Alaska Motor Fuel Excise Tax Bond: A Comprehensive Guide

December 11th, 2020

This guide provides information for insurance agents to help motor fuel dealers on Alaska Motor Fuel Excise Tax bonds

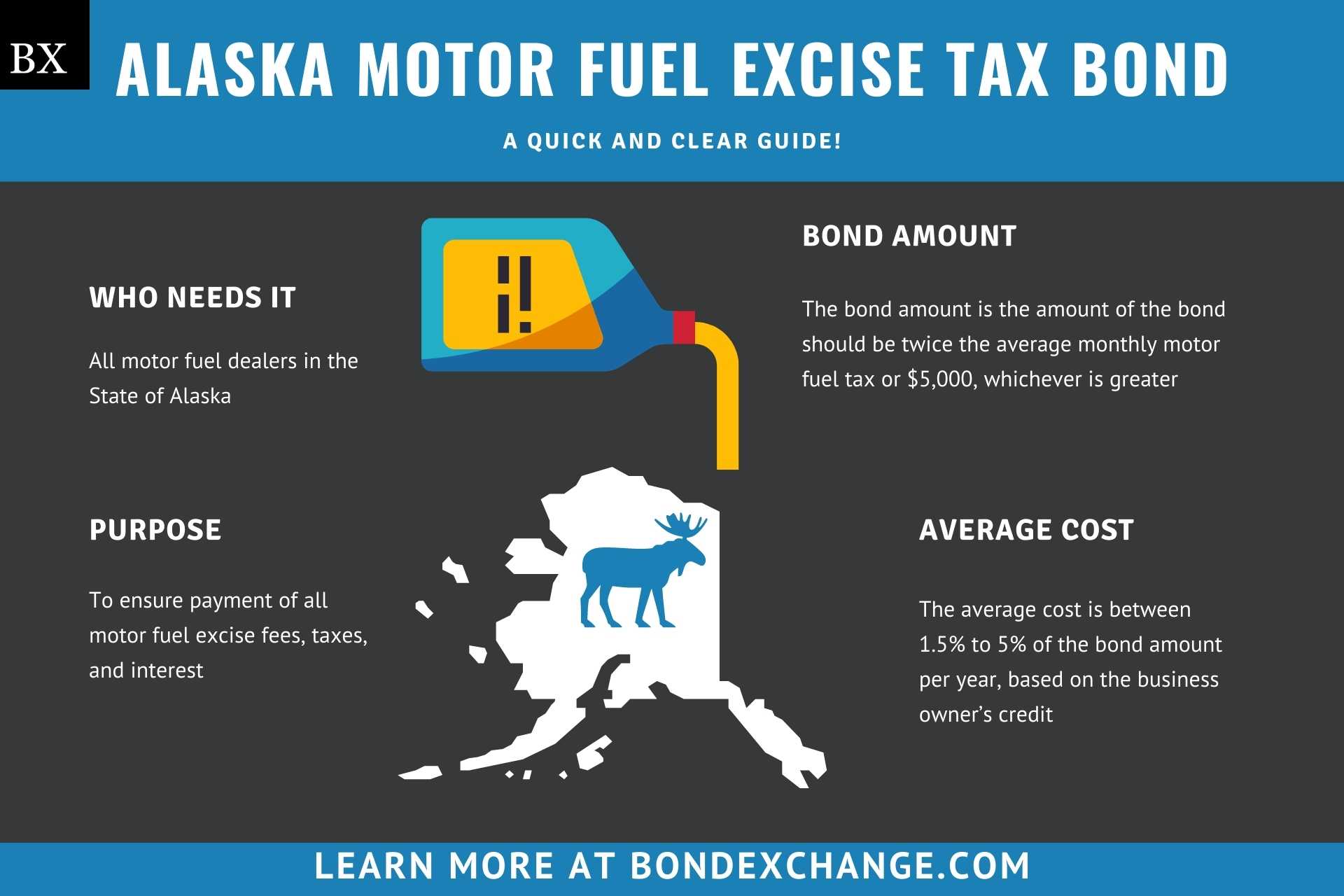

At a Glance:

- Average Cost: Between 1.5% to 5% of the bond amount per year, based on the business owner’s credit

- Bond Amount: The amount of the bond should be twice the average monthly motor fuel tax or $5,000, whichever is greater

- Who Needs It: All motor fuel dealers in the State of Alaska

- Purpose: To ensure payment of all motor fuel excise fees, taxes, and interest

- Who Regulates Motor Fuel Dealers in Alaska: The Alaska Department of Revenue (DOR)

Background

Alaska Statute 43.40 requires all motor fuel dealers to obtain a license with their local municipality prior to dealing motor fuel. The Alaska legislature enacted licensing laws and regulations to ensure that dealers remit all required taxes and fees. In order to provide financial security for the enforcement of the licensing law, motor fuel dealers in Alaska must post a cash deposit, obtain a letter of credit, or purchase and maintain a Motor Fuel Excise Tax surety bond to be eligible for licensure. Dealers that have shown a consistent filing and payment history for three years are eligible to have their bond requirement waived. Dealers can request a waiver by contacting dor.tax.motorfuel@alaska.gov.

What is the Purpose of the Alaska Motor Fuel Excise Tax Bond?

Alaska requires all motor fuel dealers to purchase the Motor Fuel Excise Tax Bond as part of the application process to obtain a Qualified Motor Fuel Dealer License. The bond ensures that the public will receive compensation for financial harm if the motor fuel dealer fails to comply with licensing regulations and that the dealer will pay all taxes, penalties, and interest to the State of Alaska. In short, the bond is a type of insurance that protects the public if the dealer breaks licensing laws.

How Can an Insurance Agent Obtain a Alaska Motor Fuel Excise Tax Surety Bond?

BondExchange makes obtaining a Alaska Motor Fuel Excise Tax Bond easy. Simply login to your account and use our keyword search to find the “fuel” bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone (800) 438-1162, email or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

Is a Credit Check Required for the Alaska Motor Fuel Excise Tax Bond?

Yes, surety companies will run a credit check on the dealer to determine eligibility and pricing for the Alaska Motor Fuel Excise Tax Bond.

Dealers with excellent credit and work experience can expect to receive the best rates. Dealers with poor credit may be declined by some surety companies or pay higher rates. The credit check is a “soft hit”, meaning that the credit check will not affect the dealer’s credit.

How Much Does the Alaska Motor Fuel Excise Tax Surety Bond Cost?

The Alaska Motor Fuel Excise Tax surety bond can cost anywhere between 1.5% to 5% of the bond amount per year. Insurance companies determine the rate based on a number of factors including your customer’s credit score and experience. We also offer easy interest-free financing for premiums over $500. The chart below offers a quick reference for the approximate bond cost. The amount of the bond should be twice the average monthly motor fuel tax or $5,000, whichever is greater. The chart below offers a quick reference for the approximate bond cost on a $10,000 bond requirement.

$10,000 Alaska Motor Fuel Excise Tax Bond Cost

| Credit Score* | Bond Cost (1 year) |

|---|---|

| 800+ | $150 |

| 650 – 799 | $200 |

| 625 – 649 | $250 |

| 600 – 624 | $500 |

*The credit score ranges do not include other factors that may result in a change to the annual premium offered to your customers, including but not limited to, years of experience and underlying credit factors contained within the business owner’s credit report.

How Does Alaska Define “Motor Fuel Dealer”?

Alaska Statue 43.40.100 defines a motor fuel dealer as anyone who sells or transfers motor fuel used for an engine of a motor vehicle, aircraft, watercraft, stationary engine machine, or mechanical contrivance. Exemptions to this definition include:

- Fuel delivered to foreign countries

- Fuel sold for use in jet aircraft operating flights

- Fuel used in power plants to generate electricity for:

- Sale to the General Public

- Private Residential consumption

- Commercial Enterprises 100 kilowatts or less not for resale

- Fuel used by nonprofit power associations

- Fuel used for charitable institutions

- Fuel transferred between qualified dealers

- Fuel sold to federal, state, and local government agencies

- Fuel used to heat private or commercial buildings

- Fuel used for other nontaxable purposes

- Business use of gasoline in a vehicle that is not registered for highway use

- Exported gasoline

- Gasoline and kerosene used in commercial aviation

- Undyed diesel fuel used in farming or for some bus transportation (Diesel that has been dyed red is untaxed)

How do Motor Fuel Dealers Apply for a License in Alaska?

Motor Fuel Dealers must complete certain steps to obtain a license. Below are the general guidelines dealers must follow to obtain their license.

Step 1 – Establish a Location

Dealers are required to establish a permanent place of business that meets the following minimum requirements:

-

- Be a permanent office structure capable of storing all business records

- All signs and banners must be permanently affixed

- Comply with all relevant zoning requirements

Step 2 – Obtain a Business License

Dealers must submit a copy of their LOB 42: Trade business license with their application. Dealers can obtain a business license here.

Step 3 – Purchase a Surety Bond

Dealers must deposit cash, obtain a letter of credit, or purchase and maintain a motor fuel excise tax bond.

Step 4 – Complete the Application

All new dealer regulatory license applications and dealer regulatory license renewal applications should completed online or mailed to the following address:

State of Alaska

Alaska Department of Revenue

PO Box 110420

Juneau AK, 99811-0420

Dealers should complete the application, including the following steps

4a. Business/Taxpayer Information – Dealers will need to include the following information on their application:

-

- Alaska Business License Number

- SSN

- FEIN

- QD License Number

- Taxpayer Name

- Business Name

- Mailing Address

- City/State/ZIP

- Entity Type

- Contact Person

- Contact Telephone

- Contact Email

- License Year

- Renewal Status

4b. Qualifying Activity – Dealers will need to indicate which of the following business functions they engage in:

-

- Refines, blends, imports, manufactures and/or produces motor fuel

- Sells at least 50 percent of fuel acquired to unrelated persons for resale and/or for heating fuel

- Sells at least 50 percent of fuel acquired to unrelated persons for use in jet propulsion aircraft

4c. Enter and Calculate Total Estimated Maximum Monthly Tax Liability – List the total estimated maximum monthly tax liability total of the below:

-

- Jet Fuel

- Aviation Gas

- Marine Diesel & Gasoline

- Highway Diesel, Gasoline & Gasohol

- Heating Fuel Diesel (exempt)

4d. Location of Storage, Facility or Base Port of Mobile Operations –

- Facility or vessel capacity

- Legal description of vessel name(s)

How Does an Alaska Motor Fuel Dealer Renew Their License?

Dealers can renew their license online, or mail their application to the following address:

State of Alaska

Alaska Department of Revenue

PO Box 110420

Juneau AK, 99811-0420

What Are the Insurance Requirements for the Alaska Motor Fuel Dealer License?

The State of Alaska does not require dealers to obtain any form of public liability or property damage insurance. Dealers must deposit cash, obtain a letter of credit, or file a motor fuel dealer bond.

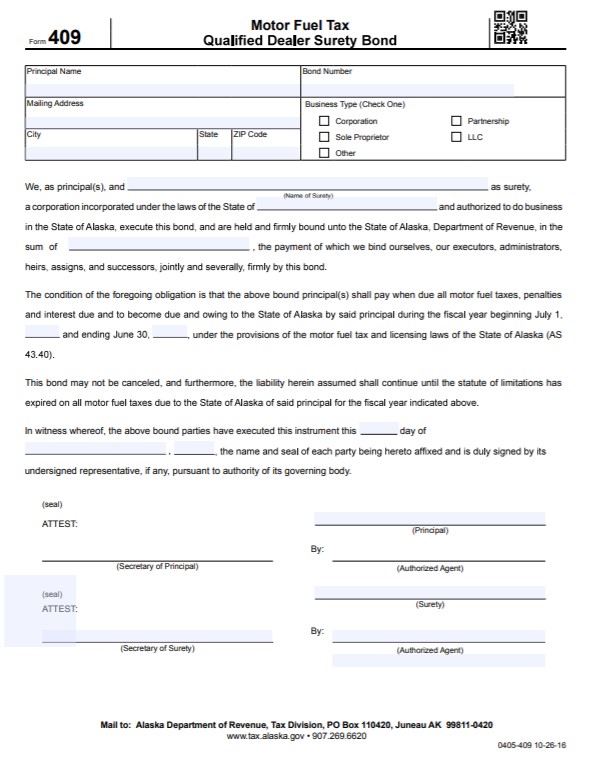

How Do Alaska Motor Fuel Dealers File Their Bond?

Dealers should mail the completed bond form, including the power of attorney, to the following address:

State of Alaska

Alaska Department of Revenue

PO Box 110420

Juneau AK, 99811-0420

The surety bond requires signatures from both the surety company that issues the bond and the dealer. The surety company should include the following information on the bond form:

- Legal name of entity/individual(s) buying the bond

- Bond amount

- Date the bond goes into effect

- Physical address where the business will operate and their email address

- Surety company’s name, address, email address and signature

- Notary signatures for both the surety company and principal

What Can Dealers Do to Avoid Claims Against the Alaska Motor Fuel Excise Tax Bond?

To avoid claims on the Motor Fuel Excise Tax Bond, dealers must follow all dealer regulations in the state, including some of the most important issues below that tend to cause claims:

- Do not engage, or allow representatives of the business to engage, in any acts of fraud

- File tax returns by the due date

- Submit full tax payments by the due date

- Do not engage in any illegal selling practices

What Other Insurance Products Can Agents Offer Dealers in Alaska?

Alaska does not require dealers to obtain any form of liability insurance, however most reputable dealers will obtain insurance anyway. Bonds are our only business at BondExchange, so we do not issue any form of liability insurance, but our agents often utilize brokers for this specific line of business. A list of brokers in this space can be found here.

How Can Insurance Agents Prospect for Alaska Motor Fuel Excise Tax Bond Customers?

Alaska conveniently provides a public database to search for active motor fuel dealers in the state. The database can be accessed here. Contact BondExchange for additional marketing resources. Agents can also leverage our print-mail relationships for discounted mailing services.