North Carolina Loan Broker Bond: A Comprehensive Guide

July 14, 2021

This guide provides information for insurance agents to help their customers obtain North Carolina Loan Broker Bonds

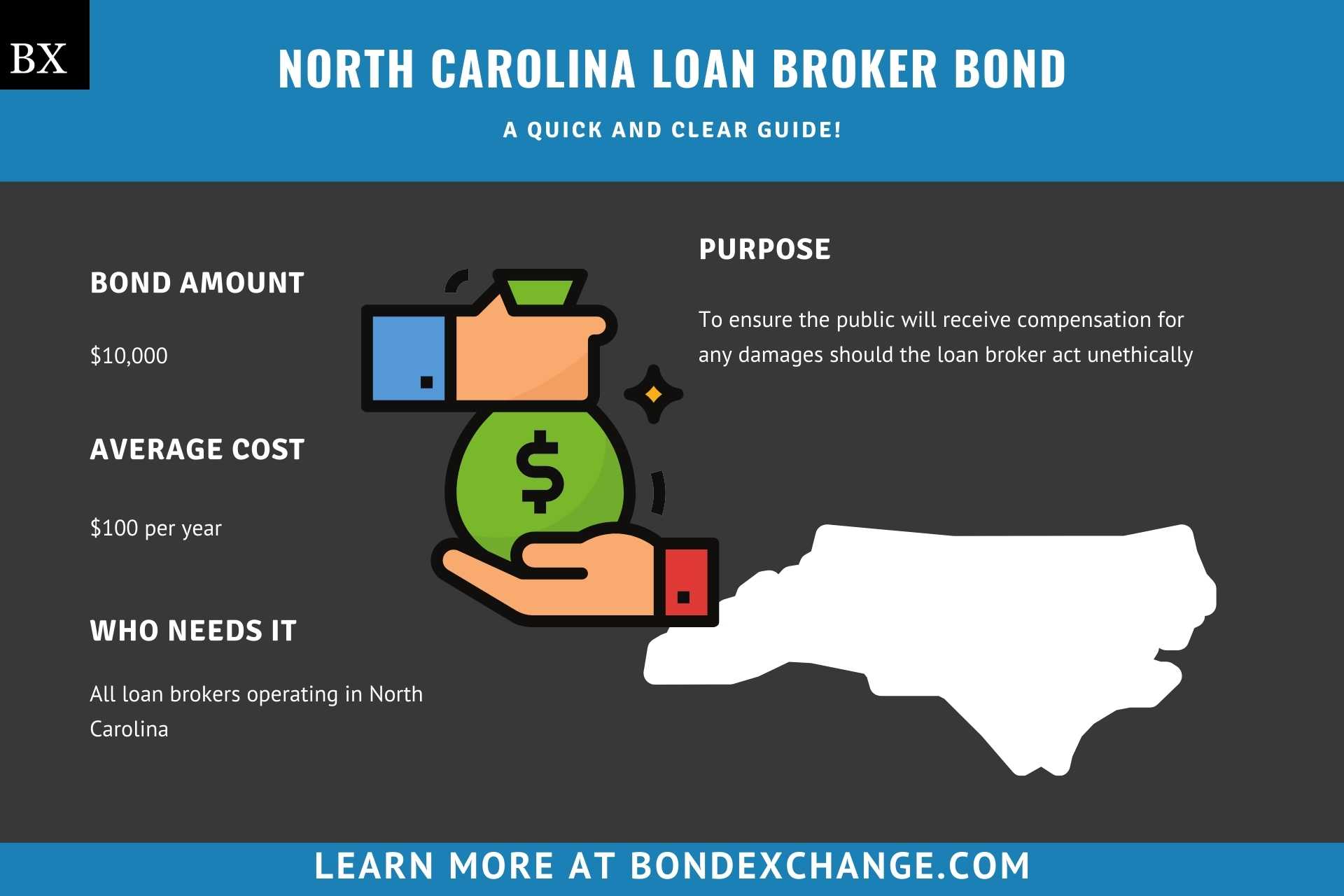

At a Glance:

- Average Cost: $100 per year

- Bond Amount: $10,000

- Who Needs it: All loan brokers operating in North Carolina

- Purpose: To ensure the public will receive compensation for any damages should the loan broker act unethically

- Who Regulates Loan Brokers in North Carolina: The North Carolina Secretary of State (SOS)

Background

North Carolina statute 66-109 requires all loan brokers operating in the state to register with the secretary of state. The North Carolina legislature enacted the registration laws and regulations to ensure that loan brokers engage in ethical business practices. In order to provide financial security for the enforcement of the registration law, loan brokers must purchase and maintain a $10,000 surety bond to be eligible for registration.

What is the Purpose of the North Carolina Loan Broker Bond?

North Carolina requires loan brokers to purchase a surety bond prior to conducting business operations. The bond ensures that the public will receive compensation for financial harm if the loan broker fails to comply with the regulations set forth in North Carolina statutes 66-106 through 66-112. Specifically, the bond protects the public in the event the loan broker engages in any acts of fraud or breaches any contracts made with consumers. In short, the bond is a type of insurance that protects the public if the loan broker acts unethically.

How Can an Insurance Agent Obtain a North Carolina Loan Broker Bond?

BondExchange makes obtaining a North Carolina Loan Broker Bond easy. Simply login to your account and use our keyword search to find the “loan” bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone (800) 438-1162, email or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

Is a Credit Check Required for the North Carolina Loan Broker Bond?

No, a credit check is not required for the North Carolina Loan Broker Bond. Because the bond is considered relatively low risk, the same low rate is offered to all loan brokers regardless of their credit history.

How Much Does the North Carolina Loan Broker Bond Cost?

The North Carolina Loan Broker Bond costs just $100 per year.

How Does North Carolina Define “Loan Broker?’

North Carolina statute 66-106 defines a loan broker as any individual or business entity who assists consumers in obtaining a non-mortgage loan from a third party.

Exemptions to this definition include:

- Mortgagees approved by the Secretary of Housing and Urban Development, Federal Housing Administration, Veterans Administration, National Mortgage Association, or any federal agency

- Individuals and businesses designated by a licensed NC insurance company

- Licensed attorneys, public accountants, and dealers

- Lenders who have made aggregate loans in the previous calendar year exceeding $1 million

How Do North Carolina Loan Brokers Register with the Secretary of State?

Loan brokers are required to create a disclosure statement, that they will present to all consumers utilizing their services. The disclosure statement must include a cover page stating, in at least 10 point font, “DISCLOSURES REQUIRED BY NORTH CAROLINA LAW” and under that, a notice reading “The State of North Carolina has not reviewed and does not approve, recommend, endorse or sponsor any loan brokerage contract. The information contained in this disclosure has not been verified by the State. If you have any questions see an attorney before you sign a contract or agreement.”

The disclosure statement must include the following information:

- The broker’s name, their business type (corporation, LLC etc.), and DBAs, and all parent companies

- Names, titles and addresses of all company owners/officers and NC employees

- Length of time the company has conducted business as a loan broker

- Total number of contracts broker has entered into in the past 12 months

- Number of contracts in which the broker has successfully obtained a loan for a consumer in the past 12 months

- Current (not older than 13 months) company financial statements

- Detailed description of all services the broker provides

- Statement explaining the specific circumstances when the broker is able to obtain or retain consideration with the party who they contract with

- Statement disclosing the company is either bonded or has established a trust account

Loan brokers should mail their completed disclosure statement and surety bond to the following address:

NC Secretary of State

Loan Broker

Post Office Box 29622

Raleigh, North Carolina 27626-0622

There is no fee required associated with registering as a loan broker in North Carolina.

How Do North Carolina Loan Brokers File Their Bond?

Loan brokers should mail the completed bond form, including the power of attorney, to the following address:

NC Secretary of State

Loan Broker

Post Office Box 29622

Raleigh, North Carolina 27626-0622

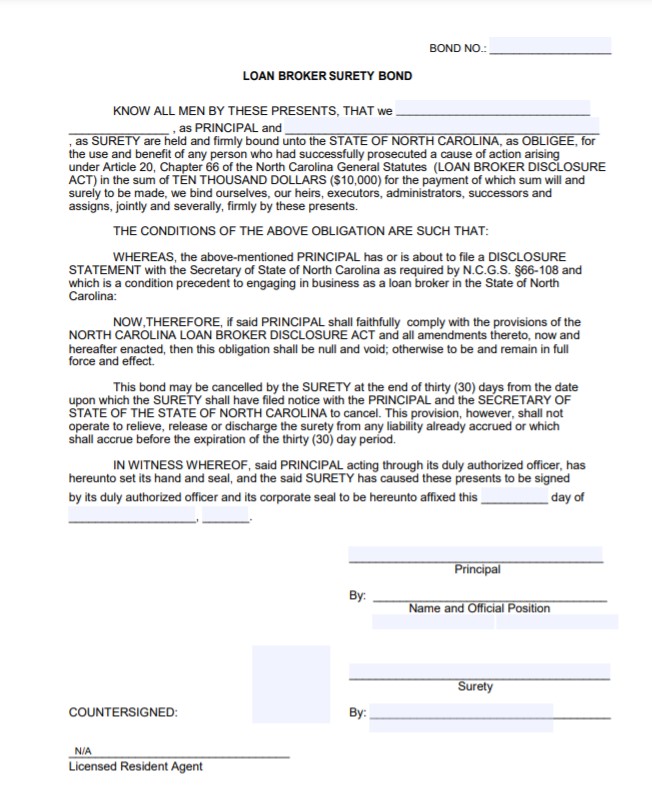

The loan broker surety bond requires signatures from both the surety company that issues the bond and a representative from the loan brokerage firm. The surety company should include the following information on the bond form:

- Legal name of entity/individual(s) buying the bond

- Surety company’s name

- Date the bond goes into effect

What Are the Insurance Requirements for North Carolina Loan Brokers?

North Carolina does not require loan brokers to obtain any form of liability insurance as a prerequisite to registering their business. Loan brokers must purchase and maintain a $10,000 surety bond.

What Can North Carolina Loan Brokers Do to Avoid Claims Against Their Bond?

To avoid claims on their bond, loan brokers in North Carolina must follow all relevant regulations in the state, including some of the most important issues below that tend to cause claim

- Do not engage in any acts of fraud

- Honor all contracts made with consumers

What Other Insurance Products Can Agents Offer Loan Brokers in North Carolina?

North Carolina does not require loan brokers to purchase any form of liability insurance as a prerequisite to obtaining a business registration. However, most reputable businesses will seek to obtain this insurance anyway. Bonds are our only business at BondExchange, so we do not issue liability insurance, but our agents often utilize brokers for this specific line of business. A list of brokers in this space can be found here.

How Can Insurance Agents Prospect for North Carolina Loan Broker Customers?

North Carolina conveniently provides a public database to search for active loan brokers in the state. The database can be accessed here. Contact BondExchange for additional marketing resources. Agents can also leverage our print-mail relationships for discounted mailing services.