California Auto Dealer Bond: A Comprehensive Guide For Insurance Agents

September 3rd, 2020

This guide provides information for insurance agents to help new and pre-owned car dealership owners on California Auto Dealer bonds

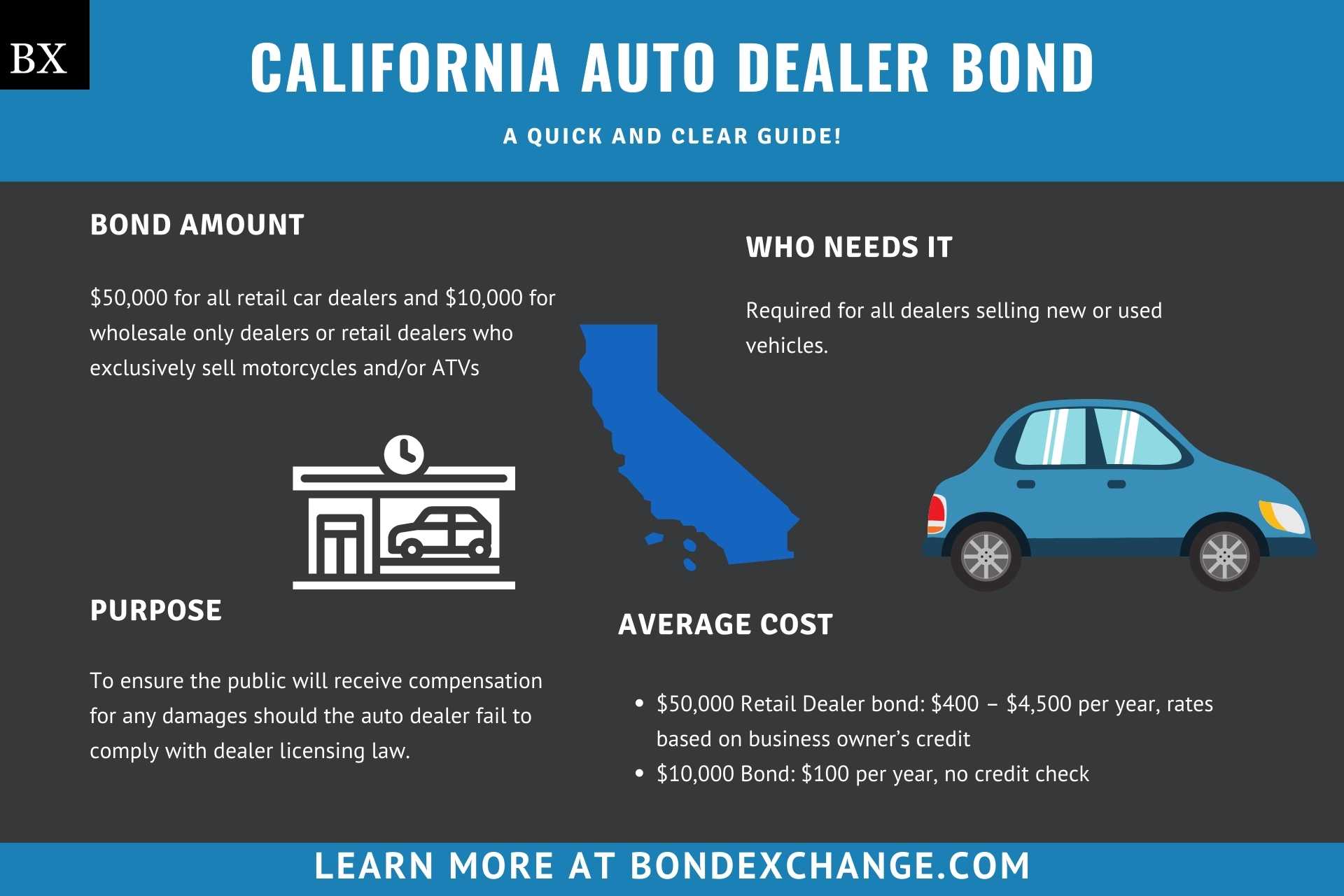

At a Glance:

- Average Cost:

- $50,000 Retail Dealer bond: $400 – $4,500 per year, rates based on business owner’s credit

- $10,000 Bond: $100 per year, no credit check

- Bond Amount: $50,000 for all retail car dealers and $10,000 for wholesale only dealers or retail dealers who exclusively sell motorcycles and/or ATVs

- Who Needs It: Required for all dealers selling new or used vehicles

- Purpose: To ensure the public will receive compensation for any damages should the auto dealer fail to comply with dealer licensing law

- Who Regulates Dealers in California: The California Department of Motor Vehicles – Licensing Operations Division, Occupational Licensing Branch

Background

California requires all vehicle dealers to obtain the appropriate vehicle dealer licenses to remain compliant with state law. California legislators implemented licensing requirements in 1959 to ensure that auto dealers engage in ethical business practices and remit required taxes and fees. The California Department of Motor Vehicles regulates dealers in compliance with Section 11710 of the California Vehicle Code (CVC). As a tool to provide financial security for the enforcement of the license law, California dealers must purchase and maintain a motor vehicle dealer surety bond in an amount based on the dealer’s license type. More on this below.

https://www.youtube.com/watch?v=Z3_10draP6c

What is the Purpose of the California Auto Dealer Bond?

California requires dealers to purchase the Motor Vehicle Dealer Bond as part of the application process for licensure. The bond protects all purchasers, sellers, financing agencies, and government agencies from monetary loss stemming from any fraud or fraudulent representation, failure to comply with licensing law, and failure to pay required taxes and fees. In short, the bond is a type of insurance that protects the public if the dealer breaks the laws pertaining to motor vehicle dealers.

How Can an Insurance Agent Obtain an Auto Dealer Bond for their Customer?

BondExchange makes obtaining a California Auto Dealer Bond easy. Simply login to your account and use our keyword search to find the “vehicle dealer” bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone, email or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

How Much Does the California Auto Dealer Bond Cost?

The $50,000 California auto dealer bond can cost anywhere between $400 to $4,500 per year. Insurance companies determine the rate based on a number of factors including your customer’s credit score and experience. We offer the financing option “in-house”, so your customer doesn’t have to deal with pesky 3rd party financing with high interest rates and lengthy paperwork! The chart below offers a quick reference for the approximate bond cost.

| Credit Score* | Premium (1 & 2 Years) | Payment Plan (based on 1 year rate) |

|---|---|---|

| 700+ | $400 / $700 | N/A |

| 690 – 700 | $500 / $875 | $133.33 Down, 10 Payments of $41.67 |

| 660 – 689 | $750 / $1313 | $175 Down, 10 Payments of $62.50 |

| 620 – 659 | $1,000 / $1,750 | $261.67 Down, 10 Payments of $83.33 |

| 580 – 619 | $1,500 / $2,625 | $300 Down, 10 Payments of $125 |

| 500 – 579 | $2,625 / $4,594 | $487.50 Down, 10 Payments of $218.75 |

| 480 – 499 | $4,500 / $7,875 | $800 Down, 10 Payments of $375.00 |

*The credit score ranges do not include other factors that may result in a change to the annual premium offered to your customers, including but not limited to, years of experience and underlying credit factors contained within the business owner’s credit report.

How Does California Define “Motor Vehicle Dealer”?

To paraphrase Section 285 of the California Vehicle Code (CVC), California defines a dealer as a person who receives compensation for buying or selling vehicles subject to registration. There are several exceptions outlined in Section 286, most notably, private sellers who are not in the business of purchasing or selling vehicles.

How Do Auto Dealers Apply for a License in California?

The process for applying for a motor vehicle dealer license in California is pretty complex. Below are the general guidelines, but dealers should refer to the Vehicle Industry Procedures Manual for details on the process.

License Period – The Vehicle Dealer license lasts for one year and must be renewed annually.

Step 1 – Complete the Application

All Vehicle Dealer License applicants selling new vehicles must complete and print off all application forms located here. Applicants seeking to solely sell used vehicles (dealer-wholesale only) can find their application forms here. Applicants seeking to obtain either the new or used dealer license must submit a live scan fingerprint of all owners. Once the live scan fingerprint is obtained, the dealer must complete the form located here.

-

- 1.a Dealer Education Program – All new and used dealers must complete the Dealer Education program. A list of approved vendors offering this program can be found here. Passing a final exam is required to complete the program. Each applicant has three attempts to pass the exam before having to retake the Dealer Education Program. There is a $16 fee administered for each subsequent exam attempt.

- 1.b Letter of Authorization – Required for new trailer dealers only and must be acquired for each type of trailer.

- 1.c Statement of Information – Corporations, limited liability companies, and limited liability partnerships must provide the California Secretary of State with either a Statement of Information (SI 550) or Statement of Information LLC (LLC 12)

- 1.d Sales Tax – Applicants must obtain a copy of the California Department of Tax and Fee Administration resale permit. This permit allows dealers to collect a sales tax. Instructions for obtaining this permit can be found here.

- 1.e Photographs of Business Location – Applicants must take photographs of each business location to ensure that their place of business complies with California licensing requirements. Guidelines for these photographs can be found here.

Step 2 – Make an Appointment with the OL Inspector

After all the necessary documents and certifications are obtained. Dealers will need to schedule an appointment with the California Occupational Licensing Inspector. The OL Inspector will inspect the following:

-

- Main office where the dealer conducts business

- Books and records relevant to the business

- Display area (wholesale only dealers exempt)

- Signage (wholesale only dealers exempt)

Step 3 – Pay Application Fees

There is a mandatory nonrefundable fee of $175. Additional fees are:

Required for all Dealers:

-

- $1 Family Support Program Fee

- $16 exam fee

- $90 fee for each dealer plate (plus any county fees)

- $92 fee for each motorcycle dealer plate (plus any county fees)

Required for Select Dealers:

-

- $300 fee for new automobile, commercial, motorcycle, ATV, motorhome, and recreational trailer dealers

- $100 autobroker endorsement fee (retail dealers only)

- $42 fee for out-of-state applicants submitting ADM 1316 Fingerprint Card

- $16 reexamination fee (for applicants who do not pass initial exam)

How Does a California Motor Vehicle Dealer Renew Their License?

The Vehicle Dealer License is valid for one year and must be renewed annually. To renew their license, dealers must:

- Provide proof of continuing education (required every two years)

- Submit a renewal application, form is located here

- Wholesale only dealers must submit a bond exemption form for the $50,000 surety bond

- Must report all lost, stolen, or surrendered occupational license special plates. The form for this can be found here

- Wholesale only dealers must submit the continuing education exemption form located here

- Pay the following fees:

- $125 application renewal fee

- $1 Family Support Program fee

- $90 fee for each dealer plate (plus any county fees)

- $92 fee for each motorcycle dealer plate (plus any county fees)

- New automobile, commercial, motorcycle, ATV, motorhome, and recreational trailer dealers required to pay a $300 fee.

- $75 autobroker endorsement fee. Information on this fee can be found here.

Mail documents and fees to the following address:

Department of Motor Vehicles

Occupational Licensing Section

P.O. Box 932342 MS, L224

Sacramento, CA 94232-3420

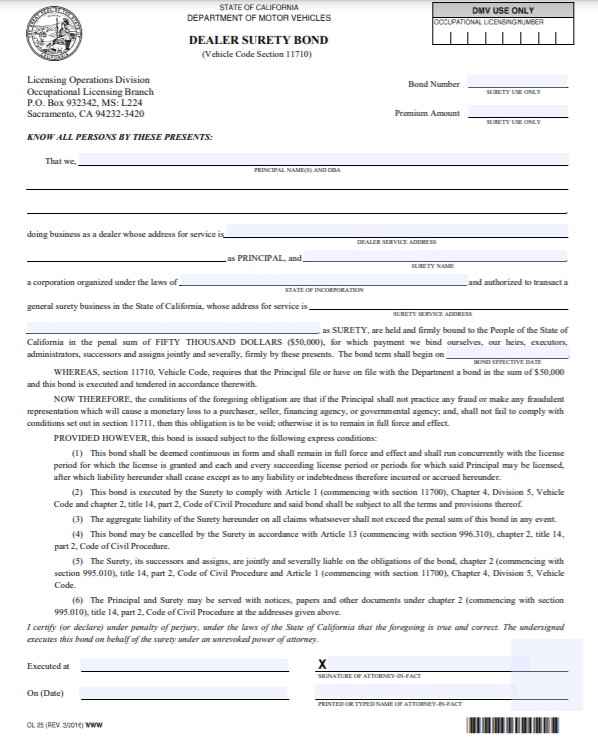

How Does the Dealer File Their Bond With the California Department of Motor Vehicles?

Motor vehicle dealers must file their completed and signed bond with the Occupational Licensing Section of the DMV; however, the process varies a bit for new applicants versus those renewing their license. As a best practice, new applicants should speak with their assigned inspector to determine if the bond should be provided to the inspector or sent directly to the DMV. Dealers renewing their license should mail the signed bond to the following address:

Department of Motor Vehicles

Occupational Licensing Section

P.O. Box 932342 MS, L224

Sacramento, CA 94232-3420

What Can Dealers Do to Avoid Claims Against the California Auto Dealer Bond?

To avoid claims on the Vehicle Dealer Bond, dealers should adhere to the following practices:

- Do not engage, or allow representatives of your business to engage, in any acts of fraud

- Ensure the title of the vehicle is appropriately transferred to the buyer.

- Remit sales proceeds for vehicles promptly and in full to sellers.

- Pay taxes on time and in full. The CDTFA assigns dealers with a tax filing frequency (quarterly, monthly, or yearly) based on the reported sales tax or anticipated sales tax at the time of registration.

- Do not engage in any illegal selling practices

- Register for and renew their Vehicle Dealer license annually

- Adhere to the dealer license plate regulations approved by the state

- Pay the application fees associated with the license type

What Other Insurance Products Can Agents Offer Dealers in California?

While California does not require liability insurance for motor vehicle dealers, most reputable dealer firms should seek garage liability insurance. Bonds are our only business at BondExchange, so we do not issue any form of liability insurance. Our agents often utilize brokers for this specific line of business.

How Can Insurance Agents Prospect for California Motor Vehicle Dealer Customers?

California conveniently provides a public database to search for active motor vehicle dealers in the state. The database can be accessed on the DMV site here. For a complete list of dealers in California, agents can request a list from the DMV on a spreadsheet or CD by completing a Request for Occupational Licensing Information. California charges a fee for the full list depending on the license type. Contact BondExchange for additional marketing resources and leverage our print-mail relationships for discounted mailing services.

What Other States Require Auto Dealer Bonds?

All 50 states and the District of Columbia require auto dealers to obtain an Auto Dealer Bond as a prerequisite for licensure. Insurance agents should utilize our Main MVD Page for a detailed analysis of the Auto Dealer Bond requirements nationwide.