Maryland Auto Dealer Bond: A Comprehensive Guide

October 20th, 2020

This guide provides information for insurance agents to help new and pre-owned car dealership owners on Maryland Auto Dealer bonds

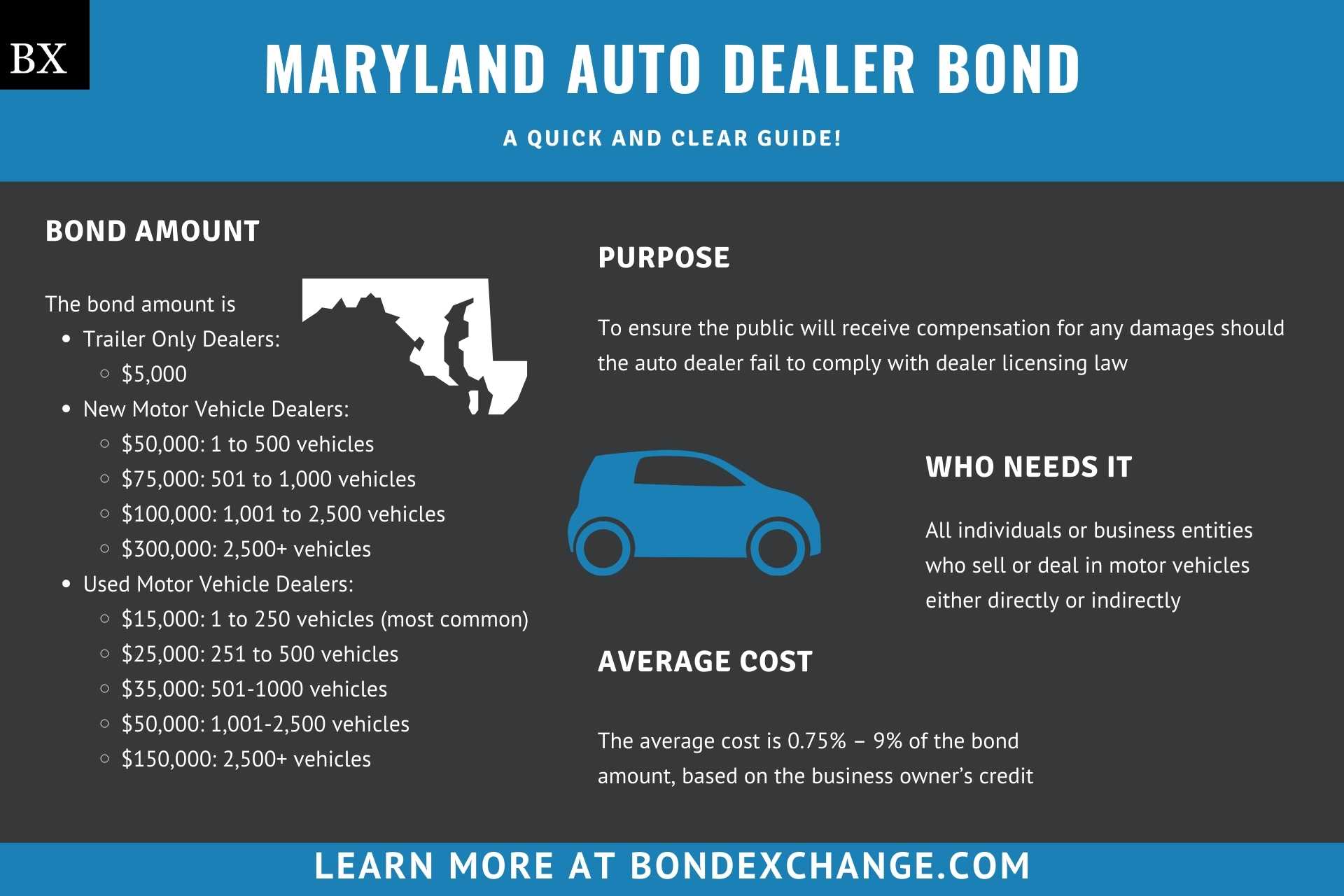

At a Glance:

- Average Cost: 0.75% – 9% of the bond amount, based on the business owner’s credit

- Bond Amount: Determined by the license type and annual vehicles sold as follows:

- Trailer Only Dealers:

- $5,000

- New Motor Vehicle Dealers:

- $50,000: 1 to 500 vehicles

- $75,000: 501 to 1,000 vehicles

- $100,000: 1,001 to 2,500 vehicles

- $300,000: 2,500+ vehicles

- Used Motor Vehicle Dealers:

- $15,000: 1 to 250 vehicles (most common)

- $25,000: 251 to 500 vehicles

- $35,000: 501-1000 vehicles

- $50,000: 1,001-2,500 vehicles

- $150,000: 2,500+ vehicles

- Trailer Only Dealers:

- Who Needs It: All individuals or business entities who sell or deal in motor vehicles either directly or indirectly

- Purpose: To ensure the public will receive compensation for any damages should the auto dealer fail to comply with dealer licensing law

- Who Regulates Dealers in Maryland: The Maryland Department of Transportation, Motor Vehicle Administration (MVA)

Background

Maryland Code 15-302 mandates auto dealers operating in the state to obtain a motor vehicle dealer license with the MVA. The Maryland legislature enacted the license and regulations to ensure that dealers engage in ethical business practices and remit required taxes and fees. In order to provide financial security for the enforcement of the license law, dealers must purchase and maintain a motor vehicle dealer surety bond in an amount between $5,000 to $300,000 to be eligible for licensure.

https://www.youtube.com/watch?v=uwGExBI1T1Y

What is the Purpose of the Maryland Auto Dealer Bond?

Maryland requires dealers to purchase the Motor Vehicle Dealer Bond as part of the application process for the Motor Vehicle Dealer License. The bond ensures that the public will receive compensation for financial harm if the auto dealer fails to comply with the licensing regulations and that the dealer will pay all required taxes and fees to the State of Maryland. In short, the bond is a type of insurance that protects the public if the dealer breaks licensing laws.

How Can an Insurance Agent Obtain a Maryland Auto Dealer Bond?

BondExchange makes obtaining a Maryland Auto Dealer Bond easy. Simply login to your account and use our keyword search to find the “auto dealer” bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone (800) 438-1162, email, or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensure that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

How Much Does the Maryland Auto Dealer Bond Cost?

The Maryland Motor Vehicle Dealer surety bond can cost anywhere between 0.75% to 9% of the bond amount per year. Insurance companies determine the rate based on a number of factors including your customer’s credit score and experience. For bond amounts over $50,000, surety companies will require a review of business financial statements in addition to the customer’s credit. We also offer easy interest-free financing for premiums over $500. The chart below offers a quick reference for the approximate bond cost on the $15,000 bond requirement.

$15,000 Maryland Auto Dealer Bond Cost

| Credit Score* | Bond Cost (1 year) |

|---|---|

| 699+ | $113 |

| 680 – 698 | $132 |

| 650 – 679 | $150 |

| 626 – 649 | $300 |

| 615 – 625 | $450 |

| 600 – 624 | $750 |

| 500 – 599 | $1,125 |

*The credit score ranges do not include other factors that may result in a change to the annual premium offered to your customers, including but not limited to, years of experience and underlying credit factors contained within the business owner’s credit report.

How Does Maryland Define “Motor Vehicle Dealer”?

The Maryland MVA Dealer Information page considers anyone who sells or deals in motor vehicles either directly or indirectly to be a motor vehicle dealer.

How Do Dealers Apply for a Motor Vehicle Dealer License in Maryland?

Dealers in Maryland must navigate several steps to secure their motor vehicle dealer license. Below are the general guidelines, but dealers should refer to the Interactive Business Licensing and Consumer Services Manual for details on the process.

License Period – The Maryland Dealer License is valid for two years from the date of issuance and must be renewed before the expiration date.

Step 1 – Determine the License Type

Maryland requires dealers to obtain specific licenses corresponding to the nature in which the dealer’s business operates. Keep in mind that dealers will need to acquire a license for each type of business they wish to operate. Below are the different types of Maryland Dealer Licenses.

-

- New Vehicle Dealer – Sells new or used motor vehicles

- Used Vehicle Dealer – Sells used motor vehicles to the public or other licensed dealers

- Wholesale Dealer – Sells used motor vehicles to other licensed dealers only

- Motorcycle Dealer – Sells new or used motorcycles

- Emergency Vehicle Dealer – Sells new or used emergency vehicles

- Trailer Dealer – Sells trailers

- Title Service Agent – Transfers MVA paperwork to customers

- Manufacturer – Manufactures new motor vehicles

- 2nd Stage Manufacturer – Manufactures new two-stage motor vehicles

- Distributor – Imports motor vehicles into the United States for sale

- Automotive Dismantler/Recycler – Dismantles motor vehicles and sells their parts

- Scrap Processor – Process scrap material for remelting purposes

- Salesman – Employed by a dealer for the purpose of selling motor vehicles

***Each license has its own set of requirements. The remaining steps will focus on how to obtain the New and Used Dealer Licenses. Dealers can find information on how to obtain all other Maryland Dealer Licenses here.***

Step 2 – Establish a Location

Dealers must establish a permanent business location that meets the following minimum requirements:

-

- Is an enclosed building that is suitable for the sale of motor vehicles (subject to the discretion of the MVA)

- Has a repair facility or a repair contract with a repair facility located a reasonable distance away from the business location (subject to the discretion of the MVA)

Step 3 – Obtain Zoning Approval

Dealers must obtain approval from the local zoning authority ensuring their business location is in compliance with all applicable zoning regulations. Dealers must submit a Zoning Approval Form with their application.

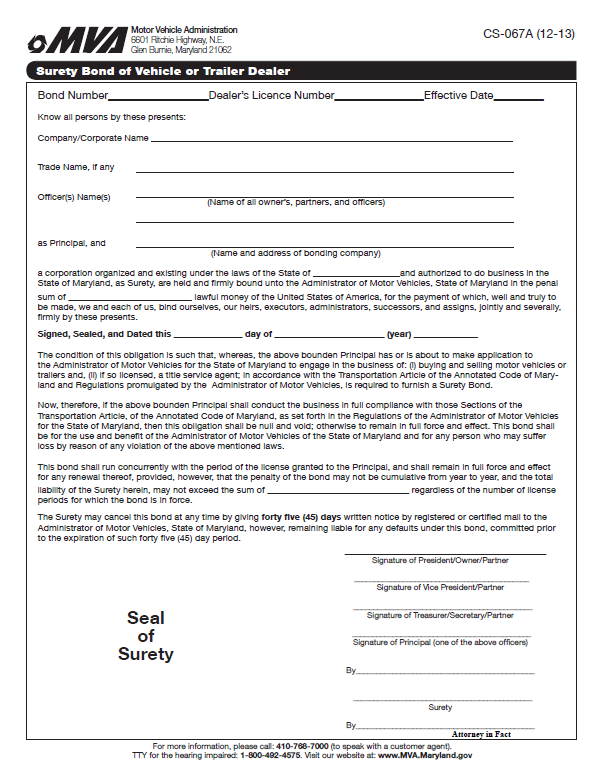

Step 4 – Purchase a Surety Bond

Dealers must purchase and maintain a Surety Bond of Vehicle or Trailer Dealer (Form S-067A). The bond amount is determined based on the license type and annual vehicle sales as shown below:

-

- Trailer Only Dealers:

- $5,000

- New Motor Vehicle Dealers:

- $50,000: 1 to 500 vehicles

- $75,000: 501 to 1,000 vehicles

- $100,000: 1,001 to 2,500 vehicles

- $300,000: 2,500+ vehicles

- Used Motor Vehicle Dealers:

- $15,000: 1 to 250 vehicles (most common)

- $25,000: 251 to 500 vehicles

- $35,000: 501-1000 vehicles

- $50,000″ 1,001-2,500 vehicles

- $150,000: 2,500+ vehicles

- Trailer Only Dealers:

Step 5 – Complete The Application

All new dealer regulatory certificate applications and dealer regulatory certificate renewal applications should be mailed to:

MVA, BL&CS, Room 146

6601 Ritchie Highway

Glen Burnie, MD 21062

The following information should be included with the application:

-

- 5.a Business Authorization – Dealers must submit a Department of Assessment and Taxation letter with their application confirming the dealer is registered to do business in the State of Maryland. Dealers can register their business here.

- 5.b Repair Facility Contract – Dealers who do not have a repair facility at their business location must submit a Repair Facility Contract form with their application

- 5.c Dealer Orientation – Dealers must register for a mandatory dealer orientation session when submitting their application. The orientation is held once a month from 9 am – 12 pm. Dealers can register for the orientation by completing the Dealer Orientation Request and submitting it with their application.

- 5.d ERT Contract – All dealers must be contracted with an Electronic Registration and Titling (ERT) provider and submit a copy of their contract with their application. Dealers can find a list of ERT vendors here.

- 5.e Background Check – All dealers must submit a criminal background check with their application. Dealers can find vendors who will provide a background check here.

- 5.f Worker’s Compensation – All Maryland businesses who have employees must obtain worker’s compensation insurance. Dealers who are claiming exemptions from the worker’s compensation insurance requirements can obtain all relevant forms here.

- 5.g Trader’s License – Dealers will need to obtain a Trader’s License from the Circuit Court whose jurisdiction the dealer operates in. Dealers can obtain a Trader’s License here.

- 5.h Use and Occupancy Permit – Dealers who use a trailer for their business location must obtain a Use and Occupancy Permit and Submit it with their application. Dealers can obtain this permit from their local zoning authority

- 5.i Franchise Agreement – Dealers selling new motor vehicles must submit a franchise agreement with their application. The franchise agreement must be signed by a manufacturer granting the dealer permission to sell each make and model of a new motor vehicle. A New Vehicle Certification form must be submitted for dealers with relationships with manufacturers that cannot be licensed in the State of Maryland.

- 5.j Salesman – All individuals seeking to directly sell motor vehicles must submit a Salesman Application.

Step 6 – Pay Fees

There is a $450 application fee that must be paid when submitting an application for either the New or Used Dealer License. Dealers can find the fees for all other Maryland Dealer Licenses here.

Step 7 – Pass Inspection

After the dealer has submitted their application and paid all required fees, they must schedule an inspection with an MVA Investigator by calling (410) 768-7216. The inspector will examine the dealer’s business location to determine if the location meets all the minimum requirements outlined in Step 2.

How Do Maryland Auto Dealers Renew Their License?

The Maryland Dealer License is valid for two years from the date of issuance and must be renewed before the expiration date. Dealers should mail their renewal application, along with all required documentation and fees to the following address:

MVA, BL&CS, Room 146

6601 Ritchie Highway

Glen Burnie, MD 21062

The vehicle or trailer dealer bond is continuous, meaning that the dealer does not need to provide a new bond at their license renewal; however, the bond should be renewed at expiration to avoid cancellation.

What Are the Insurance Requirements for the Maryland Auto Dealer License?

The State of Maryland requires all dealers with employees to obtain worker’s compensation insurance coverage for each employee. Dealers must also file a surety bond in amounts between $5,000 and $300,000 based on the license type and vehicle sales.

How Do Maryland Auto Dealers File Their Bond?

Dealers should mail the completed bond form, including the power of attorney, to the following address:

MVA, BL&CS, Room 146

6601 Ritchie Highway

Glen Burnie, MD 21062

The Maryland Auto Dealer surety bond form requires signatures from both the surety company that issues the bond and the auto dealer. The surety company should include the following information on the bond form:

- Date the bond goes into effect

- The legal name of the business entity buying the bond

- Legal name(s) of the business owner(s)/officer(s)

- Name and address of the surety company

- Bond amount

- Date the bond is signed and sealed

How Can Maryland Auto Dealers Avoid Bond Claims?

To avoid claims on the Motor Vehicle Dealer Bond, dealers must follow all dealer regulations in the state, including some of the most important issues below that, tend to cause claims:

- Do not engage, or allow representatives of the business to engage, in any acts of fraud

- Pay sellers of vehicles promptly and in full

- Transfer all vehicle titles when sold

- Pay taxes on time and in full. Dealers should consider setting aside tax obligations as they accrue.

- Do not engage in any illegal selling practices

- Honor all warranty agreements

What Other Insurance Products Can Agents Offer Dealers in Maryland?

Maryland requires all motor vehicle dealers with employees to obtain worker’s compensation insurance. Most reputable dealers should also obtain garage keeper’s liability. Bonds are our only business at BondExchange, so we do not issue any form of liability insurance, but our agents often utilize brokers for this specific line of business. A list of brokers in this space can be found here.

How Can Insurance Agents Prospect for Maryland Auto Dealer Customers?

Maryland conveniently provides a public database to search for active motor vehicle dealers in the state. The database can be accessed on the MVA site here. Contact BondExchange for additional marketing resources. Agents can also leverage our print-mail relationships for discounted mailing services.

What Other States Require Auto Dealer Bonds?

All 50 states and the District of Columbia require auto dealers to obtain an Auto Dealer Bond as a prerequisite for licensure. Insurance agents should utilize our Main MVD Page for a detailed analysis of the Auto Dealer Bond requirements nationwide.