hel

North Dakota Consumer Credit Counseling Bond: A Comprehensive Guide

July 16, 2021

This guide provides information for insurance agents to help their customers obtain North Dakota Consumer Credit Counseling Bonds

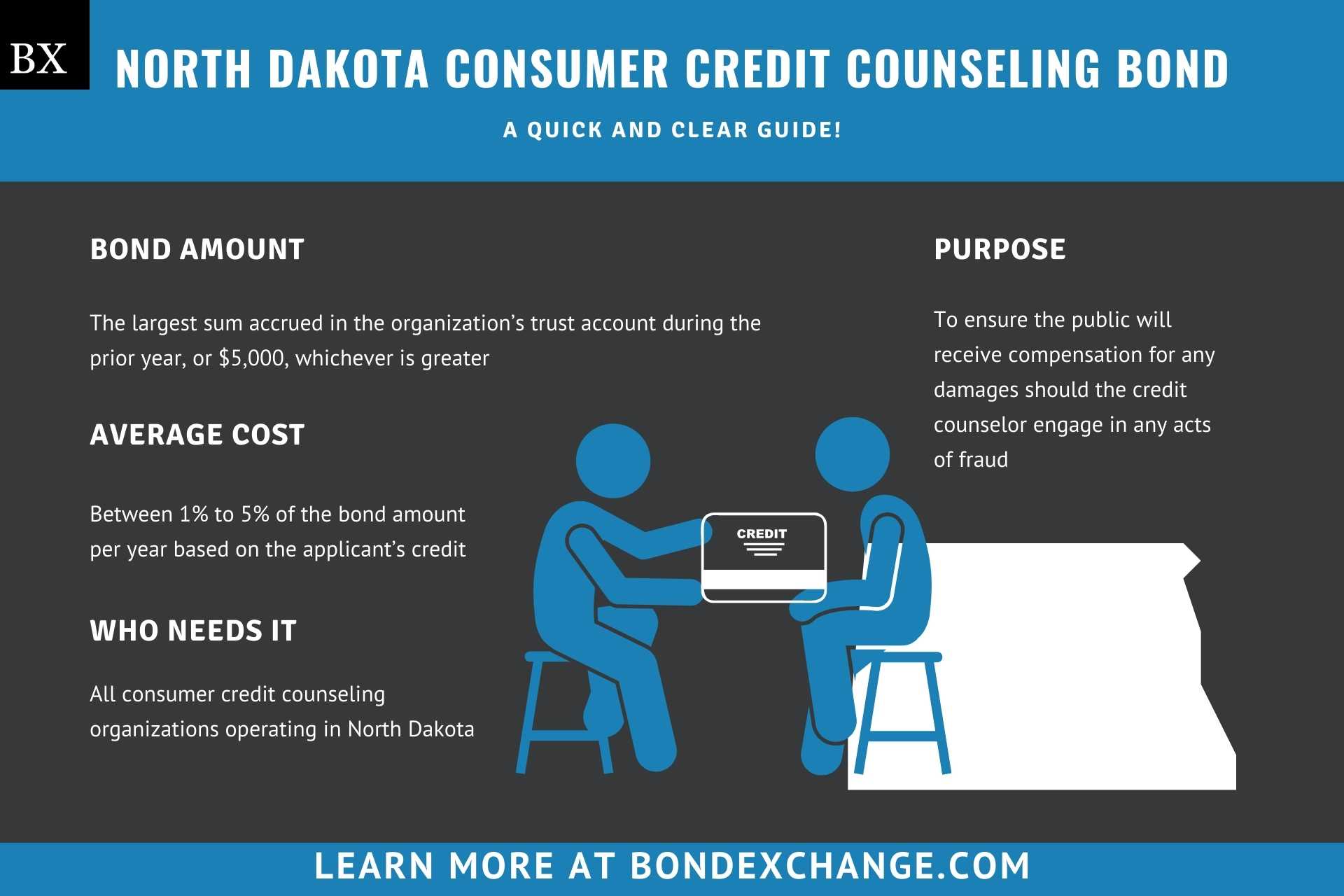

At a Glance:

- Average Cost: Between 1% to 5% of the bond amount per year based on the applicant’s credit

- Bond Amount: The largest sum accrued in the organization’s trust account during the prior year, or $5,000, whichever is greater

- Who Needs it: All consumer credit counseling organizations operating in North Dakota

- Purpose: To ensure the public will receive compensation for any damages should the credit counselor engage in any acts of fraud

- Who Regulates Credit Counselors in North Dakota: The North Dakota Attorney General

Background

North Dakota statute 13-07-3 requires all consumer credit counseling organizations operating in the state to file a surety bond with the State Attorney General. The North Dakota legislature enacted the bonding requirement to ensure that credit counselors engage in ethical business practices. There are no statewide licensing or registration requirements for consumer credit counseling organizations in North Dakota.

What is the Purpose of the North Dakota Consumer Credit Counseling Bond?

North Dakota requires consumer credit counseling organizations to purchase a surety bond prior to conducting business operations. The bond ensures that the public will receive compensation for financial harm if the credit counselor fails to comply with the regulations set forth in North Dakota statute Chapter 13-07. Specifically, the bond protects the public in the event the credit counselor engages in any acts of fraud or breaches any contracts made with consumers. In short, the bond is a type of insurance that protects the public if the credit counselor acts unethically.

How Can an Insurance Agent Obtain a North Dakota Consumer Credit Counseling Bond?

BondExchange makes obtaining a North Dakota Consumer Credit Counseling Bond easy. Simply login to your account and use our keyword search to find the “consumer” bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone (800) 438-1162, email or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

How is the Bond Amount Determined?

North Dakota statute 13-07-3 dictates that the limit on the consumer credit counseling bond be “equal to the largest sum accrued in the organization’s trust account during the prior year, or five thousand dollars, whichever is greater.”

Is a Credit Check Required for the North Dakota Consumer Credit Counseling Bond?

Surety companies will run a credit check on the owners of the credit counseling organization to determine eligibility and pricing for the North Dakota Consumer Credit Counseling bond. Owners with excellent credit and work experience can expect to receive the best rates. Owners with poor credit may be declined by some surety companies or pay higher rates. The credit check is a “soft hit”, meaning that the credit check will not affect the owner’s credit.

How Much Does the North Dakota Consumer Credit Counseling Bond Cost?

The North Dakota Consumer Credit Counseling Bond can cost anywhere between 1% to 5% per year. Insurance companies determine the rate based on a number of factors including your customer’s credit score and experience. The chart below offers a quick reference for the approximate bond cost on a $10,000 bond requirement.

$10,000 Consumer Credit Counseling Bond Cost

| Credit Score | Bond Cost (1 year) |

|---|---|

| 800+ | $100 |

| 680 – 799 | $150 |

| 650 – 679 | $200 |

| 600 – 649 | $400 |

| 450 – 599 | $500 |

How Does North Dakota Define “Consumer Credit Counseling Service?”

North Dakota statute 13-07-01 defines a consumer credit counseling service as any individual or business entity that provides one or more of the following services:

- Assists a debtor in liquidating their debts by implementing structured installments

- Reduces a debtor’s finance charges or fees for late payments, default, or delinquency

Do North Dakota Consumer Credit Counseling Organizations Need to Obtain a License?

No, North Dakota does not require consumer credit counseling organizations to obtain any state wide license or registration. However, certain municipalities may require consumer credit counseling organizations to obtain a tax receipt, permit, or local professional license. Credit counselors should check with their local municipal authority regarding these requirements prior to conducting business.

What Are the Insurance Requirements for North Dakota Consumer Credit Counseling Organizations?

North Dakota does not require consumer credit counseling organizations to obtain any form of liability insurance as a prerequisite to conducting business operations. Consumer credit counseling organizations must purchase a surety bond with a limit equal to the largest sum accrued in the organization’s trust account during the prior year, or five thousand dollars, whichever is greater.

How Do North Dakota Consumer Credit Counseling Organizations File Their Bond?

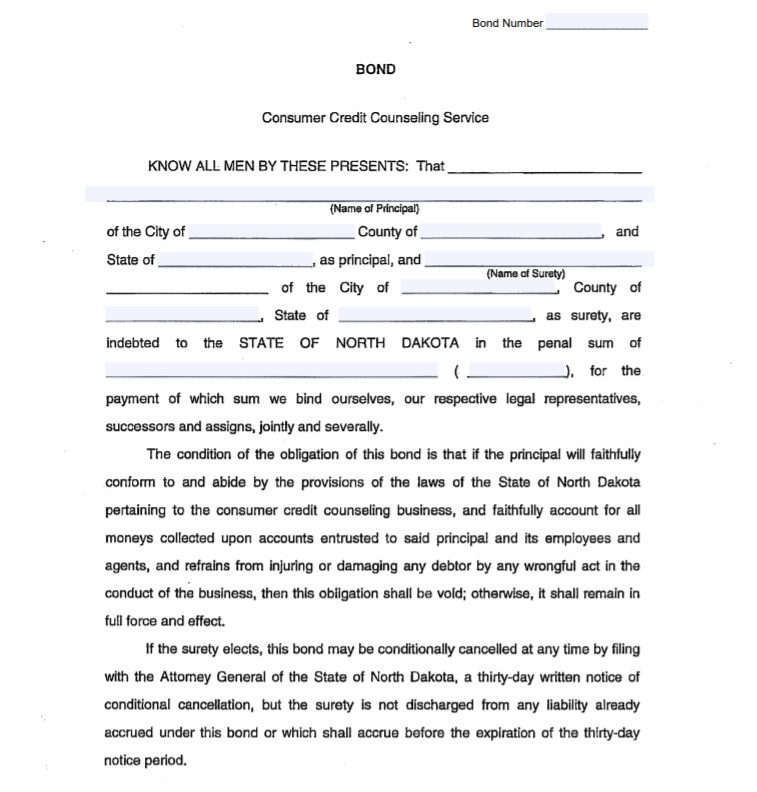

Consumer credit counseling organizations should mail the completed bond form, including the power of attorney, to the following address:

Office of Attorney General

600 East Boulevard Avenue, Department 125

Bismarck, ND 58505-0040

The consumer credit counseling surety bond requires signatures from both the surety company that issues the bond and a representative from the consumer credit counseling organization. The surety company should include the following information on the bond form:

- Legal name, state, county, and city of entity/individual(s) buying the bond

- Surety company’s name, state, county, and city

- Bond amount

- Date the bond goes into effect

What Can Consumer Credit Counseling Organizations Do to Avoid Claims Against their Bond?

To avoid claims on against their bond, consumer credit counseling organizations in North Dakota must adhere to the following guidelines:

- Do not engage in any acts of fraud

- Do not breach any contracts made with consumers

What Other Insurance Products Can Agents Offer Consumer Credit Counseling Organizations in North Dakota?

North Dakota does not require consumer credit counseling organizations to purchase any form of liability insurance as a prerequisite to conducting business. However, most reputable businesses will seek to obtain this insurance anyway. Bonds are our only business at BondExchange, so we do not issue liability insurance, but our agents often utilize brokers for this specific line of business. A list of brokers in this space can be found here.

How Can Insurance Agents Prospect for North Dakota Consumer Credit Counseling Customers?

North Dakota unfortunately does not provide a public database to search for active credit counselors in the state. We recommend contacting the office of the North Dakota Attorney General or a list services company to obtain this information. Contact BondExchange for additional marketing resources. Agents can also leverage our print-mail relationships for discounted mailing services.