Virginia Auto Dealer Bond: A Comprehensive Guide For Insurance Agents

September 16th, 2020

This guide provides information for insurance agents to help new and pre-owned car dealers on Virginia Auto Dealer bonds

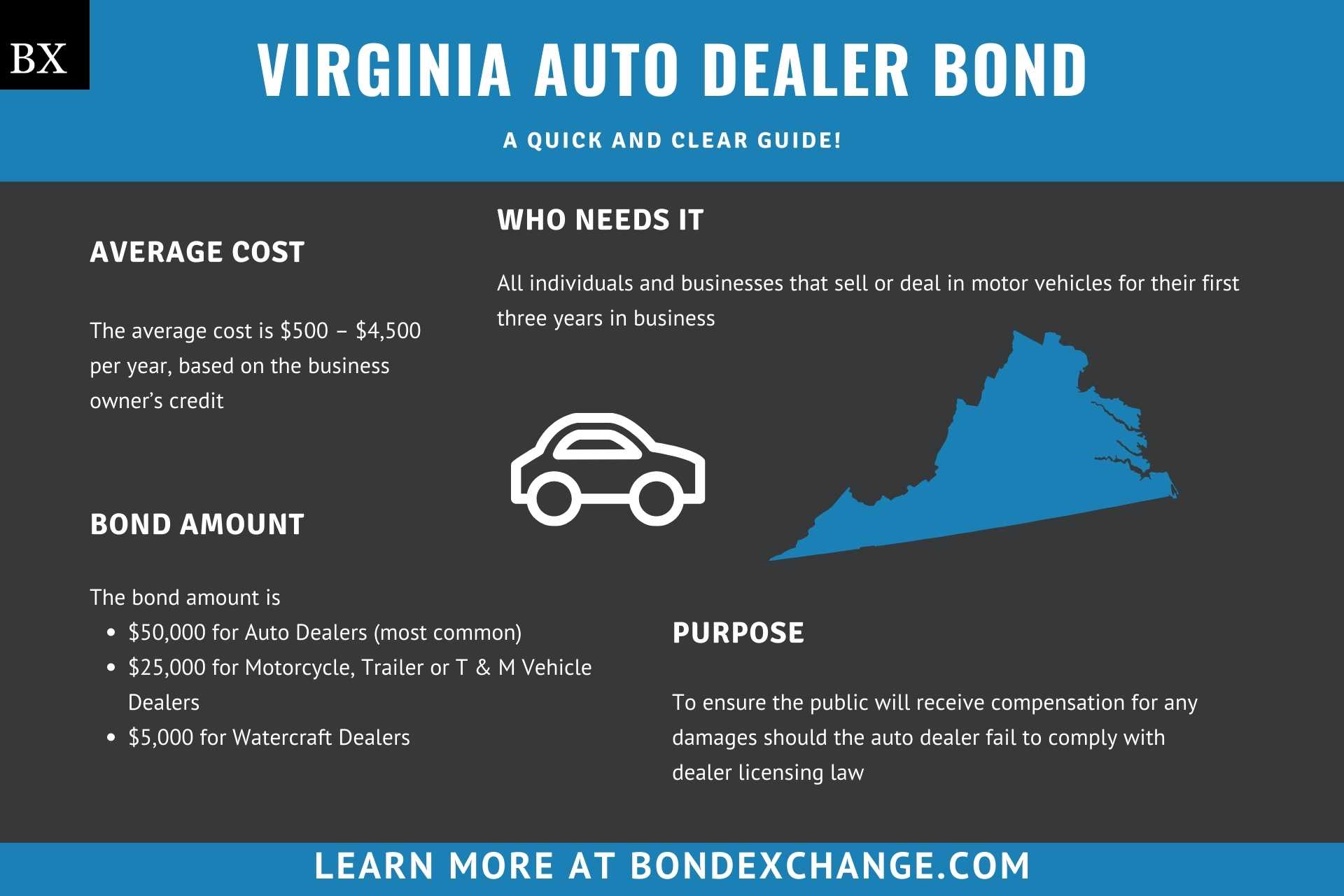

At a Glance:

- Average Cost: $500 – $4,500 per year, based on the business owner’s credit

- Bond Amount:

- $50,000 for Auto Dealers (most common)

- $25,000 for Motorcycle, Trailer or T & M Vehicle Dealers

- $5,000 for Watercraft Dealers

- Who Needs It: All individuals and businesses that sell or deal in motor vehicles for their first three years in business

- Purpose: To ensure the public will receive compensation for any damages should the auto dealer fail to comply with dealer licensing law

- Who Regulates Dealers in Virginia: The Virginia Motor Vehicle Dealer Board (MVDB), is in charge of licensure and regulation of motor vehicle dealers

Background

Code of Virginia 46.2-1508 mandates auto dealers operating in the state to obtain a motor vehicle dealer license with the MVDB. The Virginia legislature enacted the license and regulations to ensure that dealers engage in ethical business practices and remit required taxes and fees. In order to provide financial security for the enforcement of the license law, dealers must purchase and maintain a $50,000 motor vehicle dealer surety bond and contribute $350 annually to the Motor Vehicle Transaction Recovery Fund to be eligible for licensure.

***Important Note: Dealers who go three consecutive years without a claim or cancellation on their bond will have their bond and recovery fund fee requirement waived.

What is the Purpose of the Virginia Auto Dealer Bond?

Virginia requires dealers to purchase the Motor Vehicle Dealer Surety Bond as part of the application process for the Motor Vehicle Dealer License. The bond ensures that the public will receive compensation for financial harm if the auto dealer fails to comply with the licensing regulations and that the dealer will pay all required taxes and fees to the State of Virginia. In short, the bond is a type of insurance that protects the public if the dealer breaks licensing laws.

How Can an Insurance Agent Obtain a Virginia Auto Dealer Surety Bond?

BondExchange makes obtaining a Virginia Auto Dealer Bond easy. Simply login to your account and use our keyword search to find the “auto dealer” bond in our database. Don’t have a login? Enroll now and let us help you satisfy your customers’ needs. Our friendly underwriting staff is available by phone, email or chat from 7:30 AM to 7:00 PM EST to assist you.

At BondExchange, our 40 years of experience, leading technology, and access to markets ensures that we have the knowledge and resources to provide your clients with fast and friendly service whether obtaining quotes or issuing bonds.

How Much Does the Virginia Auto Dealer Bond Cost?

The $50,000 Virginia Auto Dealer surety bond can cost anywhere between $500 to $4,500 per year. Insurance companies determine the rate based on a number of factors including your customer’s credit score and experience. We also offer easy interest-free financing for premiums over $500. The chart below offers a quick reference for the approximate bond cost on the $50,000 bond requirement.

| Credit Score* | Bond Cost (1 Year) |

|---|---|

| 700+ | $500 |

| 630 – 699 | $1,000 |

| 600 – 629 | $1,500 |

| 575 – 599 | $2,500 |

| 525 – 574 | $3,500 |

| 500 – 524 | $4,500 |

*The credit score ranges do not include other factors that may result in a change to the annual premium offered to your customers, including but not limited to, years of experience and underlying credit factors contained within the business owner’s credit report.

How Does Virginia Define “Motor Vehicle Dealer”?

Code of Virginia 46.2 Chapter 15 defines a motor vehicle dealer as anyone who:

- Buys, sells, exchanges or arranges the sale of a motor vehicle

- Is wholly or partly engaged in the business of selling new or used motor vehicles

- Offers to sell, sells, displays, or permits the display for sale, of five or more motor vehicles within any 12 consecutive months.

How Do Dealers Apply for a Motor Vehicle Dealer License in Virginia?

The process for applying for a motor vehicle dealer license in Virginia is pretty complex. Below are the general guidelines, but dealers should refer to the Virginia Dealer Manual for details on the process.

License Period – The dealer license period is valid for either one or two years from the date of issuance dependent on the dealer’s preference, and must be renewed prior to the expiration date for dealers to continue operations.

Step 1 – Determine Dealer Type

Before dealers can apply for a license they must first determine whether they will operate as franchise or independent dealer.

-

- Franchise Dealer: Dealer who has a franchise agreement with a manufacturer or distributor to sell new or used trademark vehicles

- Independent Dealer: Deals solely in used vehicles

- Motorcycle, Trailer or T & M Vehicle Dealer: Dealer who sells trailers, travel trailers, motorhomes and motorcycles

- Watercraft Dealer: Virginia Code Chapter 8 (§ 29.1-800 et seq.) of Title 29.1 requires anyone who sells or deals 2 or more water vehicles in a twelve month period (Watercraft dealers are regulated by the Virginia Department of Wildlife Resources)

Step 2 – Pass the Operator Exam

All Virginia dealerships must employ a certified dealer operator. To qualify as a certified dealer operator, franchise dealers simply have to pass a written examination administered at the local DMV. Independent dealers must pass a two day course and final exam. There is a $50 fee to take the dealer exam, and a $410 fee to take the independent dealer operator course.

Step 3 – Register the Business Entity

Dealers who operate as either a corporation or LLC must register with the State Corporate Commission. Dealers can register their business here.

Step 4 – Establish a Location

All dealers must own or lease an established place of business and obtain a signature from the local zoning official acknowledging that the location satisfies all zoning codes. The location must meet the following requirements:

-

- Be an enclosed building that contains at least 250 square feet of office space and is not a place of residence

- Store all records the dealer is required to keep under Code of Virginia 46.2-1529

- Contain a desk, chairs, filing space, a telephone line that the public can call, internet, an email address, and working utilities

- Display the business hours at the main entrance

- Be open at least 20 hours per week, 10 of which must be during 9am-5pm

- Have parking space able to display at least 10 vehicles

- Have a permanent sign visible from the front of the business that contains the business’s name in letters at least 6 inches in height

Step 5 – Complete the application

All new dealer regulatory license applications and dealer regulatory license renewal applications should be mailed to:

Virginia MVDB

2201 W Broad St #104

Richmond VA, 23220

For more information about what is required on the application, view this form.

-

- 5.a Dealer Plates and Insurance – All dealers must obtain comprehensive liability insurance for each vehicle with a dealer plate. Dealerships are only allowed to have four times as many dealer plates as they have salespeople. The dealer plate application form can be found here.

- 5.b Zoning Certificate – Dealers are required to submit a zoning compliance certification form signed by their local zoning official as part of their application (see Step 4 for zoning requirements). The certification form can be found here.

- 5.c Salesperson License – Each salesperson who works for the dealer must be licensed by the State of Virginia and consent to a background check. Dealers must submit an application for each salesperson with their dealer license application. The salesperson application form can be found here.

- 5.d Buyer’s Order – Applicable dealers must submit a copy of Compliant Buyer’s Order as part of their application. More information about who needs this and what it covers can be found here.

Step 6 – Pay Fees

There is a mandatory $225 application fee to obtain the dealer license. Certain dealers may have to pay some or all of the additional fees listed below:

-

- $25 for each additional license type endorsement

- $350 Motor Vehicle Transaction Recovery Fund (for dealers who have been in business for less than three years)

- $60 for first two dealer plates and $26 for each additional plate

- $30 for each salesperson license

- $10 for each background check

All fees are based off of a one year renewal schedule, for a two year renewal schedule simply double the fees

Step 7 – Pass Inspection

After the dealer’s application is processed, a field agent from the MVDB will contact the dealer to set an appointment to conduct an inspection of the business location. If the location meets the requirements (see Step 4 for requirements) then the field agent will issue the dealer their license.

Step 8 – Purchase and File a Surety Bond

Motor vehicle dealers must purchase and file a $50,000 motor vehicle dealer bond. More on the filing process below.

How Does a Virginia Motor Vehicle Dealer Renew Their License?

The Virginia Motor Vehicle Dealer License is valid for either one or two years and dealers must renew the license before the expiration date. Dealers will receive a renewal packet 45 days prior to the license expiration date containing all the required forms and fees that need to be submitted.

Dealers can mail their renewal packet to:

Virginia MVDB

2201 W Broad St #104

Richmond VA, 23220

What Are the Insurance Requirements for the Virginia Auto Dealer License?

The State of Virginia requires all auto dealers to maintain comprehensive liability insurance on all vehicles with dealer plates to remain in compliance with licensing regulations. Dealers must also file a $50,000 motor vehicle dealer bond.

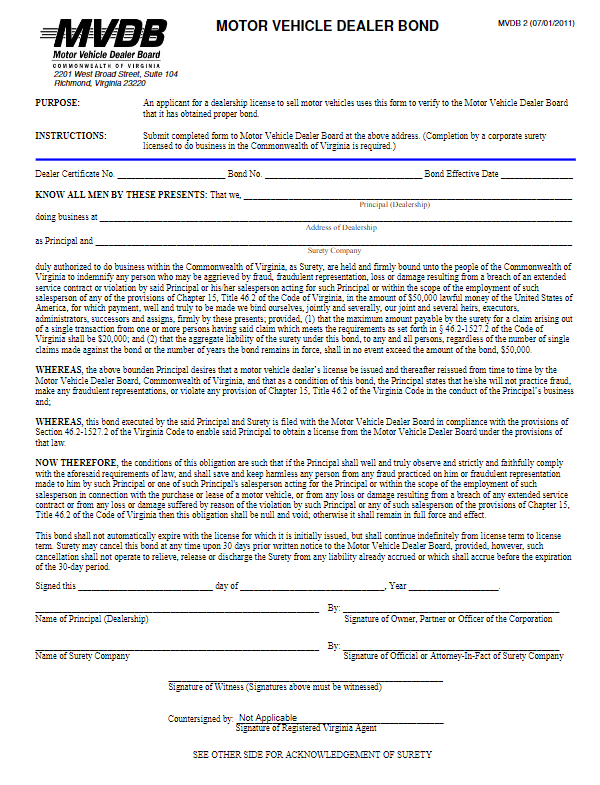

How Do Virginia Auto Dealers File Their Bond?

The $50,000 surety bond requires signatures from both the surety company that issues the bond and the auto dealer. The bond form will require the following items:

- Dealer Certificate Number

- Legal name of entity/individual(s) buying the bond

- Physical address where the business will operate

- Surety company’s name, address and signature

- Date on which the bond will be executed

- An affidavit and acknowledgement of surety form

Dealers should mail the completed bond form, including the power of attorney, to the following address:

Virginia MVDB

2201 W Broad St #104

Richmond VA, 23220

What Can Dealers Do to Avoid Claims Against the Virginia Auto Dealer Bond?

To avoid claims on the Motor Vehicle Dealer Bond, dealers must follow all dealer regulations in the state, including some of the most important issues below that tend to cause claims:

- Do not engage, or allow representatives of the business to engage, in any acts of fraud

- Do not engage in any illegal selling practices

- Honor all warranties and service contracts

- Pay the annual $350 Motor Vehicle Transaction Recovery Fund

What Other Insurance Products Can Agents Offer Dealers in Virginia?

Virginia requires dealers to obtain comprehensive liability insurance on all vehicles with dealer plates. Most reputable dealers that provide towing or service station services should also obtain garage keepers liability. Bonds are our only business at BondExchange, so we do not issue any form of liability insurance, but our agents often utilize brokers for this specific line of business. A list of brokers in this space can be found here.

How Can Insurance Agents Prospect for Virginia Auto Dealer Customers?

Virginia conveniently provides a public database to search for active motor vehicle dealers in the state. The database can be accessed on the DMV site here. Contact BondExchange for additional marketing resources. Agents can also leverage our print-mail relationships for discounted mailing services.

What Other States Require Auto Dealer Bonds?

All 50 states and the District of Columbia require auto dealers to obtain an Auto Dealer Bond as a prerequisite for licensure. Insurance agents should utilize our Main MVD Page for a detailed analysis of the Auto Dealer Bond requirements nationwide.