Iowa Money Transmitter Bond: A Comprehensive Guide

April 28, 2021

This guide provides information for insurance agents to help money services businesses obtain Iowa Money Transmitter Bonds

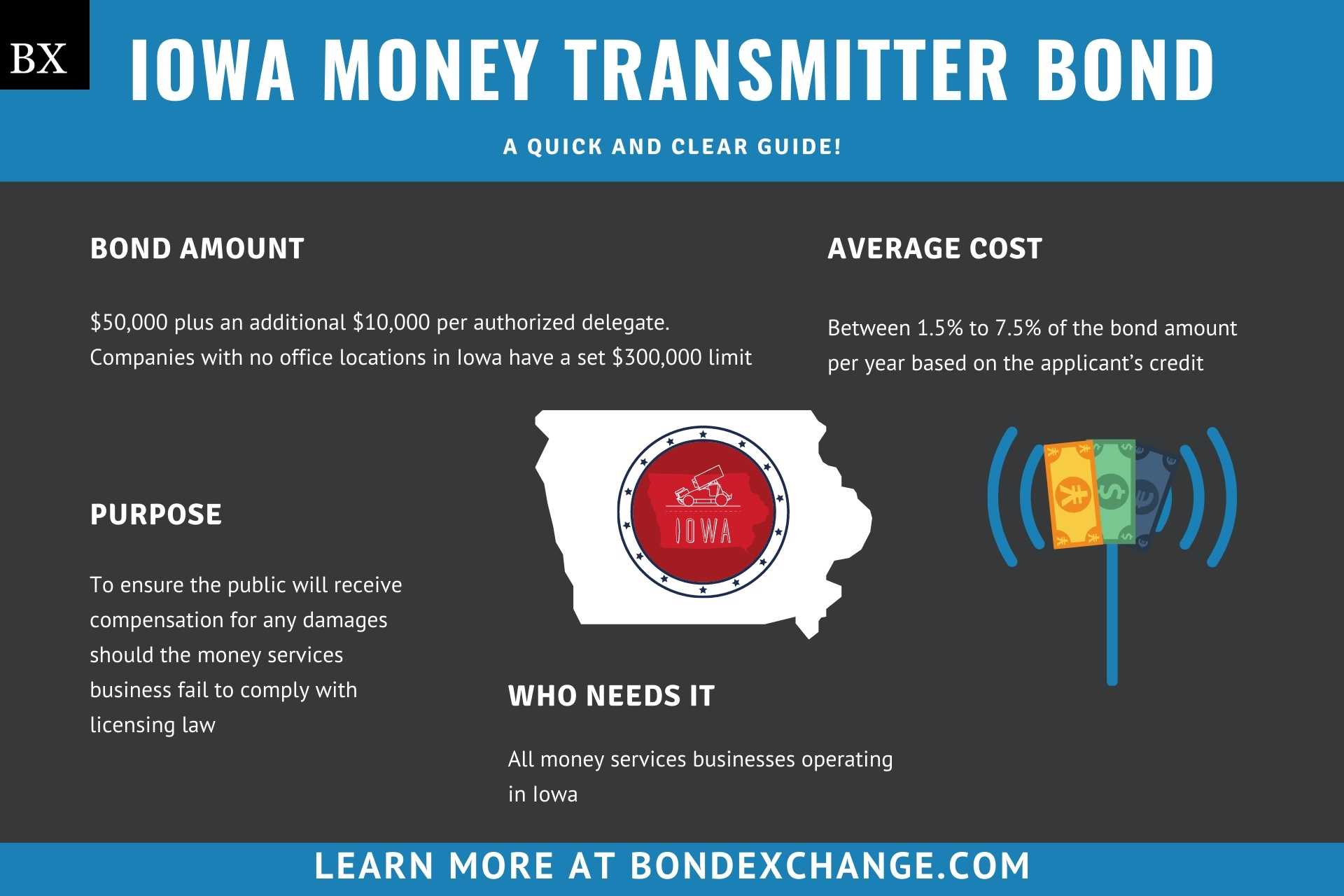

At a Glance:

- Average Cost: Between 1.5% to 7.5% of the bond amount per year based on the applicant’s credit

- Bond Amount: $50,000 plus an additional $10,000 per authorized delegate. Companies with no office locations in Iowa have a set $300,000 limit

- Who Needs it: All money services businesses operating in Iowa

- Purpose: To ensure the public will receive compensation for any damages should the money services business fail to comply with licensing law

- Who Regulates Money Services Businesses in Iowa: The Iowa Division of Banking

Background

Iowa statute 533C.201 requires all money services businesses operating in the state to obtain a license with the Division of Banking. The Iowa legislature enacted the licensing laws and regulations to ensure that money services businesses engage in ethical business practices. In order to provide financial security for the enforcement of the licensing law, money services businesses must purchase and maintain a $25,000 surety bond to be eligible for licensure.

What is the Purpose of the Iowa Money Transmitter Bond?

Iowa requires money services businesses to purchase a surety bond as part of the application process to obtain a business license. The bond ensures that the public will receive compensation for financial harm if the money services business fails to comply with the licensing regulations. In short, the bond is a type of insurance that protects the public if the money services business breaks licensing laws.

How Can an Insurance Agent Obtain an Iowa Money Transmitter Surety Bond?

BondExchange makes obtaining an Iowa Money Transmitter Bond easy. Simply login to your account and use our keyword search to find the “money” bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone (800) 438-1162, email or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

Is a Credit Check Required for the Iowa Money Transmitter Bond?

Surety companies will run a credit check on the owners of the money services business to determine eligibility and pricing for the Iowa Money Transmitter bond. Owner’s with excellent credit and work experience can expect to receive the best rates. Owners with poor credit may be declined by some surety companies or pay higher rates. The credit check is a “soft hit”, meaning that the credit check will not affect the owner’s credit.

How Much Does the Iowa Money Transmitter Bond Cost?

The Iowa Money Transmitter surety bond can cost anywhere between 1.5% to 7.5% of the bond amount per year. Insurance companies determine the rate based on a number of factors including your customer’s credit score and experience. The chart below offers a quick reference for the approximate bond cost on a $50,000 bond requirement.

$50,000 Money Transmitter Bond Cost

| Credit Score | Bond Cost (1 year) |

|---|---|

| 800+ | $750 |

| 650 – 799 | $1,000 |

| 600 – 649 | $2,000 |

| 550 – 599 | $3,750 |

*The credit score ranges do not include other factors that may result in a change to the annual premium offered to your customers, including but not limited to, years of experience and underlying credit factors contained within the business owner’s credit report.

How Does Iowa Define “Money Services Business?”

Iowa statute 533C.102 defines a money services business as any business entity who performs one or more of the following functions:

- Sells payment instruments to one or more persons or issues payment instruments which are sold to one or more persons

- Receives money or monetary value for transmission

- Receives money for obligors for the purpose of paying obligors’ bills, invoices, or accounts

- Receives compensation for the exchange of money of one government for money of another government

How do Money Services Business Apply for a License in Iowa?

Money services businesses in Iowa must navigate several steps to secure their license. Below are the general guidelines, but applicants should refer to the NMLS’s application guidelines for details on the process.

License Period – The Iowa Money Services License expires on December 1 of each year and must be renewed before the expiration date

Step 1 – Meet the Net Worth Requirements

Applicants for the Iowa Money Services License must have a company net worth (assets – liabilities) of at least $100,000, plus an additional $10,000 per authorized delegate, with a maximum requirement of $500,000. Applicants must submit two auditedfinancial statements verifying their net worth when submitting their license application.

Step 2 – Purchase a Surety Bond

Money services businesses must purchase and maintain a $50,000 surety bond, plus an additional $10,000 per authorized delegate. Companies with no office locations in Iowa have a set $300,000 limit.

Step 3 – Request a NMLS Account

The Iowa Money Services License application is submitted electronically through the Nationwide Multistate Licensing System (NMLS). To submit a license application, applicants must first request to obtain an NMLS account.

Step 4 – Complete the Application

All Iowa Money Services License applications can be completed online through the NMLS. Applicants must complete the entire application, and submit the following items:

-

- Two audited company financial statements

- List of all company authorized agents

- Primary company and consumer complaint contact information

- Business plan containing the following information:

- Marketing strategies

- Products

- Target markets

- Fee schedule

- Operating structure the applicant intends to employ

- Certificate of Good Standing obtained from the Iowa Secretary of State

- Sample contract for authorized delegates

- Sample form of payment instrument or instrument upon which storedvalue is recorded (if applicable)

- Company formation documents

- Management chart showing the company’s hierarchy

- Organizational chart showing the company’s ownership structure

Applicants for the Iowa Debt Management License must pay the following fees when submitting their application:

-

- $1,000 application fee

- $500 license fee

- $10 authorized agent fee per Iowa location

- $0.25 annual authorized agent fee, capped at $10,000. The company’s first 100 agents are not subject to this fee

How Do Iowa Money Transmission Businesses Renew Their License?

Money transmission businesses can renew their license online through the NMLS. License holders need to simply login to their account to access their renewal application. The Iowa Money Services License expires on December 1 of each year and must be renewed before the expiration date.

What Are the Insurance Requirements for the Iowa Money Services License?

The State of Iowa does not require money services businesses to obtain any form of liability insurance as a prerequisite to obtaining a license. Money services businesses must purchase and maintain a $50,000 surety bond, plus an additional $10,000 per authorized delegate. Companies with no office locations in Iowa have a set $300,000 limit.

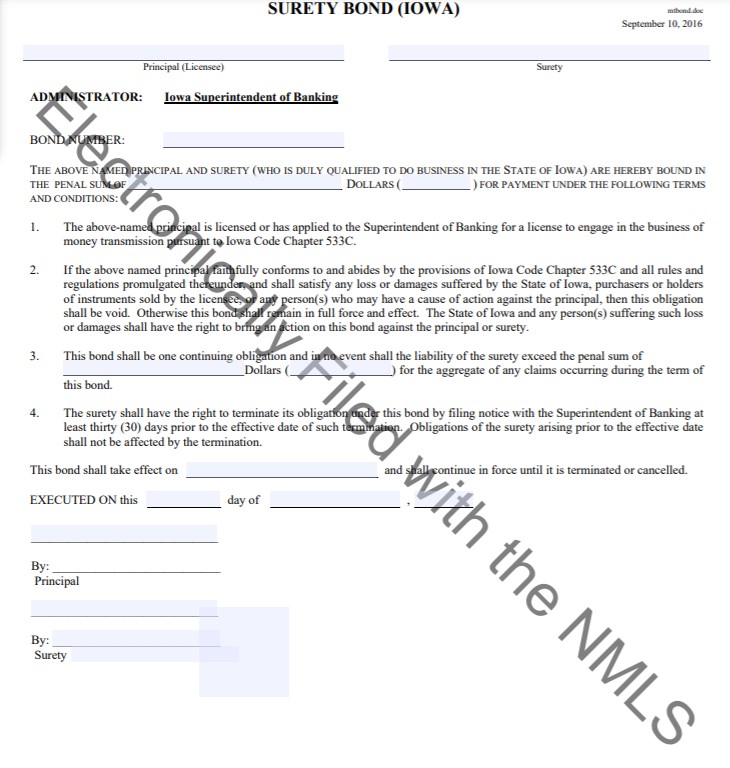

How Do Iowa Money Services Businesses File Their Bond?

Money services businesses should submit the completed bond form, including the power of attorney, electronically through the NMLS. The surety bond requires signatures from both the surety company that issues the bond and a representative from the money services business. The surety company should include the following information on the bond form:

- Legal name of entity/individual(s) buying the bond

- Surety company’s name

- Bond amount

- Date the bond is signed

- Date the bond goes into effect

What Can Iowa Money Services Businesses Do to Avoid Claims Against Their Bond?

In order to avoid claims made against their bond, money services businesses in Iowa must follow all license regulations in the state. Including some of the most important issues below that tend to cause claims:

- Promptly pay all funds owed to consumers

- Do not engage in any acts of fraud

What Other Insurance Products Can Agents Offer Money Services Businesses in Iowa?

Iowa does not require money services businesses to purchase any form of liability insurance as a prerequisite to obtaining a license. However, most reputable businesses will seek to obtain this insurance anyway. Bonds are our only business at BondExchange, so we do not issue liability insurance, but our agents often utilize brokers for this specific line of business. A list of brokers in this space can be found here.

How Can Insurance Agents Prospect for Iowa Money Services Businesses Customers?

The NMLS conveniently provides a public database to search for active money services businesses in Iowa. The database can be accessed here. Contact BondExchange for additional marketing resources. Agents can also leverage our print-mail relationships for discounted mailing services.