well plugging/maintenance, and cleanup process may also need to be bonded. While oil and gas bonds cover a wide range of actions, they are primarily used for reclamation purposes. Essentially, if your customer is in any way responsible for ensuring that the drilling site will be returned to its original state then they will most likely need to purchase an oil and gas bond. Oil companies will need to purchase a separate surety bond for each drilling license/permit being applied for. A notable exception to this rule is for drilling activities conducted in Texas; who only requires oil and gas companies to purchase one blanket surety bond.

Who Regulates Oil and Gas Bonds?

The obligee (the individual or entity requiring the bond) for oil and gas bonds will most often be the Department of Interior’s Bureau of Land Management, Bureau of Ocean Energy Management, or a state equivalent agency. Federal statute 43 CFR 3104 mandates that all oil companies purchase a surety bond prior to engaging in drilling operations on federally owned land. Many states have passed legislation mirroring this requirement on a state level. While the aforementioned statutes mandate the purchase of oil and gas bonds for drilling operations conducted on public lands, many states have enacted surety bond requirements for drilling operations conducted on privately owned lands as well.

What are the Underwriting Requirements for Oil and Gas Bonds?

Oil and gas bonds are inherently risky, and surety companies subject these bonds to strict underwriting requirements. Why are these bonds so risky? Well, surety companies have extended liability on these bonds, meaning that a claim can be filed against them years after the completion of the drilling project. When determining an applicant’s eligibility for an oil and gas bond, surety companies will examine the following factors:

- Credit Rating: Arguably the most important underwriting factor as an oil company’s credit history is indicative of the likelihood the company will repay the surety company if a valid claim is made against their bond

- Financial Stability: Oil companies who are financially stable are deemed less risky by surety underwriters as strong financial statements indicate their ability to repay the surety company for all claims and claims handling expenses. Additionally, strong financial statements signify that the oil company will likely pay all claims directly and never have to repay the surety company. To determine an oil company’s financial stability, surety companies will oftentimes require the company’s business financial statements.

- Experience: Oil companies with multiple years of business experience, as well as a history of complying with drilling regulations, are more likely to be approved for an oil and gas bond

How Much Do Oil and Gas Bonds Cost?

Oil and gas bonds will typically cost between 3% to 5% of the bond amount per year. As mentioned above, surety companies will review a variety of underwriting information to determine the qualifications of the applicant. In addition to the premium, some carriers may even require the principal to post collateral to secure the bond and limit the risk to the Surety. The limit on an oil and gas bond will vary depending on the government entity requiring the bond. Many states require oil companies to purchase a surety bond for each drilling license/permit being applied for, with notable exceptions being Texas and California who allow oil companies to purchase a blanket bond.

How Do Oil Companies File Their Bonds?

Surety bond companies will provide the oil company with a completed surety bond form to be presented to the obligee (regulatory agency). Surety companies should include the following information on most supply bond forms:

- Legal name and address of the oil company buying the bond

- Surety company’s name and address

- Bond amount

- Signatures of the surety representative

- Date the bond is effective and issued

- Corporate seal of the surety company

- Power of Attorney

Do Oil and Gas Bonds Need to Be Renewed?

Oil and gas bonds will remain in effect for the duration of the drilling project. Oil companies will need to pay premium on their bond(s) yearly. When the project has been completed, oil companies will need to obtain a release from the obligee signing off on the oil companies satisfactory clean up of the site.

What Can Oil Companies Do to Avoid Claims Against Their Bond?

To avoid claims against their bond(s), oil and gas companies must ensure they comply with all relevant drilling regulations. Claims are most often made against oil and gas bonds for the following reasons:

- Failure to return the land used for drilling to its previous condition

- Failure to properly dispose of all pollutants

- Improper well maintenance and plugging

How Can an Insurance Agent Obtain an Oil and Gas Bond?

BondExchange makes obtaining an Oil and Gas bond easy. Simply login to your account and use our keyword search to find the “oil” bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone (800) 438-1162, email or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

What Other Insurance Products Can Agents Offer Oil Companies?

Most reputable oil companies will purchase liability insurance to protect themselves from losses in the event a well leaks or experiences malfunctions. Bonds are our only business at BondExchange, so we do not issue any other forms of insurance, but our agents often utilize brokers on these lines. A list of brokers in the supply bond space can be found here.

Which States Require Oil Companies to Purchase a Bond?

In addition to the federal government, 14 states have oil and gas bond requirements.

Click on the image below to view a state by state guide on oil and gas bonds.