Kentucky Auto Dealer Bond: A Comprehensive Guide for Insurance Agents

September 22nd, 2020

This guide provides information for insurance agents to help new and pre-owned car dealers on Kentucky Auto Dealer bonds

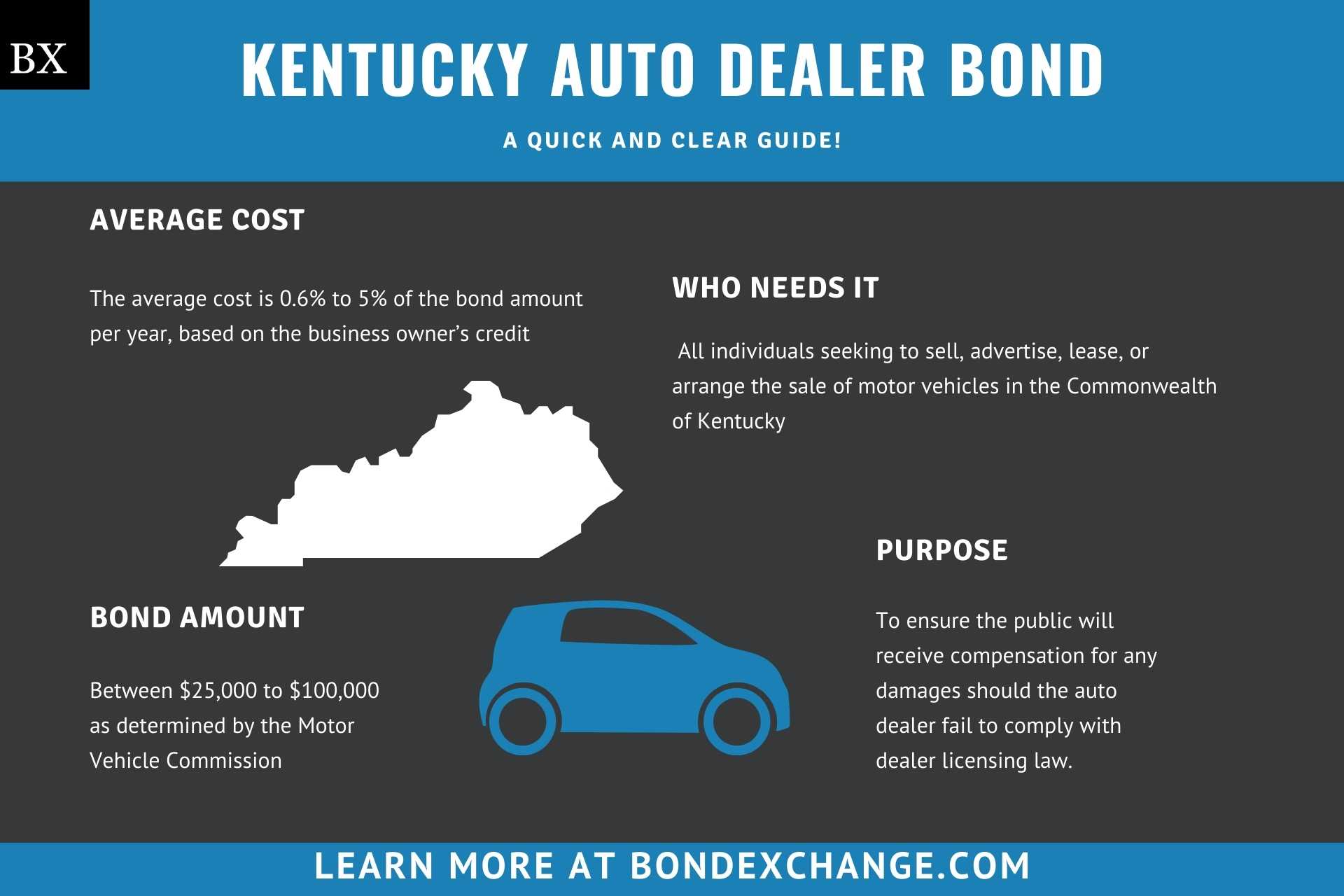

At a Glance:

- Average Cost: 0.6% to 5% of the bond amount per year, based on the business owner’s credit

- Bond Amount: Between $25,000 to $100,000 as determined by the Motor Vehicle Commission (more on this below)

- Who Needs It: All individuals seeking to sell, advertise, lease, or arrange the sale of motor vehicles in the Commonwealth of Kentucky

- Purpose: To ensure the public will receive compensation for any damages should the auto dealer fail to comply with dealer licensing law

- Who Regulates Dealers in Kentucky: The Kentucky Department of Transportation, Motor Vehicle Commission is in charge of licensure and regulation of motor vehicle dealers.

Background

Kentucky Revised Statutes 190.030 mandates auto dealers operating in the state to obtain a motor vehicle dealer license with the Motor Vehicle Commission. The Kentucky legislature enacted the license and regulations to ensure that dealers engage in ethical business practices and remit required taxes and fees. In order to provide financial security for the enforcement of the license law, dealers must purchase and maintain a motor vehicle dealer surety bond with a limit between $25,000 to $100,000. The Motor Vehicle Commission will determine the bond amount after the dealer submits their application based upon the dealer’s prior sales and financial position

https://www.youtube.com/watch?v=HY0p1xlcOfY

What is the Purpose of the Kentucky Auto Dealer Bond?

Kentucky requires dealers to purchase the Motor Vehicle Dealer Bond as part of the application process for the Motor Vehicle Dealer License. The bond ensures that the public will receive compensation for financial harm if the auto dealer fails to comply with the licensing regulations and that the dealer will pay all required taxes and fees to the Commonwealth of Kentucky. In short, the bond is a type of insurance that protects the public if the dealer breaks licensing laws.

How Can an Insurance Agent Obtain a Kentucky Auto Dealer Surety Bond?

BondExchange makes obtaining a Kentucky Auto Dealer Bond easy. Simply login to your account and use our keyword search to find the “auto dealer” bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone, email or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

How Much Does the Kentucky Auto Dealer Bond Cost?

Kentucky Motor Vehicle Dealer bonds can cost anywhere between 0.6% and 5% of the bond amount per year. Insurance companies determine the rate based on a number of factors including your customer’s credit score and experience. We also offer easy interest-free financing for premiums over $500. The chart below offers a quick reference for the approximate bond cost (prices based on a $50,000 bond amount).

$50,000 Kentucky Auto Dealer Bond Cost

| Credit Score* | Bond Cost ($25,000 Bond) |

|---|---|

| 699+ | $300 |

| 660 – 698 | $340 |

| 649 – 659 | $390 |

| 630 – 648 | $500 |

| 620 – 629 | $650 |

| 600 – 619 | $1,000 |

| 550 – 600 | $2,000 |

| 500 – 549 | $2,500 |

*The credit score ranges do not include other factors that may result in a change to the annual premium offered to your customers, including but not limited to, years of experience and underlying credit factors contained within the business owner’s credit report.

How Does Kentucky Define “Motor Vehicle Dealer”?

Kentucky Revised Statutes 190.010 defines a motor vehicle dealer as anyone who sells, offers to sell, solicits or advertises the sale of new or used motor vehicles for commercial or retail purposes. Exceptions to this definition include:

- Any person anointed or acting under the judgment of a court of law

- A bank, trust or lending institution authorized federally to dispose of or repossess motor vehicles

- Public officers performing their duties

How Do Dealers Apply for an Auto Dealer License in Kentucky?

The process for applying for an auto dealer license in Kentucky is pretty complex. Below are the general guidelines, but dealers should refer to the Kentucky MVC Dealer Handbook for details on the process.

License Period – The Kentucky Dealer License expires on December 31st of each year and must be renewed prior to the expiration date.

Step 1 – Determine the License Type

Kentucky requires dealers to obtain specific licenses corresponding to the nature in which the dealer’s business operates. Keep in mind that dealers will need to acquire a license for each type of business they wish to operate. Below are the different types of dealer licenses in Kentucky.

-

- New Motor Vehicle: Has a franchise or contract agreement with a manufacturer to sell new motor vehicles

- Used Motor Vehicle: Sells used vehicles either retail or retail and wholesale

- Motor Vehicle Leasing: Leases motor vehicles for at least a 30 day term

- Supplemental Lot: Required for franchise dealers seeking to sell used motor vehicles if the used vehicle display lot is not directly adjacent to the new vehicle display lot.

- Wholesale Motor Vehicle: Deals in used motor vehicles solely as a wholesaler

- Motor Vehicle Auction: Operates an auction for motor vehicles

- Motorcycle: Deals solely in motorcycles

- Restricted/Mobility: Deals solely in specialized motor vehicles

- Restricted/Automotive Recycling: Dismantles, salvages, or recycles motor vehicles

- Recreational Camper: Deals in recreational motor vehicles

- Storage Lot: A lot for the sole purpose of storing motor vehicles

Step 2 – Establish a Location

Before dealers can obtain their dealer license they must first buy or lease a permanent business location. The location must meet the following requirements:

-

- Permanent, enclosed, and utilized for commercial use only

- Contain a display lot that is at least 2,000 square feet

- Display lot must be a hard surface (gravel, concrete, asphalt)

- Display lot must prevent public traffic from driving through it

- Office space must be:

- At least 100 square feet and furnished

- Underpinned and on a permanent foundation

- On or immediately adjacent to the display lot

- Cannot be a residence

Step 3 – Obtain Insurance

Dealers must purchase and maintain garage liability coverage for all vehicles owned and/or associated with the business. The minimum insurance limits are:

-

- $250,000 per person

- $500,000 per occurrence

- $250,000 for property damage

The dealer’s insurance company must submit a certificate of insurance to the Motor Vehicle Commission upon request from the commission.

***The insurance certificate is not required to be submitted with the dealer application, the commission will notify the dealer when the certificate is needed.***

Step 4 – Choose a Business Name

All dealers must choose a name for their business that meets the following criteria:

-

- Must incorporate the words “Used Cars”, “Auto Sales”, “Auto Mart” or other similar phrases that identify the business as a motor vehicle dealer

- Cannot use the name of any make of motor vehicle. This does not apply to Franchise Dealers.

- Cannot contain the words “wholesale” or “leasing” unless applying for those specific licenses

- Cannot contain the words “broker” or “consignment”

Step 5 – Obtain a Salesperson License

All owners and employees who sell motor vehicles must obtain a Motor Vehicle Salesperson License. Dealers can request a salesperson license application when completing their dealer license application. The salesperson license must be renewed annually and there is a $20 application fee each time the application is submitted.

Step 6 – Erect a Sign

All dealers (except wholesale dealers) must display a permanent sign at their business location that meets the following requirements:

-

- Can be seen from the nearest roadway

- Contains the business’s name in letters at least 9 inches in height

- Must be installed prior to the submitting the dealer application

Step 7 – Complete the Application

All new dealer regulatory license applications should be mailed to:

Motor Vehicle Commission

105 Sea Hero Road, Suite 1

Frankfort, KY 40601

The dealer license application form can be viewed here.

-

- 7.a Zoning Approval – Applicants must acquire the signature of the local zoning official certifying that the business location complies with all zoning requirements

- 7.b Pictures of the Business Location – All dealers must submit both a photograph and drawing (with dimension) of their business location

- 7.c Financial Statement – A financial statement explaining both the dealer’s personal and business assets, liabilities and debts

- 7.d Sales Tax – The dealer’s sales tax permit number must be included in the application. Instructions for obtaining a sales tax permit can be found here.

- 7.e Franchise Agreement – Dealers must submit a copy of their franchise agreement if they intend to sell new cars

- 7.f Background Check – Dealers must submit a $20 criminal background check fee with their application. The commission will conduct the background check.

Step 8 – Pay Fees

The following fees are associated with obtaining the dealer license:

-

- $100 dealer license fee

- $40 application fee

- $20 background check fee per person

- $20 license fee for each salesperson

Step 9 – Acquire Dealer Tags

After the dealer license is issued, dealers must register with the county clerk’s office and pay a $28 fee to obtain dealer license plates. Dealers must submit the personal information of all individuals who are authorized to operate vehicles with dealer plates.

Step 10 – Purchase a Surety Bond

Dealers must purchase and maintain a motor vehicle dealer bond. The bond amount is determined based upon the dealer’s prior sales and financial position.

How Does a Kentucky Auto Dealer Renew Their License?

The Motor Vehicle Dealer License is valid until December 31st of each year and must be renewed prior to the expiration date. Dealers must renew their license online here. Dealers should keep the documentation required for the initial application on hand to assist with the renewal process.

What Are the Insurance Requirements for Kentucky Auto Dealers?

Kentucky requires auto dealers to maintain comprehensive liability insurance on all vehicles with dealer plates to remain in compliance with licensing regulations. Dealers must also file a motor vehicle dealer bond with a limit between $25,000 – $100,000.

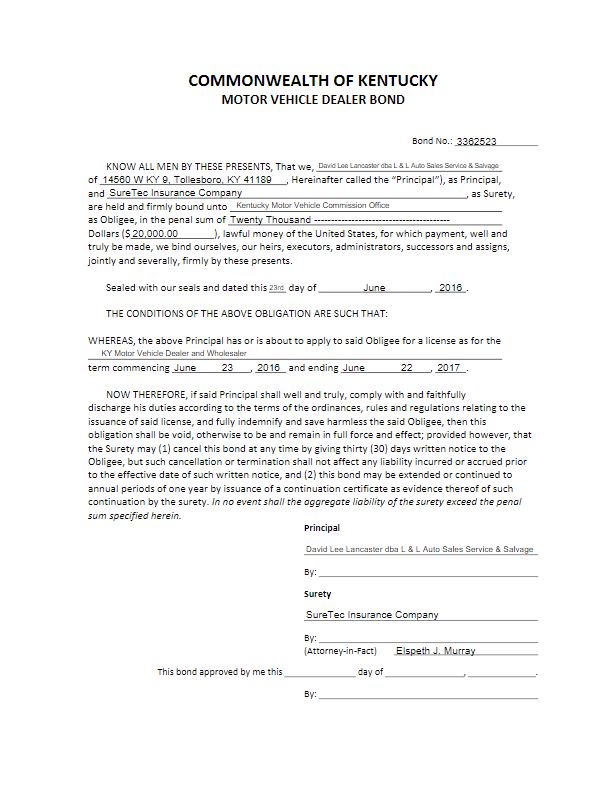

How Do Kentucky Auto Dealers File Their Bond?

The bond requires signatures from both the surety company that issues the bond and the auto dealer. The bond form will require the following items:

- Legal name of entity/individual(s) buying the bond

- Physical address where the business will operate

- Surety company’s name, address and signature

- Date on which the bond will be executed

- Bond amount

- License term

Dealers should mail the completed bond form, including the power of attorney, to the following address:

Motor Vehicle Commission

105 Sea Hero Road, Suite 1

Frankfort, KY 40601

What Can Dealers Do to Avoid Claims Against the Kentucky Auto Dealer Bond?

Claimants must prove in a court of law that the dealer violated the licensing terms to receive damages from the bond. To avoid claims on the Motor Vehicle Dealer Bond, dealers must follow all dealer regulations in the state, including some of the most important issues below that tend to cause claims:

- Only display vehicles for sale at an established salesroom

- Disclose all required information when transferring ownership of a vehicle

- Do not engage, or allow representatives of the business to engage, in any acts of fraud

- Pay sellers of vehicles promptly and in full

- Pay taxes on time and in full. Dealers should consider setting aside tax obligations as they accrue.

- Do not engage in any illegal selling practices

- Adhere to the dealer license plate regulations approved by the state

- Pay the license application fees

What Other Insurance Products Can Agents Offer Auto Dealers in Kentucky?

Kentucky requires dealers to obtain comprehensive liability insurance on all vehicles with dealer plates. Most reputable dealers that provide towing or service station services should also obtain garage keepers liability. Bonds are our only business at BondExchange, so we do not issue any form of liability insurance, but our agents often utilize brokers for this specific line of business. A list of brokers in this space can be found here.

How Can Insurance Agents Prospect for Kentucky Auto Dealer Customers?

Kentucky conveniently provides a public database to search for active auto dealers in the state. The database can be accessed on the DMV site here. Contact BondExchange for additional marketing resources. Agents can also leverage our print-mail relationships for discounted mailing services.

What Other States Require Auto Dealer Bonds?

All 50 states and the District of Columbia require auto dealers to obtain an Auto Dealer Bond as a prerequisite for licensure. Insurance agents should utilize our Main MVD Page for a detailed analysis of the Auto Dealer Bond requirements nationwide.