New York Auto Dealer Bond: A Comprehensive Guide For Insurance Agents

September 16th, 2020

This guide provides information for insurance agents to help their customers on New York Auto Dealer bonds.

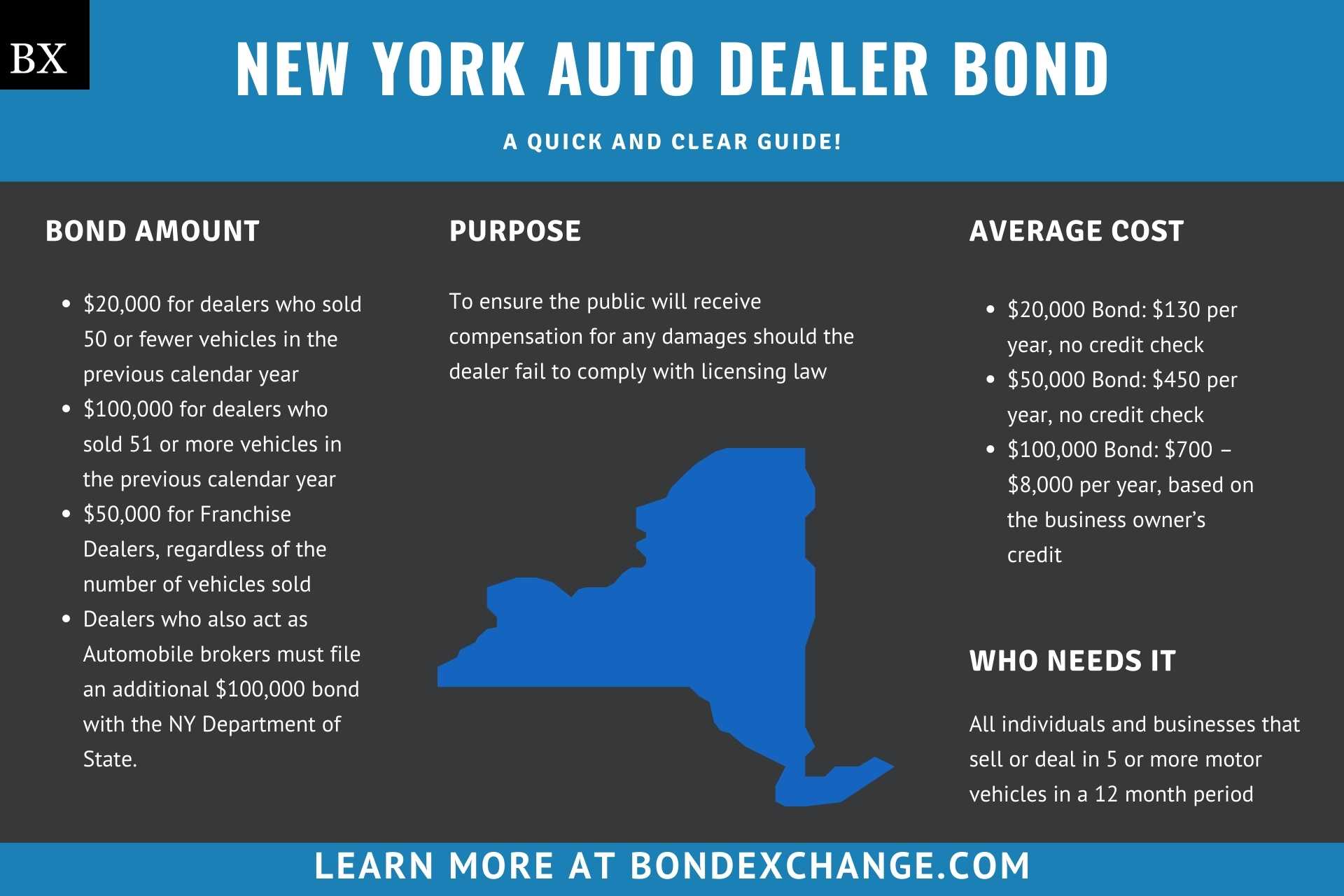

At a Glance:

- Average Cost:

- $20,000 Bond: $130 per year, no credit check

- $50,000 Bond: $450 per year, no credit check

- $100,000 Bond: $700 – $8,000 per year, based on the business owner’s credit

- Bond Amount:

- $20,000 for dealers who sold 50 or fewer vehicles in the previous calendar year

- $100,000 for dealers who sold 51 or more vehicles in the previous calendar year

- $50,000 for Franchise Dealers, regardless of the number of vehicles sold

- Dealers who also act as Automobile brokers must file an additional $100,000 bond with the NY Department of State.

- Who Needs It: All auto dealers selling new or used vehicles

- Purpose: To ensure the public will receive compensation for any damages should the auto dealer fail to comply with dealer licensing law

- Who Regulates Dealers in New York: New York Department of Motor Vehicles is in charge of licensure and regulation of motor vehicle dealers

Background

New York consolidated law section 415 mandates auto dealers operating in the state to obtain a motor vehicle dealer license with the DMV. The New York legislature enacted the license and regulations to ensure that dealers engage in ethical business practices and remit required taxes and fees. On September 29th, 2016, New York passed Assembly Bill 8166A and states that dealers must purchase and maintain either a $20,000 or $100,000 surety bond (more on this topic below). The surety bond provides financial security for the enforcement of the license law.

What is the Purpose of the New York Auto Dealer Bond?

New York requires dealers to purchase the Motor Vehicle Dealer Bond as part of the application process for the Vehicle Dealer License. The bond ensures that the public will receive compensation for financial harm if the auto dealer fails to comply with the licensing regulations and that the dealer will pay all required taxes and fees to the State of New York. In short, the bond is a type of insurance that protects the public if the auto dealer breaks licensing laws.

How Can an Insurance Agent Obtain a New York Auto Dealer Surety Bond?

BondExchange makes obtaining a New York Auto Dealer Bond easy. Simply login to your account and use our keyword search to find the “auto dealer” bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone, email or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

How Much Does the New York Auto Dealer Bond Cost?

The $100,000 New York Auto Dealer surety bond can cost anywhere between $700 to $8,000 per year. The $20,000 bond costs only $130 per year with our exclusive no-credit check program. For the $100,000 bond, insurance companies determine the rate based on a number of factors including your customer’s credit score and experience. We also offer easy interest-free financing for premiums over $500. The chart below offers a quick reference for the approximate bond cost on the $100,000 bond amount:

| Credit Score* | Bond Cost (1 Year) |

|---|---|

| 700+ | $700 |

| 650 – 699 | $1,000 |

| 625 – 649 | $1,500 |

| 600 – 624 | $2,000 |

| 550 – 599 | $4,000 |

| 500 – 549 | $8,000 |

*The credit score ranges do not include other factors that may result in a change to the annual premium offered to your customers, including but not limited to, years of experience and underlying credit factors contained within the business owner’s credit report.

How Does New York Define “Motor Vehicle Dealer”?

To paraphrase New York consolidated law section 415, New York defines a motor vehicle dealer as anyone who buys, sells, or deals in 5 or more motor vehicles in a single calendar year. Any person who displays or permits the display of 3 or more vehicles in a single month will also be considered a dealer.

How Do Dealers Apply for a Motor Vehicle Dealer License in New York?

The process for applying for a motor vehicle dealer license in New York is pretty complex. Below are the general guidelines, but dealers should refer to the Motor Vehicle Dealers and Transporters Regulations for details on the process.

License Period – The dealer license period is valid for two years from the date of issuance, and must be renewed prior to the expiration date for dealers to continue operations.

Step 1 – Complete the Application

The first thing dealers should do is acquire all the necessary items for their application, including:

Original Facility Application: Dealers must submit their original facility application as part of their dealer license application. The application determines whether a dealer is operating a dealership, repair shop, or inspection station. The application form can be found here.

Location: Applicants are required to present proof that they are permitted to use their business location. This proof can be in the form of a lease, mortgage, deed, etc.

Sales Tax: A sales tax number and a copy of the dealer’s Sales Tax Certificate of Authority must be submitted with the application. Dealers can register as a sales tax vendor here.

Proof of Insurance: All New York vehicle dealers must obtain and present proof of Workers Compensation Insurance (if they have employees) and garage liability for all vehicles with dealer plates as part of their application. Guidelines for obtaining the workers compensation insurance can be found here.

Starter Kit: Dealers are required to purchase a Dealer Starter Kit and present a receipt of purchase in their application. The starter kit is available through a handful of vendors which can be found here.

Signs: Dealers must submit their receipts for the purchase of the required dealer sign that must be displayed at their location. The guidelines for dealer signs are:

-

-

- Red background and white lettering

- At least 3ft wide and 2ft tall

- Must display “REGISTERED (Facility Number) STATE OF NEW YORK MOTOR VEHICLE DEALER” in two inch block lettering

- Permanently mounted and visible from nearest street/highway

-

Proof of Business Name: All dealers must submit either a filing receipt from the NY Department of State (corporation or L.L.C), or a Business Certificate obtained from the County Clerk in their jurisdiction (assumed name or partnership).

Step 2 – Submit the Application

All new dealer regulatory license applications and dealer regulatory license renewal applications should be mailed to:

NYS DMV

Bureau of Consumer & Facility Services

Application Unit

P.O. Box 2700

Albany, NY 12220-0700

Step 3 – Pay Fees

There is a $487.50 application fee associated with obtaining the Dealer License. The cost of dealer plates is determined by the number of plates the dealer will use. The amount of plates required and the cost is determined during the inspection (more on that below).

Step 4 – Pass Inspection

Once the dealer license application has been submitted, an automotive facilities inspector will contact the dealer to schedule an on-site inspection. For a list of items the inspector will be checking, view the dealer application page located here.

Step 5 – Purchase and File a Surety Bond

Used motor vehicle dealers must purchase and file a $20,000 or $100,000 motor vehicle dealer bond based on the number of vehicles sold in the prior year. More on the filing process below.

How Does a New York Auto Dealer Renew Their License?

The dealer license period is valid for two years from the date of issuance, and must be renewed prior to the expiration date. Dealers can renew their license online here if they have the following items:

- Facility and validation numbers located on the dealer’s Business Certificate

- Federal Employer ID number

- Social Security Number of the business owner, partner or officer

- Business email address and phone number

Dealers can also mail their renewal application to:

NYS DMV

Bureau of Consumer & Facility Services

Application Unit

P.O. Box 2700

Albany, NY 12220-0700

There is a $450 fee associated with renewing the dealer application.

What Are the Insurance Requirements for the New York Auto Dealer License?

The State of New York requires all auto dealers to maintain workers compensation insurance and garage liability insurance to remain in compliance with licensing regulations. Used auto dealers must also file either a $100,000 or $20,000 motor vehicle dealer bond.

How Do New York Auto Dealers File Their Bond?

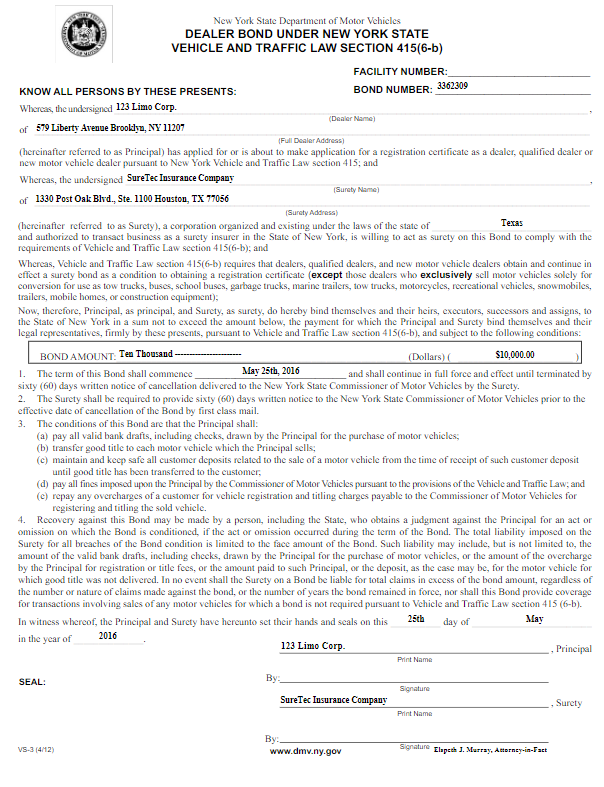

Both the $100,000 and $20,000 surety bond require signatures from both the surety company that issues the bond and the auto dealer. The bond form will require the following items:

- Legal name of entity/individual(s) buying the bond

- Physical address where the business will operate

- Surety company’s name, address and signature

- Bond amount

- Date the bond is sealed

Dealers should mail the completed bond form, including the power of attorney, to the following address:

NYS DMV

Bureau of Consumer & Facility Services

Application Unit

P.O. Box 2700

Albany, NY 12220-0700

What Can Dealers Do to Avoid Claims Against the New York Auto Dealer Bond?

To avoid claims on the Motor Vehicle Dealer Bond, dealers must follow all dealer regulations in the state, including some of the most important issues below that tend to cause claims:

- Pay all valid bank drafts

- Promptly transfer the titles on all vehicles sold

- Ensure safekeeping of all consumer deposits

- Pay all fines levied by the State of New York

- Repay any consumer overcharges

What Other Insurance Products Can Agents Offer Dealers in New York?

New York requires dealers to obtain workers compensation insurance (if the dealer has employees) and garage liability for all vehicles with dealer plates. Bonds are our only business at BondExchange, so we do not issue any form of liability insurance, but our agents often utilize brokers for this specific line of business. Workers Compensation can be purchased through the New York State Insurance Fund or from private carriers. A list of brokers for garage liability can be found here.

How Can Insurance Agents Prospect for New York Auto Dealer Customers?

New York conveniently provides a public database to search for active motor vehicle dealers in the state. The database can be accessed on the DMV site here. Contact BondExchange for additional marketing resources. Agents can also leverage our print-mail relationships for discounted mailing services.

What Other States Require Auto Dealer Bonds?

All 50 states and the District of Columbia require auto dealers to obtain an Auto Dealer Bond as a prerequisite for licensure. Insurance agents should utilize our Main MVD Page for a detailed analysis of the Auto Dealer Bond requirements nationwide.