Florida Construction Contractor License Bond: A Comprehensive Guide

November 13th, 2020

This guide provides information for insurance agents to help contractors on Florida Construction Contractor License bonds (Florida 660 Contractor Bond)

***This page focuses exclusively on the Florida Construction Contractor License Bond. For more information on the Florida Financially Responsible Officer Bond and license requirements, view our Florida Financially Responsible Officer Bond Page.***

At a Glance:

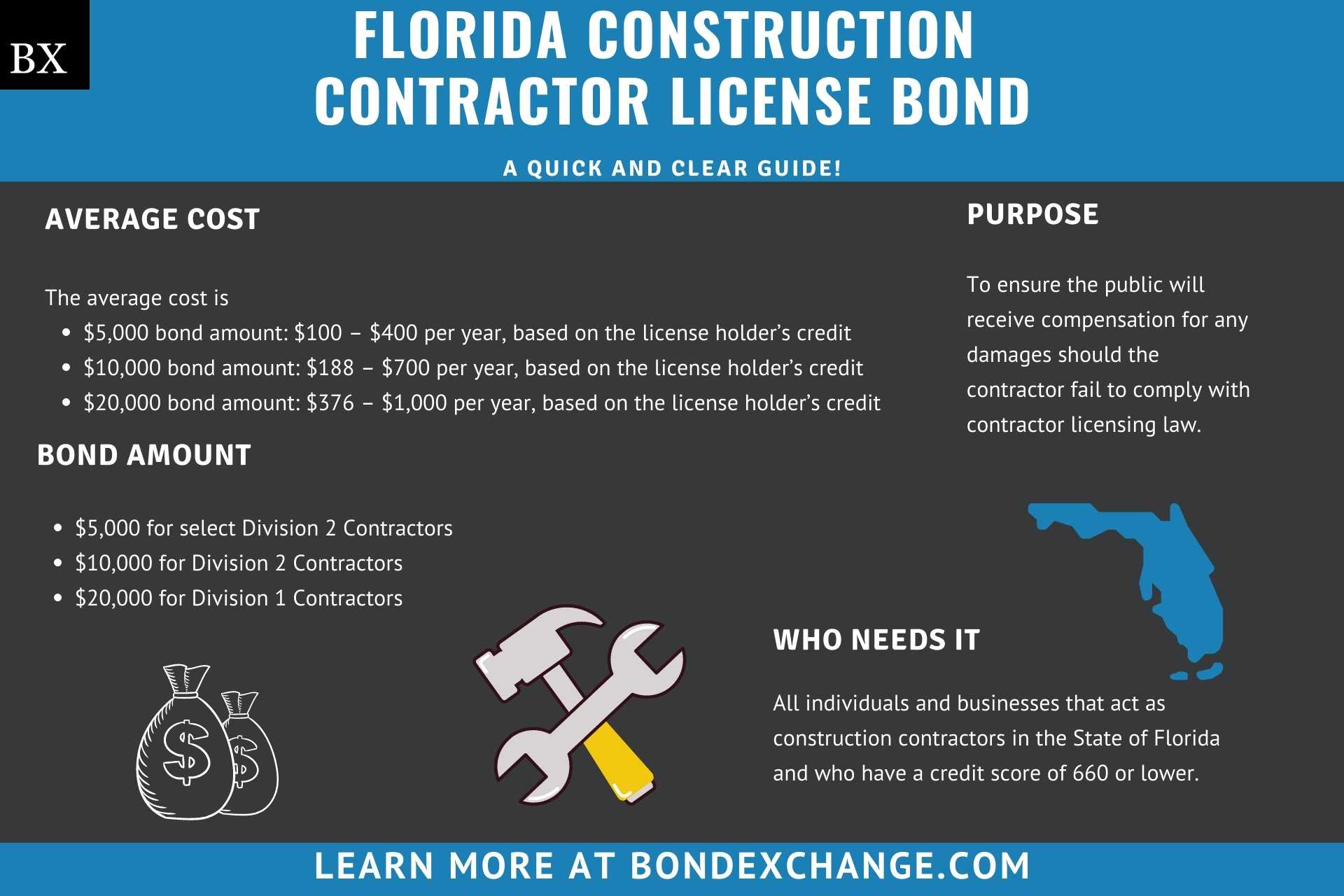

- Average Cost:

- $5,000 bond amount: $100 – $400 per year, based on the license holder’s credit

- $10,000 bond amount: $188 – $700 per year, based on the license holder’s credit

- $20,000 bond amount: $376 – $1,000 per year, based on the license holder’s credit

- Bond Amount:

- $5,000 for select Division 2 Contractors (more on this topic below)

- $10,000 for Division 2 Contractors

- $20,000 for Division 1 Contractors

- Who Needs It: All individuals and businesses that act as construction contractors in the State of Florida and who have a credit score of 660 or lower

- Purpose: To ensure the public will receive compensation for any damages should the contractor fail to comply with contractor licensing law

- Who Regulates Construction Contractors in Florida: The Florida Construction Industry Licensing Board (CILB)

Background

Florida Statutes 489.101-489.146 requires construction contractors operating in the state to obtain a license with the CILB. The Florida legislature enacted licensing laws and regulations to ensure that contractors engage in ethical business practices.

In order to provide financial security for the enforcement of the license law, contractors with a credit score lower than 660 must post a cash deposit or purchase and maintain either a $5,000, $10,000, or $20,000 construction contractor license surety bond to be eligible for licensure.

What is the Purpose of the Florida Construction Contractor License Bond?

Florida requires contractors to purchase the Construction Contractor Bond as part of the application process for the Construction Contractor License. The bond ensures that the public will receive compensation for financial harm if the contractor fails to comply with the licensing regulations. In short, the bond is a type of insurance that protects the public if the contractor breaks licensing laws.

Who is Required to Purchase a Florida Construction Contractor Bond?

Florida requires construction contractors who have a credit score below 660 to obtain a construction contractor bond. If a contractor’s credit score drops below 660, they will need to purchase the bond regardless of if they have already obtained their license. Contractors whose credit score rises to 660 or higher can cancel their bond requirement (there is a 30 day cancellation period).

Can Florida Contractors Decrease their Required Bond Amount?

Florida gives contractors the opportunity to decrease their required bond amount by completing a board-approved financial responsibility course. Division 1 contractors who complete this course will only be required to obtain a $10,000 surety bond, and Division 2 contractors who complete this course will only need to obtain a $5,000 surety bond.

How Can an Insurance Agent Obtain a Florida Construction Contractor License Surety Bond?

BondExchange makes obtaining a Florida Construction Contractor License Bond easy. Simply login to your account and use our keyword search to find the “contractor” bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone (800) 438-1162, email, or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensure that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

Is a Credit Check Required for the Florida Construction Contractor License Bond?

Yes, surety companies will run a credit check on the contractor to determine eligibility and pricing for the Florida Construction Contractor bond.

Contractors with excellent credit and work experience can expect to receive the best rates. Contractors with poor credit may be declined by some surety companies or pay higher rates. The credit check is a “soft hit”, meaning that the credit check will not affect the contractor’s credit.

How Much Does the Florida Construction Contractor License Bond Cost?

The Florida Construction Contractor surety bond can cost anywhere between 1.8% to 8% of the bond amount per year.

Insurance companies determine the rate based on a number of factors including your customer’s credit score and experience. We also offer easy interest-free financing for premiums over $500. The chart below offers a quick reference for the approximate bond cost on the $10,000 bond requirement.

$10,000 Florida Construction Contractor License Bond Cost| Credit Score* | Bond Cost (1 year) |

|---|---|

| 650 – 659 | $188 |

| 600 – 649 | $400 |

| 550 – 599 | $500 |

| 500 or lower | $700 |

*The credit score ranges do not include other factors that may result in a change to the annual premium offered to your customers, including but not limited to, years of experience and underlying credit factors contained within the business owner’s credit report.

How Does Florida Define “Contractor”?

To paraphrase Florida Statute 489.105, a contractor is any individual who is qualified to perform a job and submits a bid or offers to perform a construction-related job as an independent business.

How Do Contractors Apply for a License in Florida?

Contractors in Florida must navigate several steps to secure their construction contractor’s license. Below are the general guidelines, but contractors should refer to the Florida Department of Business and Professional Regulation’s Application Center for details on the process.

License Period – All Florida certified construction contractor licenses expire on August 31 of every even-numbered year (2020, 2022, etc) regardless of the date of issuance. All Florida registered construction contractor licenses expire on August 31 of every odd-numbered year (2021, 2023, etc) regardless of the date of issuance.

Step 1 – Meet the Initial Qualifications

Contractors seeking to obtain a license in Florida must meet the following prerequisites before applying for a license:

-

- Be at least 18 years of age

- Be of good moral character

- Have a valid social security number

- Have at least 4 years of experience in the trade the contractor is applying for

- Educational training (college, vocational school, apprenticeship, etc) counts as experience

- Contractors will need to submit proof of experience (degree, W2 forms, etc) with their application

Businesses must employ at least one “qualifying agent” who meets the experience requirements and has passed the exam corresponding to the license’s classification. If the qualifying agent does not have an ownership interest in the construction company, the company will need to designate a Financially Responsible Officer who is responsible for all the financial decisions of the company.

Step 2 – Determine the License Type

There are two different types of the Florida construction contractor license:

-

- Certified – Contractors can operate statewide and are not limited to a single municipality

- Registered – Contractors are licensed locally and can only operate in their designated municipality

***The remaining steps will focus exclusively on how to obtain a Certified License***

Step 3 – Determine the License Class

Florida requires contractors to obtain specific licenses corresponding to the nature in which the contractor’s business operates. The license classes are broken up into two divisions. Below are the different classes of the Florida Construction Contractors License:

Division 1

-

- Building – Engages in the construction of commercial or residential buildings

- General – Can perform any type of contract work

- Residential – Engages in the construction of residential buildings only

Division 2

-

- Air Conditioning – Works on central air-conditioning, refrigeration, heating, and ventilating systems

- Glass and Glazing – Installs and attaches any type of window or glass

- Mechanical – May perform all duties associated with an air conditioning contractor, plus is allowed to perform extra duties such as replacing gas pipes in buildings

- Plumbing – Performs any plumbing related contract work

- Pollutant Storage System – May perform any type of work on pollution storage tanks

- Pool/Spa – Permitted to engage in the construction, repair, or service of any pool or spa

- Roofing – Performs any roofing related contract work

- Sheet Metal – Performs any contract work related to sheet metals

- Solar – May engage in contract work related to solar panels

- Specialty – May only perform work relating to a specific phase of the construction process

- Underground Utility and Excavation – May perform underground utility and excavation services

Step 4 – Purchase a Surety Bond or Deposit Cash

Contractors with a credit score below 660 must deposit cash or purchase and maintain a construction contractor license surety bond in the following amounts:

-

- $5,000 for Division 2 contractors who have completed a financial responsibility course

- $10,000 for:

- Division 2 contractors (have not completed financial responsibility course)

- Division 1 contractors (have completed a financial responsibility course)

- $20,000 for Division 1 contractors (have not completed financial responsibility course)

When a contractor’s qualifying agent is not an owner of the company, the contracting company will need to designate a Financially Responsible Officer who will need to purchase and maintain a $100,000 surety bond.

Step 5 – Purchase Worker’s Compensation Insurance

All contractors in Florida must obtain worker’s compensation insurance coverage for their employees, owners, and corporate officers. Contractors may apply for an exemption for any individual who owns more than a 10% stake in the business. No more than three exemptions may be active at one time, and contractors seeking an exemption will need to apply for an exemption.

Step 6 – Pass the Exam

Construction contractors in Florida will need to pass all required parts of the Florida State Construction Examination prior to submitting their license application. The exam is open notes, and contractors can register to take their exam here. The Florida State Construction Examination is broken down into two sections:

-

- Business & Finance

- Trade Knowledge

Contractors can learn more about the exam requirements for their specific license class, as well as obtain an exam schedule here.

Step 7 – Pass Exam Fees

Contractors will need to pay a $215 fee when registering to take their licensure exam.

Step 8 – Complete the Application

All construction contractor regulatory license applications should be mailed to:

Department of Business and Professional Regulation

2601 Blair Stone Road

Tallahassee, FL 32399-0783

Contractors must complete the application corresponding to their specific license type, including the following steps:

-

- 8.a Credit Report – Contractors will need to obtain a personal credit report and submit it with their application. Contractors can find a list of approved vendors for obtaining their credit report here.

- 8.b Fingerprints – Contractors will need to submit a copy of their fingerprints to the CILB when submitting their application. Contractors can find fingerprint service providers here.

How Do Florida Construction Contractors Renew Their License?

Florida construction contractors can renew their license online here.

All renewal applicants must complete at least 14 hours of continuing education every renewal period. A list of approved continuing education providers can be found here.

Certified construction contractor licenses expire on August 31 of every even-numbered year (2020, 2022, etc) regardless of the date of issuance. Registered construction contractor licenses expire on August 31 of every odd-numbered year (2021, 2023, etc) regardless of the date of issuance.

What Are the Insurance Requirements for the Florida Construction Contractors License?

The state of Florida requires all contractors to obtain worker’s compensation insurance for their employees, owners, and corporate officers (exemptions to this rule are listed in Step 5). Contractors with a credit score lower than 660 must post a cash deposit or purchase and maintain either a $5,000, $10,000, or $20,000 construction contractor surety bond.

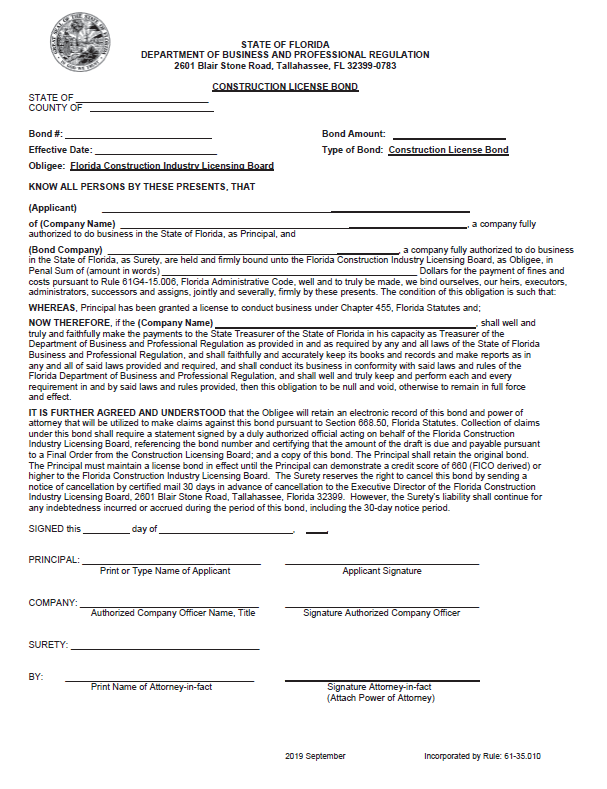

How Do Florida Construction Contractors File Their Bond With The Florida CILB?

Contractors should mail the completed bond form, including the power of attorney, to the following address:

Department of Business and Professional Regulation

2601 Blair Stone Road

Tallahassee, FL 32399-0783

The construction contractor surety bond requires signatures from both the surety company that issues the bond and the contractor. The surety company should include the following information on the bond form:

- The legal name of entity/individual(s) buying the bond

- Bond amount

- Date the bond goes into effect

- Date the bond is signed

How Can Florida Construction Contractors Avoid Bond Claims?

To avoid claims on the Construction Contractor Bond, contractors must follow all license regulations in the state, including some of the most important issues below that, tend to cause claims:

- Pay taxes and contributions due to the state and municipalities on time and in full

- Abide by contracts and repair improper or negligent work

- Repair all public facilities damaged through the course of the project

- Pay all laborers and employees

- Pay suppliers for all materials and equipment

What Other Insurance Products Can Agents Offer Contractors in Florida?

Florida does not require construction contractors to obtain any form of liability insurance. However, most reputable contractors will seek to obtain this insurance anyway. Contractors with employees will have to purchase workers’ compensation insurance. Bonds are our only business at BondExchange, so we do not issue any form of insurance, but our agents often utilize brokers for this specific line of business. A list of brokers in this space can be found here.

How Can Insurance Agents Prospect for Florida Contractors?

Florida conveniently provides a public database to search for active construction contractors in the state. The database can be accessed here. Contact BondExchange for additional marketing resources.

What Other Contractor License Bonds are required in Florida?

Contractors in Florida will need to obtain specific bonds correlating with their license type. Below are all the different contractor licensing bonds required by the State of Florida:

- $100,000 Financially Responsible Officer Bond

- Painted Galvanized Steel Structures Performance