Indiana Auto Dealer Bond: A Comprehensive Guide

October 19th, 2020

This guide provides information for insurance agents to help new and pre-owned car dealership owners on Indiana Auto Dealer bonds

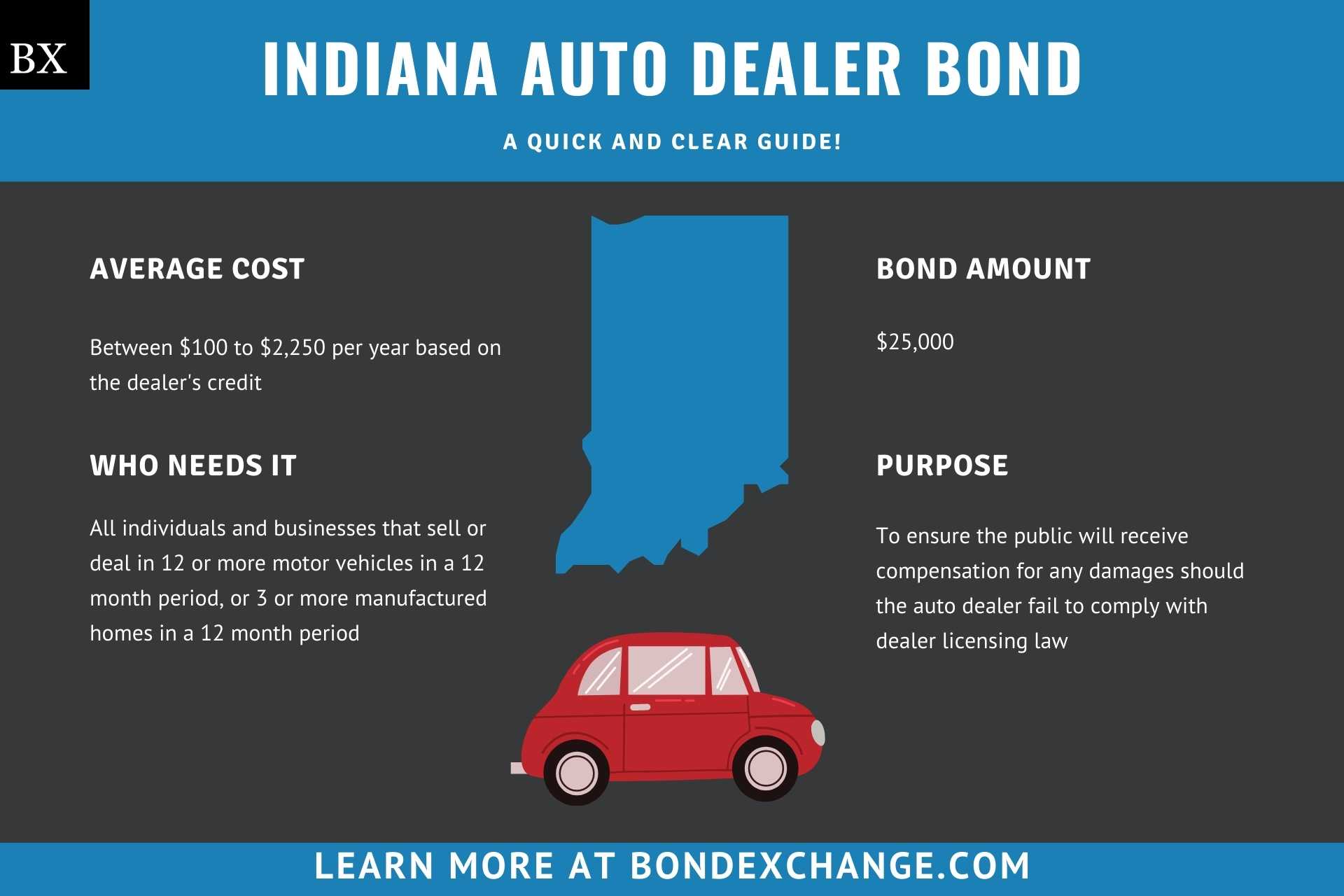

At a Glance:

- Average Cost: $100 – $2,250 per year, based on the business owner’s credit

- Bond Amount: $25,000

- Who Needs It: All individuals and businesses that sell or deal in 12 or more motor vehicles in a 12 month period, or 3 or more manufactured homes in a 12 month period

- Purpose: To ensure the public will receive compensation for any damages should the auto dealer fail to comply with dealer licensing law

- Who Regulates Dealers in Indiana: The Indiana Secretary of State (SOS)

Background

Indiana Code 9-32-16-2 mandates auto dealers operating in the state to obtain a motor vehicle dealer license with the SOS. The Indiana legislature enacted the license and regulations to ensure that dealers engage in ethical business practices and remit required taxes and fees. In order to provide financial security for the enforcement of the license law, dealers must purchase and maintain a $25,000 motor vehicle dealer surety bond.

https://www.youtube.com/watch?v=o7PAgU5SFkk

What is the Purpose of the Indiana Auto Dealer Bond?

Indiana requires dealers to purchase the Vehicle Merchandising Certificate/Bond as part of the application process for licensure. The bond protects all purchasers, sellers, financing agencies, and government agencies from monetary loss stemming from any fraud or fraudulent representation, failure to comply with licensing law, and failure to pay required taxes and fees. In short, the bond is a type of insurance that protects the public if the dealer breaks the laws pertaining to motor vehicle dealers.

How Can an Insurance Agent Obtain an Indiana Auto Dealer Bond?

BondExchange makes obtaining an Indiana Auto Dealer Bond easy. Simply login to your account and use our keyword search to find the “auto dealer” bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone (800) 438-1162, email, or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensure that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

How Much Does the Indiana Auto Dealer Bond Cost?

The $25,000 Indiana auto dealer bond costs between $100 to $2,250 for a 1-year term. Insurance companies determine the rate based on a number of factors including your customer’s credit score and experience. We also offer easy interest-free financing for premiums over $500. The chart below offers a quick reference for the approximate bond cost.

$25,000 Indiana Auto Dealer Bond Cost (Table 1.1)

| Credit Score* | Bond Cost (1 year) |

|---|---|

| 749+ | $100 |

| 699 – 748 | $125 |

| 660 – 698 | $175 |

| 649 – 659 | $250 |

| 629 – 648 | $300 |

| 619 – 628 | $500 |

| 600 – 618 | $750 |

| 580 – 599 | $1,000 |

| 570 – 579 | $1,750 |

| 550 – 569 | $2,000 |

| 500 – 549 | $2,250 |

*The credit score ranges do not include other factors that may result in a change to the annual premium offered to your customers, including but not limited to, years of experience and underlying credit factors contained within the business owner’s credit report.

How Does Indiana Define “Motor Vehicle Dealer”?

The Indiana Auto Dealer Booklet defines a motor vehicle dealer as any person or business entity who “sells, offers for sale, or advertises for sale twelve (12) or more motor vehicles, or six (6) or more watercraft, within a twelve (12) month period.”

How Do Dealers Apply for a Motor Vehicle Dealer License in Indiana?

The process for applying for a motor vehicle dealer license in Indiana is pretty complex, and each license type has its own specific set of requirements. Below are the general guidelines, but dealers should refer to the Indiana Dealer Page for details on the process. The Indiana Dealer Licensing Handbook also contains valuable information dealers should be aware of.

License Period – The Indiana Dealer License expires annually regardless of the date of issuance and must be renewed before the expiration date. The dealer license will expire at different periods throughout the year based on the first letter of the dealer’s business name. The below table lists the expiration dates for the Indiana Dealer License:

Dealer License Expiration (Table 1.2)

| First Letter of Business Name | License Expiration |

|---|---|

| A – B | February 1 |

| C – D | March 1 |

| E – F | April 1 |

| G – H | May 1 |

| I – J | June 1 |

| K – L | July 1 |

| M – N | August 1 |

| O – P | September 1 |

| Q – R | October 1 |

| S – T / Numbers or Symbols | November 1 |

| U – V | December 1 |

| W – Z | January 1 |

Step 1 – Determine the License Type

Indiana requires dealers to obtain specific licenses corresponding to the nature in which the dealer’s business operates. Keep in mind that dealers will need to acquire a license for each type of business they wish to operate. Below are the different types of Indiana Dealer License.

-

- Auto Auction – Facilitates the auction of motor vehicles

- Automotive Salvage Recycler – Sells used motor vehicle parts, dismantles motor vehicles for parts, or stores salvaged motor vehicles

- Converter Manufacturer – Modifies already assembled motor vehicles

- Dealer – Sells new or used motor vehicles or only used motor vehicles

- Distributor – Sells motor vehicles to licensed dealers

- Manufacturer – Manufactures new motor vehicles and sells them either to other dealers or the general public

- Transfer Dealer – Transfers the ownership of motor vehicles as a result of primary business activities. Examples include financial institutions and insurance companies selling repossessed motor vehicles

- Watercraft – Sells watercraft vehicles or trailers designed to pull watercraft vehicles

***The remainder of this section will focus on the process for obtaining the Dealer License. Readers can click the name of each license type listed above to view the application requirements for each specific license type.***

Step 2 – Establish a Location

Dealers are required to establish a permanent place of business that meets the following minimum requirements:

-

- Must be used for commercial purposes only

- Able to receive mail

- Open a minimum of 30 per week during normal business hours

- Be at least 1,300 square feet

- Have display space large enough for at least 10 motor vehicles

- Be well lit during hours of operation

- Have a permanently affixed sign displaying the business name

- Customer parking and is not in a retail complex

- The office that is a minimum of 100 square feet, is furnished and has functional utilities

Step 3 – Obtain Zoning Approval

Dealers must have their local zoning official sign a Zoning Affidavit Form acknowledging the dealer’s business location is in compliance with all applicable zoning regulations. Dealers should submit the form with their application.

Step 4 – Acquire Insurance

Dealers are required to obtain garage liability insurance and submit a Certificate of Insurance with their application. The minimum insurance limits are:

-

- $100,000 per person

- $300,000 per accident

- $50,000 property damage

Step 5 – Purchase a Surety Bond

Dealers must purchase and maintain a $25,000 vehicle merchandising certificate/bond.

Step 6 – Complete the Application

The Indiana Dealer Licenses can be submitted online through the Indiana dealer portal. Dealers can view the Online License Application Guide for guidance on submitting their applications online.

-

- 6.a Background Check – Dealers must submit an FBI National Background Check with their license application. Dealers can obtain a background check by following the instructions listed here.

- 6.b Business Entity Documentation – Dealers must register their business with the State of Indiana and submit their business entity documentation with their application. Dealers can register their business here.

- 6.c Mobility Equipment – Dealers selling mobility equipment must submit their National Mobility Equipment Dealers Association Accreditation which they can obtain here.

- 6.d Pictures – Dealers must submit photographs of their business location with their application. Dealers should view the photo checklist before submitting their photos. Dealers must also submit a form of state-approved photo identification (driver’s license, passport, etc).

- 6.e Retail Merchant – Dealers selling motor vehicles retail must submit a copy of their Retail Merchant Certificate which they can obtain with the Indiana Department of Revenue here.

Step 7 – Pay Fees

There is a $30 fee associated with obtaining the Indiana Dealer License. A full list of fees for all Indiana dealer license types can be found here.

How Do Indiana Auto Dealers Renew Their License?

The Indiana Dealer License expires annually regardless of the date of issuance and must be renewed before the expiration date. The dealer license will expire at different periods throughout the year based on the first letter of the dealer’s business name. Table 1.2 shows the expiration schedule for all Indiana dealer licenses.

Dealers can submit their renewal application online through the Indiana dealer portal. Dealers should follow the instructions listed in the Online Renewal Steps document when submitting their renewal application online, including the need to file a surety bond with each renewal.

What Are the Insurance Requirements for the Indiana Auto Dealer License?

The State of Indiana requires auto dealers to maintain garage liability insurance with limits of 100/300/50. Dealers must also file a $25,000 motor vehicle dealer bond.

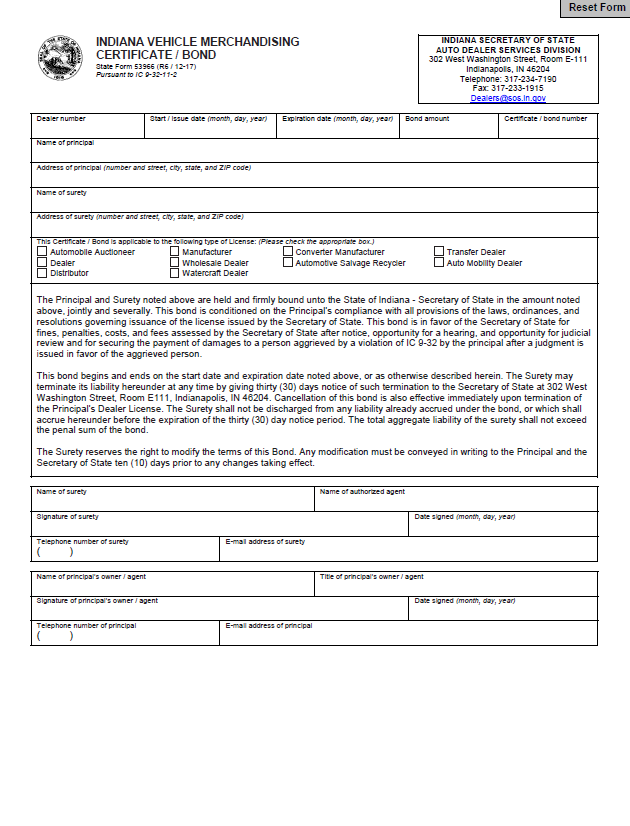

How Do Indiana Auto Dealers File Their Bond?

Dealers should mail the completed bond form, including the power of attorney, to the following address:

Indiana Secretary of State

Auto Dealer Services Division

302 West Washington Street, Room E-11

Indianapolis, IN 46204

The $25,000 surety bond requires signatures from both the surety company that issues the bond and the auto dealer. The surety company should include the following information on the bond form:

- Date the bond is issued and the date it expires

- Legal name, address, email, and phone number of both the principal (dealer) and the surety company

- License type

How Can Indiana Auto Dealers Avoid Bond Claims?

To avoid claims on the Motor Vehicle Dealer Bond, dealers must follow all dealer regulations in the state, including some of the most important issues below that, tend to cause claims:

- Pay sellers of vehicles promptly and in full

- Do not sell any vehicle with a faulty or altered odometer

- Pay taxes on time and in full. Dealers should consider setting aside tax obligations as they accrue.

- Do not engage, or allow representatives of the business to engage, in any acts of fraud

- Pay the license application fees

What Other Insurance Products Can Agents Offer Dealers in Indiana?

Indiana requires motor vehicle dealers to obtain garage liability insurance. Most reputable dealers that provide towing or service station services should also obtain garage keeper’s liability. Bonds are our only business at BondExchange, so we do not issue any form of liability insurance, but our agents often utilize brokers for this specific line of business. A list of brokers in this space can be found here.

How Can Insurance Agents Prospect for Indiana Auto Dealer Customers?

Indiana conveniently provides a public database to search for active motor vehicle dealers in the state. The database can be accessed on the dealer portal site here. Contact BondExchange for additional marketing resources. Agents can also leverage our print-mail relationships for discounted mailing services.

What Other States Require Auto Dealer Bonds?

All 50 states and the District of Columbia require auto dealers to obtain an Auto Dealer Bond as a prerequisite for licensure. Insurance agents should utilize our Main MVD Page for a detailed analysis of the Auto Dealer Bond requirements nationwide.