Illinois Lost Title Bond: A Comprehensive Guide

September 21, 2021

This guide provides information for insurance agents to help their customers obtain an Illinois Lost Title Bond

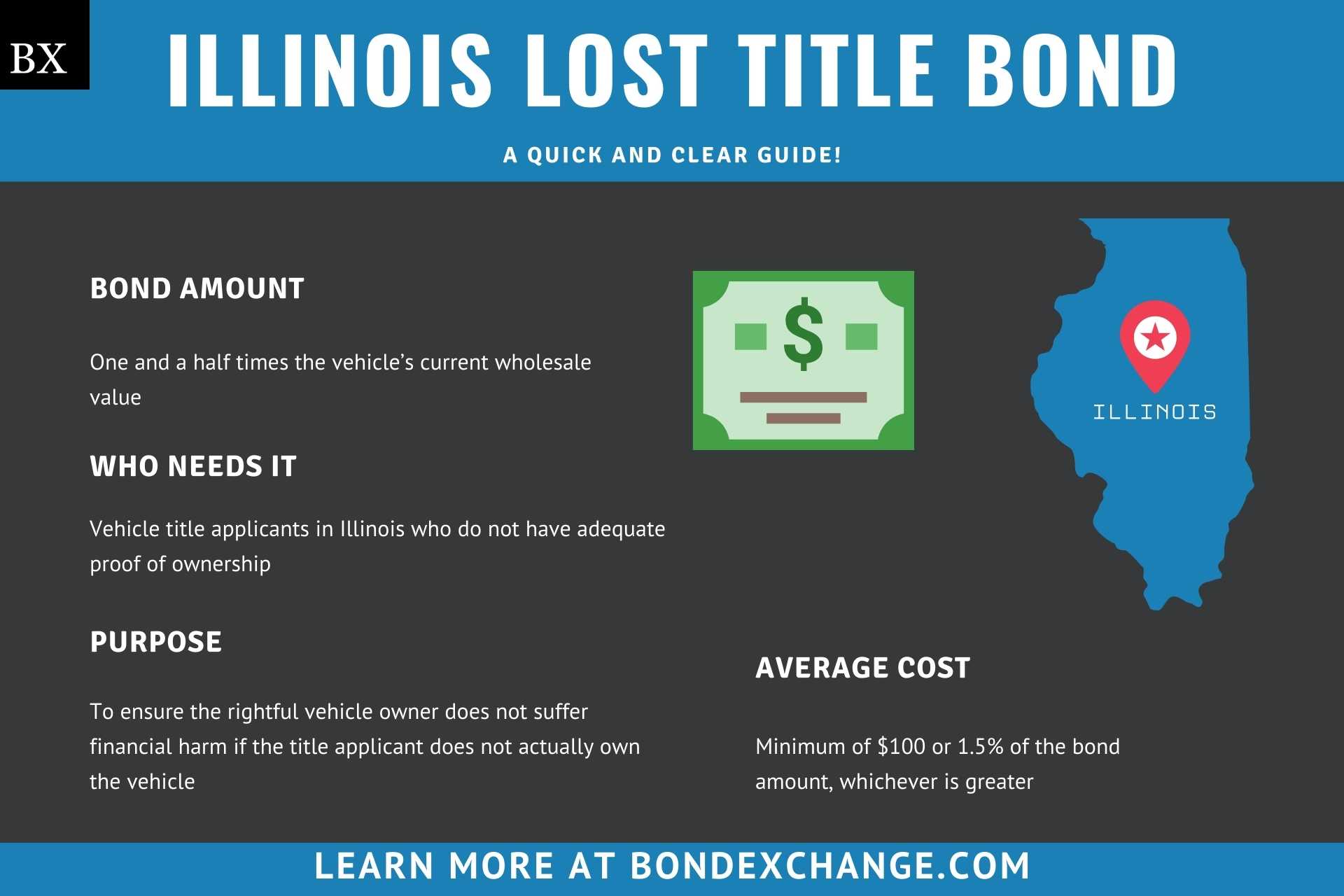

At a Glance:

- Average Cost: Minimum of $100 or 1.5% of the bond amount, whichever is greater

- Bond Amount: One and a half times the vehicle’s current wholesale value

- Who Needs it: Vehicle title applicants in Illinois who do not have adequate proof of ownership

- Purpose: To ensure the rightful vehicle owner does not suffer financial harm if the title applicant does not actually own the vehicle

- Who Regulates Lost Title Bonds In Illinois: The Illinois Secretary of State

Background

Illinois statute 3-109 requires residents who do not have adequate proof that they own their vehicle to purchase a surety bond prior to obtaining a duplicate title. The Illinois legislature enacted the bonding requirement to ensure that the rightful vehicle owner will receive compensation if the title applicant does not actually own the vehicle. The bond will be active for three years from the date of issuance and must be in an amount equal to one and a half times the vehicle’s current wholesale value.

What is the Purpose of the Illinois Lost Title Bond?

Illinois requires residents to purchase a surety bond as part of the application process to obtain a bonded title. The bond ensures that the rightful vehicle owner will not suffer a financial loss if the title applicant is seeking to obtain the title fraudulently. If the title applicant is engaging in fraud, then the rightful vehicle owner can file a claim against the bond and receive compensation up to the full amount of the bond. In short, the bond acts as a safeguard against people attempting to obtain ownership of a vehicle through unethical means.

How Can an Insurance Agent Obtain an Illinois Lost Title Bond?

BondExchange makes obtaining an Illinois Lost Title Bond easy. Simply log in to your account and use our keyword search to find the “title” bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone at (800) 438-1162, email, or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

How is the Bond Amount Determined?

Illinois statute 3-109 dictates that the bond amount must be equal to one and a half times the vehicle’s current wholesale value. To determine the vehicle’s wholesale value, title applicants must have it appraised by either a:

- Licensed auto dealer

- Licensed rebuilder

- Licensed real estate agent

- Officer of an antique vehicle club or association

All appraisals must be conducted by disinterested and qualified parties. Licensed dealers cannot perform their own appraisals.

Is a Credit Check Required for the Illinois Lost Title Bond?

Surety companies will not conduct a credit check for bonds that are less than $25,000. At limits over $25,000, surety companies will review the applicant’s credit standing to determine qualification for the bond. For larger bond amounts, applicants with poor credit may be subject to a higher rate. Generally, most carriers want to understand how the applicant came to have ownership of the vehicle.

How Much Does the Illinois Lost Title Bond Cost?

The Illinois Lost Title Bond costs either $100 or 1.5% of the bond amount, whichever is greater (rates may vary for bonds greater than $25,000).

Who is Required to Purchase a Bond?

The Illinois Secretary of State will require a title applicant to purchase a surety bond if the applicant cannot present the secretary with adequate proof that the applicant does in fact own the vehicle. Typically, lost title bonds are required for the following reasons:

- The vehicle has never been titled

- The applicant never received the title

- The previous owner never titled the vehicle

- The applicant has the title but there is an error in the title transfer

- The applicant purchased an unclaimed/abandoned vehicle and is not a bonded agent

How do Illinois Residents Apply for a Bonded Title?

To apply for a bonded title, Illinois residents must complete the following steps:

Step 1 – Consult the Department of Vehicle Services

Bonded title applicants in Illinois should consult the Department of Vehicle Services prior to purchasing a surety bond. Illinois does not require all title applicants to obtain a bonded title, and title applicants should ensure that they actually need a bond before purchasing one.

Step 2 – Get an Appraisal

Bonded title applicants must get their vehicle appraised by either a:

-

- Licensed auto dealer

- Licensed rebuilder

- Licensed real estate agent

- Officer of an antique vehicle club or association

The appraisal must contain the following information:

-

- Description of the vehicle: year, make, model, and vehicle identification number

- Current wholesale value

- Statement that the vehicle is intact and that all major component parts are present or statement that the appraisal applies to a salvage or junk vehicle

- A statement that the appraisal value is accurate to the best of the appraiser’s knowledge and that the affirmation is made under penalties of perjury

- Signature and printed name of the appraiser

- Firm name, address, and dealer license number, or real estate license number (if applicable)

- Date of appraisal

Step 3 – Purchase a Surety Bond

Bonded title applicants must purchase and maintain a surety bond in an amount equal to one and a half times the vehicle’s current wholesale value

Step 4 – Complete the Application

The application can be completed online here. Title applicants should print it out and mail it, along with a tax use form (if applicable), to the following address:

Secretary of State

Vehicle Titles Division Attn: Bonded Titles

609 Howlett Building

501 S. Second St.

Springfield, IL 62756-7000

All liens on the vehicle must be released prior to obtaining a bonded title.

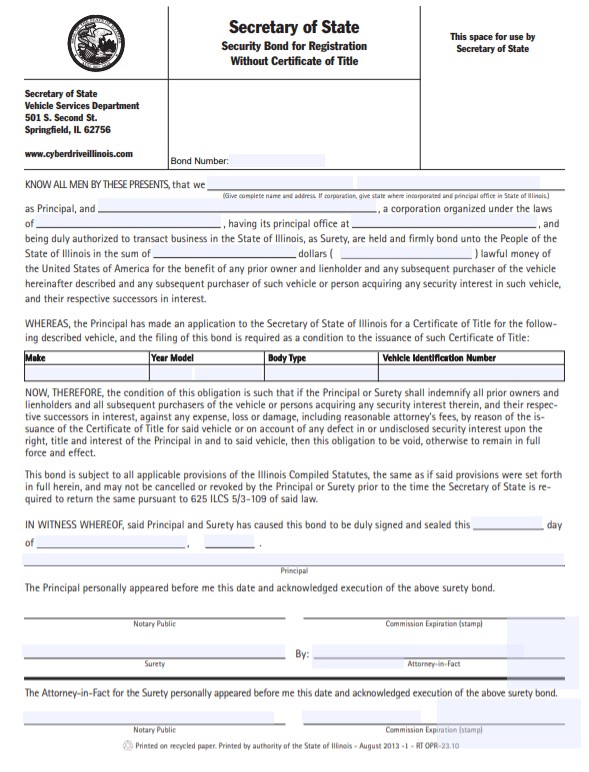

How Do Illinois Bonded Title Applicants File Their Bond?

In Illinois, bonded title applicants should mail the completed bond form, including the power of attorney, to the following address:

Secretary of State

Vehicle Titles Division Attn: Bonded Titles

609 Howlett Building

501 S. Second St.

Springfield, IL 62756-7000

The Illinois Lost Title Surety Bond requires signatures from both the surety company that issues the bond and the bonded title applicant. The surety company should include the following information on the bond form:

- The legal name and address of entity/individual(s) buying the bond

- Surety company’s name and address

- Bond amount

- Vehicle information

- Date the bond is signed

- Notary signatures for the principal and surety company

What Are the Insurance Requirements for Bonded Title Applicants in Illinois?

Illinois requires all motor vehicle owners to purchase auto insurance with the following minimum limits:

- $25,000 per person

- $50,000 per accident

- $20,000 property damage per accident

Bonded title applicants must purchase and maintain a surety bond in an amount equal to one and a half times the vehicle’s current wholesale value.

How Can Illinois Residents Avoid Claims Against Their Lost Title Bond?

To avoid claims against their bond, bonded title applicants in Illinois must ensure that they are the rightful owners of the motor vehicle.

What Other Insurance Products Can Agents Offer Bonded Title Applicants in Illinois?

Illinois requires all motor vehicle owners to purchase auto insurance. Bonds are our only business at BondExchange, so we do not issue other types of insurance, but our agents often utilize brokers for this specific line of business. A list of brokers in this space can be found here.